Silver takes the stage as markets lose faith in policy clarity

With the Fed divided and the dollar softening, silver emerges as the bridge between fear and recovery.

From Gold fever to Silver rotation

For weeks the spotlight has belonged to gold. The yellow metal’s surge through the $4,000 mark became the headline symbol of a world seeking shelter from political paralysis and monetary confusion. But as traders lock in profits on gold’s record run, a quieter rotation is underway — into silver.

Silver’s rise is not just spill-over momentum; it’s a structural repricing of how markets perceive trust versus utility. Gold hedges against failure; silver hedges against transition. When confidence in policy coordination fades but growth expectations refuse to die, capital looks for an asset that carries both defensive and cyclical traits. That’s precisely where silver lives.

The macro backdrop invites it. The United States remains partially paralyzed by a lingering government shutdown. Key statistical agencies are still silent, leaving traders to rely on private proxies such as ADP, ISM, and PMI releases. Inside the Federal Reserve, the divide between hawks and doves has widened to the point where speeches contradict one another within hours. The result is an information vacuum — and in that vacuum, commodities with clear physical demand become the new compass.

Unlike gold, whose value depends on monetary anxiety, silver responds to two impulses: fear of policy error and hope of industrial resilience. As green-energy spending, electronics output, and photovoltaic demand hold firm, the metal’s industrial side offsets its defensive reputation. That hybrid identity is now turning silver into the market’s preferred middle ground.

Macro drivers: Trust, yield, and the policy void

The common denominator of the current rally is uncertainty made systemic. Bond yields keep sliding as traders price in at least two more rate cuts before year-end. Real yields have fallen even faster, deepening the pressure on the dollar. In normal times, these moves would signal an approaching soft landing. Today, they signal a market that no longer trusts official guidance.

Every new Fed speech amplifies the noise. Governor Bowman warns about “reigniting inflation,” while Daly insists policy should stay “adaptive.” Powell repeats that “data dependence” will guide decisions — a phrase stripped of meaning when official data are missing. The institution’s mixed messaging mirrors the Renko pattern of alternating white and red bricks: progress, hesitation, reversal, repeat. Traders, starved of reliable benchmarks, are reacting to sentiment rather than sequence.

That environment is fertile ground for silver. The US Dollar Index has retreated toward 101 and shows a consistent loss of momentum. Each attempt to rebound meets fresh selling as rate-cut expectations entrench. At the same time, industrial metals (copper, aluminum, nickel) have stabilized after months of drawdowns, suggesting that the real-economy pulse remains alive. Silver sits exactly between those two currents: a hedge if policy fails, a play if recovery endures.

Market flows confirm the shift. ETF holdings in silver have risen for four consecutive weeks, while managed-money positioning on COMEX shows the fastest buildup in net longs since early 2023. In the options space, skew has flipped in favor of calls, reflecting renewed appetite for upside exposure. All this while gold’s implied volatility begins to plateau — a telltale sign that traders are diversifying their safe-haven bets.

Renko tells the story

Technically, silver’s Renko chart illustrates a textbook breakout. The decisive move above $45.00 in early October erased months of sideways congestion and produced a clean sequence of white bricks, each confirming rising conviction. Support now rests around $44.20 — the former resistance zone — while the next caps are $46.50 and $47.80, levels that coincide with multi-month highs from last spring.

Momentum indicators back the move. The MACD histogram on the Renko-filtered series remains positive with no divergence, and stochastic oscillators hover near, but not yet inside, overbought territory — a constructive sign that the trend has room to extend. Volume-weighted averages cluster tightly under the current price, showing strong follow-through rather than exhaustion.

