A dearth of economic data on Monday will keep investors glued to US political developments as Republicans race against time to implement a new tax bill before the year’s end.

The day begins at 07:00 GMT with a report on German producer inflation. The producer price index (PPI) is forecast to rise 0.2% in October after climbing 0.3% the month before. This translates into a year-over-year gain of 2.7%. Annualized PPI came in at 3.1% in September.

Later in the session, the Greek government will report on the current account balance for the month of September. The August balance showed a surplus of €1.827 billion when measured in year-over-year terms.

At 14:00 GMT, European Central Bank (ECB) President Mario Draghi will deliver a speech that will be closely watched by the financial markets. The ECB is embarking on a long path to policy normalization after announcing it will begin to wind down its quantitative easing program next year. However, policymakers said there is a good chance that stimulus will continue longer than previously expected.

It is unlikely that Trump’s Republicans will pass much needed tax reform this year. Several members of his own party have lashed out against the proposed reforms, signaling that they will not support any measure that increases the deficit. Trump’s tax plan intends to make up for the shortfall with added growth.

US markets are expected to see diminished volume as the week draws to a close as traders take a few extra days off for the Thanksgiving holiday. This could impact US dollar pairs on Thursday and Friday.

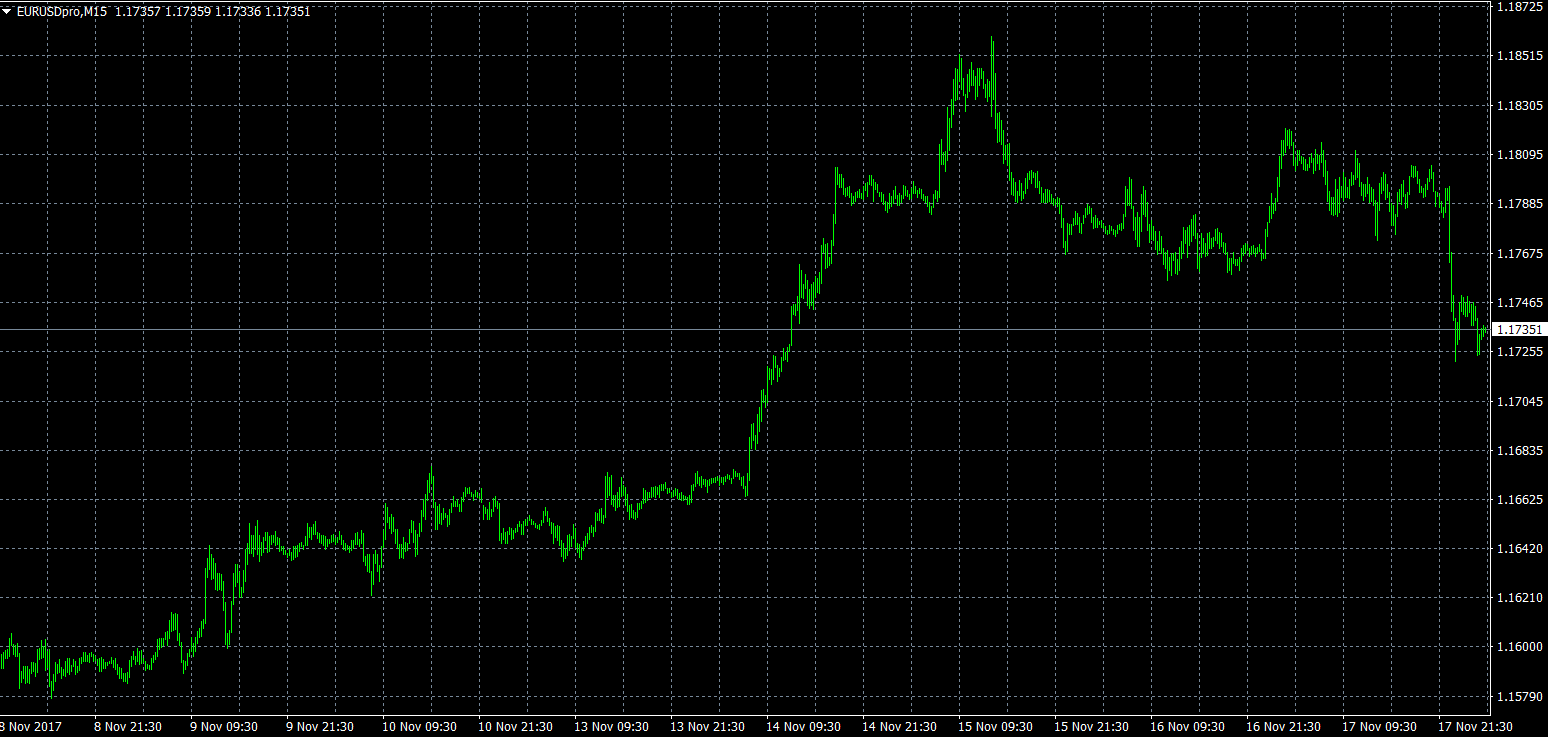

EUR/USD

The euro slammed on the breaks Monday, falling sharply below the 1.1800 handle. The EUR/USD touched a session low near 1.1720. It would later recover near 1.1732 for a daily drop of 0.5%. The pair has fallen below the immediate support level of 1.1745. The psychological 1.1700 level is the next zone of support, followed by 1.1665. On the opposite side of the ledger, immediate resistance is located at 1.1830, followed by 1.1860 and 1.1890.

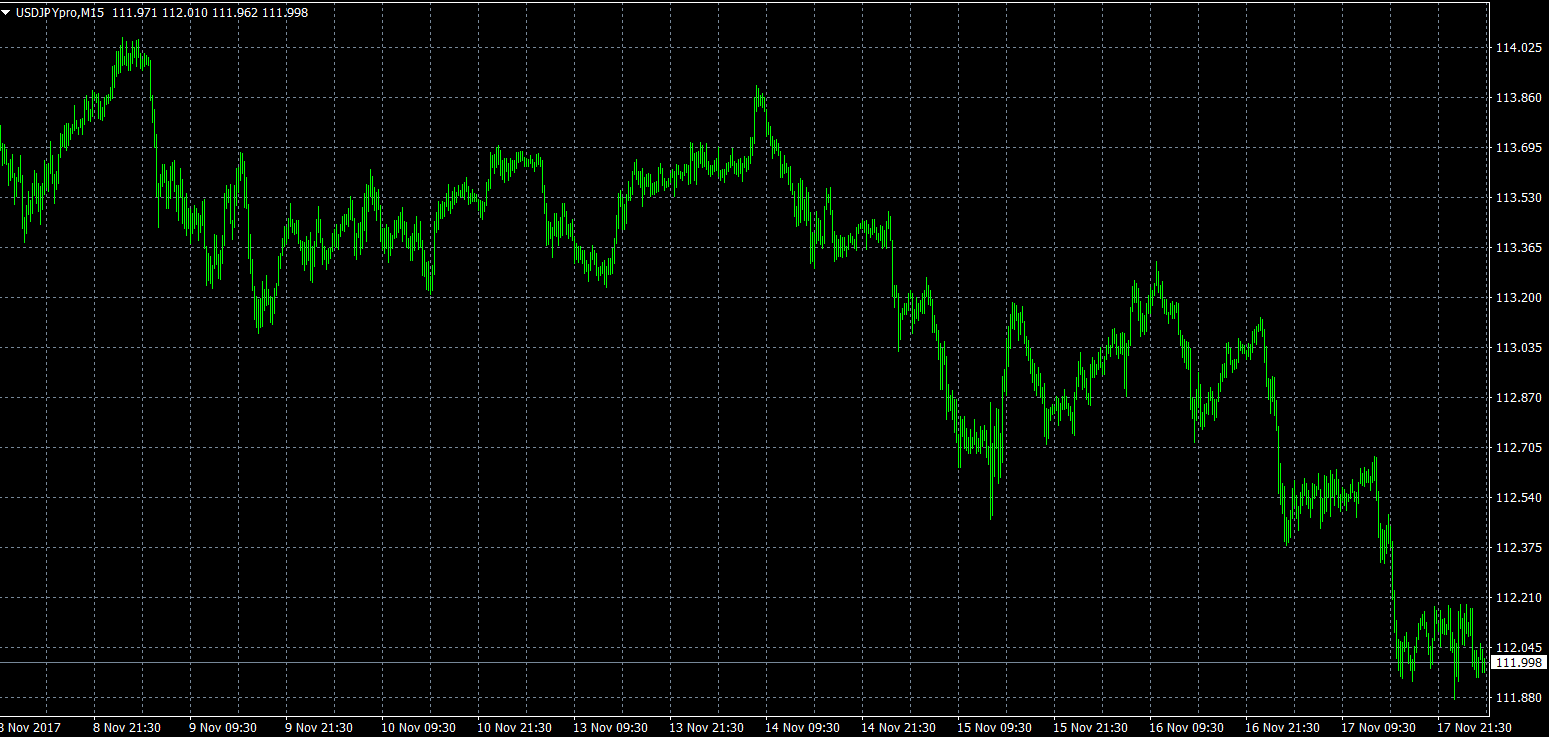

USD/JPY

The dollar traded within a narrow range against the yen on Monday, as the pair continued to hold near 112.00. Prices remain well supported above 111.90. A clean break below that level would expose heavier losses toward 111.50, which is a critical support level.

