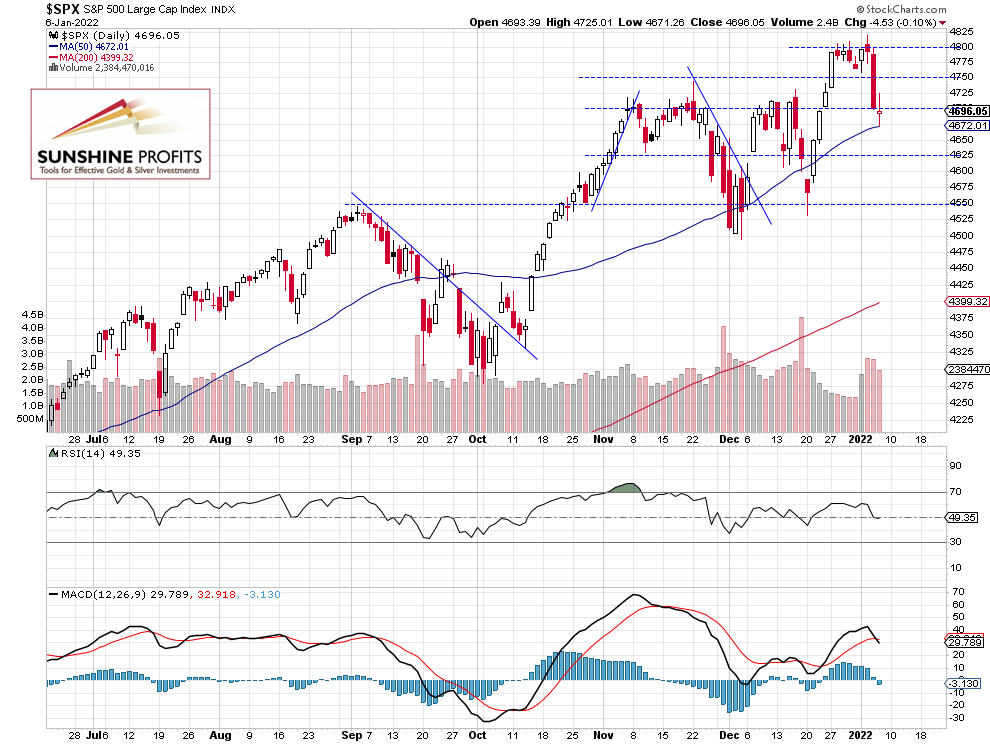

Stocks extended their downtrend yesterday, but the index closed virtually flat. So was it a short-term bottom? The S&P 500 index lost 0.1% on Thursday, Jan. 6, as it fluctuated following Wednesday’s sell-off of almost 2%. The market reached a new local low at 4,671.26 before bouncing back closer to the 4,700 level. So it traded almost 150 points below Tuesday’s record high of 4,818.62. The recent consolidation along the 4,800 level was a topping pattern. And the market got back to its November-December trading range.

On Dec. 3 the index fell to the local low of 4,495.12 and it was 5.24% below the previous record high. So it was a pretty mild downward correction or just a consolidation following last year’s advances.

The nearest important resistance level is now at 4,700-4,720, and the next resistance level remains at around 4,750. On the other hand, the support level is now at 4,650, marked by some previous local highs. The S&P 500 remains close to the November’s-December’s consolidation local highs, as we can see on the daily chart.

Apple price broke below the trend line

Apple stock broke below its two-month-long upward trend line on Wednesday after reaching the new record high of $182.94 on Tuesday. So far, it looks like a downward correction and the nearest important support level is at $165-170, marked by the previous highs and lows.

Is this a medium-term topping pattern? It’s getting very hard to fundamentally justify Apple’s current market capitalization of around $3 trillion.

Conclusion

The S&P 500 index is expected to open 0.2% lower today. So the volatility is on the light side after the mixed monthly jobs data release from this morning. We may see some more short-term fluctuations and possibly an intraday upward correction.

Here’s the breakdown:

-

The S&P 500 fluctuated following its Wednesday’s sell-off.

-

Jobs data release was mixed and rather neutral for the markets.

-

In our opinion no positions are currently justified from the risk/reward point of view.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

AUD/USD remains under pressure above 0.6400

AUD/USD managed to regain some composure and rebounded markedly from Tuesday’s YTD lows in the sub-0.6400 region ahead of the release of the Australian labour market report on Thursday.

EUR/USD holds above 1.0650 amid renewed selling pressure in US Dollar

The EUR/USD pair edges higher to 1.0672 on Thursday during the early Asian session. The recovery of that major pair is bolstered by renewed selling pressure in the US Dollar and a risk-friendly environment.

Gold retreats as lower US yields offset the impact of hawkish Powell speech

Gold prices retreated from close to weekly highs during the North American session on Wednesday amid an improvement in risk appetite. The bullish impulse arrived despite hawkish commentary by US Federal Reserve officials.

Bitcoin price uptrend to continue post-halving, Bernstein report says as traders remain in disarray

Bitcoin price is dropping amid elevated risk levels in the market. It comes as traders count hours to the much-anticipated halving event. Amid the market lull, experts say we may not see a rally until after the halving.

Australia unemployment rate expected to rise back to 3.9% in March as February boost fades

Australia will publish its monthly employment report first thing Thursday. The Australian Bureau of Statistics is expected to announce the country added measly 7.2K new positions in March after the outstanding 116.5K jobs created in February.