GOLD

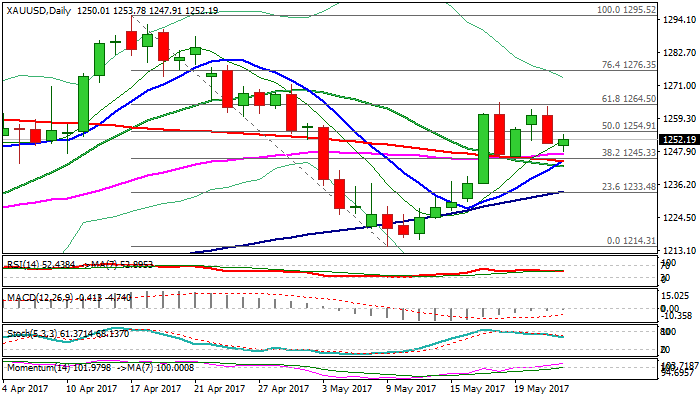

Spot Gold is holding within $1245/$1265 congestion for the fifth day. Repeated upside rejection under $1265 and strong bearish close on Tuesday, turned near-term focus lower and signal possible retest of strong $1245 support. Support is provided by daily cloud base and Fibo 38.2% of $1214/$1265 upleg, reinforced by 200SMA and rising 10SMA which is attempting to form Golden Cross on break higher. In addition, 55SMA at $1247 and 20SMA at $1242, reinforce support zone, which marks the lower breakpoint. Bullish near-term bias could be expected while $1245 holds, however, lift above daily cloud ($1257) is seen as minimum requirement for extension and retest of $1265 pivot (double upside rejection / Fibo 61.8% of $1295/$1214 descend) break of which is needed to confirm bullish continuation. Alternatively, strong bearish signal could be expected on firm break below $1245 which would trigger extension towards $1233 (Fibo 61.8% of $1214/$1265). Gold may stay within narrow range ahead of FOMC minutes due later today, which may give stronger direction signals, depending on Fed's tone about next rate hike.

Res: 1253; 1257; 1263; 1265

Sup: 1247; 1245; 1242; 1239

Interested in Gold technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

GBP/USD stays weak near 1.2400 after UK Retail Sales data

GBP/USD stays vulnerable near 1.2400 early Friday, sitting at five-month troughs. The UK Retail Sales data came in mixed and added to the weakness in the pair. Risk-aversion on the Middle East escalation keeps the pair on the back foot.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.