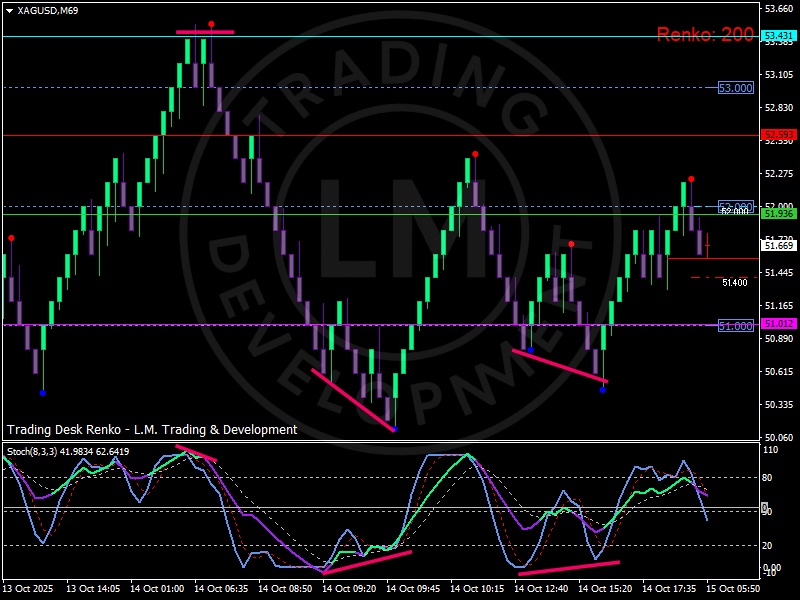

After two clear bullish divergences on the stochastic oscillator, price action carved out higher lows and broke decisively above 51.60 $. The sequence of rising white bricks confirms renewed institutional demand, while resistance at 52.60 $ marks the current inflection zone between momentum continuation and consolidation.

Visually, the chart communicates what macro data cannot: order amid confusion. Where the Fed’s tone oscillates, the Renko bricks march methodically upward, brick by brick. That pattern of consistency is what traders crave most in a noisy macro world. It explains why capital is shifting from theoretical refuges into tangible ones.

Comparative dynamics: Gold vs. Silver

The gold-silver ratio, long a barometer of relative confidence, has started to compress from above 90 in mid-September to near 87 today. Historically, ratio declines of that magnitude coincide with early phases of cyclical recovery or reflation trades. Yet this time the driver is not optimism but pragmatism: gold’s premium has become too expensive, while silver offers similar protection at a discount and with an industrial kicker.

Institutional desks frame it as “hedging rotation.” After months of buying gold to insure against dysfunction, portfolios are rebalancing toward assets that still benefit from easing but also participate in demand rebounds. For cross-asset strategists, that means silver, platinum, and even copper derivatives are regaining strategic weight. The irony is that a fractured Fed is inadvertently fueling an industrial-metal rally — not by growth, but by doubt.

Technically, this rotation shows up in correlation matrices: silver’s beta to gold has dropped below 0.80, its beta to copper has climbed above 0.45. That shift might seem marginal, but in positioning terms it reclassifies silver from “pure hedge” to “hybrid macro trade.” For discretionary macro funds, that’s a reason to allocate risk where both monetary and cyclical forces align.

Outlook — When a hedge becomes a trade

Silver’s renewed momentum sits on a fragile foundation: policy doubt and data scarcity. As long as the U.S. government shutdown leaves major statistical agencies offline, traders will keep extrapolating from partial indicators, and every whisper of the Fed will trigger outsized reactions. In such an environment, volatility is information.

The base case remains straightforward. If the Fed proceeds with two additional cuts by year-end, the dollar’s decline should persist, yields will remain capped, and the bias for silver stays upward. The metal thrives when real rates drift lower and when portfolio managers look for hedges that still carry growth optionality.

A secondary driver lies in industrial demand. Photovoltaic manufacturers report record order books for 2025, and electric-vehicle wiring demand continues to rise despite slower global sales. Silver’s dual nature — precious in price, practical in use — keeps it relevant even if inflation moderates. Unlike gold, which needs fear to rally, silver only needs ambiguity: enough anxiety to justify insurance, enough hope to justify utilization.