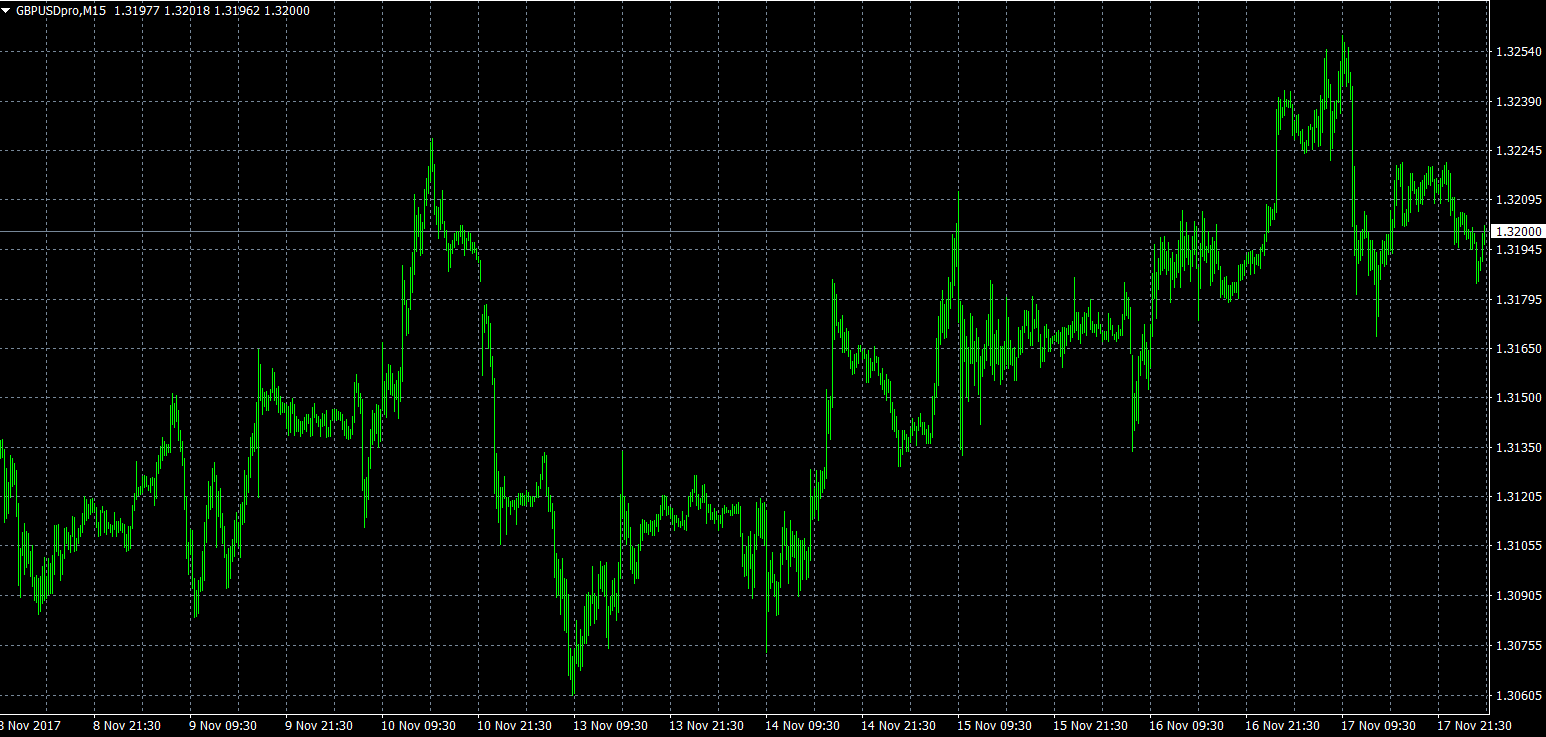

GBP/USD

Cable traded within a narrow range at the start of the week, with the GBP/USD holding slightly above 1.3200. The pair faces immediate resistance at 1.32330, followed by 1.3260. Pound sterling remains at the mercy of Brexit talks, which means investors can expect further volatility in the near term. Economic data from both sides of the Atlantic can also influence this trade.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.