Still, overextension is a real risk. The metal has rallied nearly 12% since late September, and momentum traders are crowding into the same corridor. Should Congress unexpectedly resolve the budget impasse or if the Fed push back against excessive dovish pricing, a short-term pullback toward $44.00 would be natural. A deeper retracement, however, would require a decisive rebound in Treasury yields or a surprise uptick in inflation expectations — scenarios that currently appear low-probability.

Scenarios and risk map

| Scenario | Macro trigger | Expected silver reaction | Notes |

|---|---|---|---|

| Soft-landing dovish | Gradual Fed cuts, stable growth | Bullish → 48 $ | Baseline case; supports industrial + monetary bid |

| Re-inflation surprise | CPI re-accelerates above 3% | Neutral → Bearish → 42 $ | Real yields rise; metals pause |

| Hard-landing panic | Deep data contraction, Fed emergency cut > 50 bp | Spike → 50 $ then correction | Fear trade dominates short-term |

| Fiscal breakthrough | Shutdown ends, data resume | Short-term dip → 44 $ | “Sell the relief” move likely |

| Global risk rally | Equities +5%, DXY < 100 | Bullish → 47–49 $ | Risk-on doesn’t kill metals due to weak USD |

Such mapping underscores how asymmetric silver’s payoff profile has become: limited downside unless policy clarity returns, significant upside if uncertainty lingers.

From a technical lens, as long as the Renko sequence prints higher lows above 50.20 $ and fails to generate three consecutive red bricks, the structural bias remains intact. Only a reversal below 48.00 $ would neutralize the short-term trend and signal exhaustion.

Market positioning and behavioral shift

Recent CFTC data show leveraged funds increasing long exposure while reducing gold hedges, a telling rotation of speculative capital. Retail sentiment, often a contrarian indicator, has also turned bullish but without extremes, implying that the move is still under institutional control.

What’s more revealing is the behavior of volatility. One-month implied vol on silver options has risen to 26%, compared with 32% for gold, a narrower spread than at any time since 2021. That convergence signals that professional traders now view silver as a core volatility hedge, not a secondary play.

In practical trading terms, the asset behaves like a barometer of policy confusion: every sign of Fed disagreement translates into an uptick in silver demand. The more mixed the messages, the firmer the metal trades. It’s the mirror image of credibility erosion.

The broader message — policy credibility as a commodity

At its heart, the silver story is about credibility. When the world doubts its policymakers, tangible assets reclaim relevance. Silver’s ascent is not simply a reaction to lower yields or a weaker dollar; it’s a vote against fragmentation. The market is saying that reliability itself has become scarce — and that scarcity now carries a price per ounce.

In prior cycles, such dynamics marked the start of monetary fatigue, when words lose power faster than rates lose altitude. Each divided Fed speech, each delayed dataset, reinforces the notion that control has shifted from policymakers to markets. That’s why metals with both defensive and productive appeal — silver, platinum, copper — are drawing flows: they embody autonomy from institutions.

Personal take — between trust and utility

To me, this rally captures something deeper than the typical “Fed-cut = buy metals” formula. It captures a psychological realignment. Traders no longer seek shelter from inflation alone; they seek assets that don’t require institutional permission to hold value.

Gold expresses faith lost. Silver expresses function found.

Its strength comes from being believable, not perfect: useful in factories, measurable in volts and panels, yet still liquid enough to symbolize caution. In an era where data vanish and speeches contradict, that blend of tangibility and adaptability may be the most credible signal the market has left.

For now, the Renko chart says it best — brick after brick, the path of least resistance remains upward. Unless policy coherence returns, silver’s quiet rally may keep building the very thing central banks have misplaced: consistency.

Author

Luca Mattei

LM Trading & Development

Luca Mattei is a market analyst focusing on FX, metals, and macroeconomic trends. He develops trading tools for retail and professional traders, coding indicators and EAs for MT4/MT5 and strategies in Pine Script for TradingView.