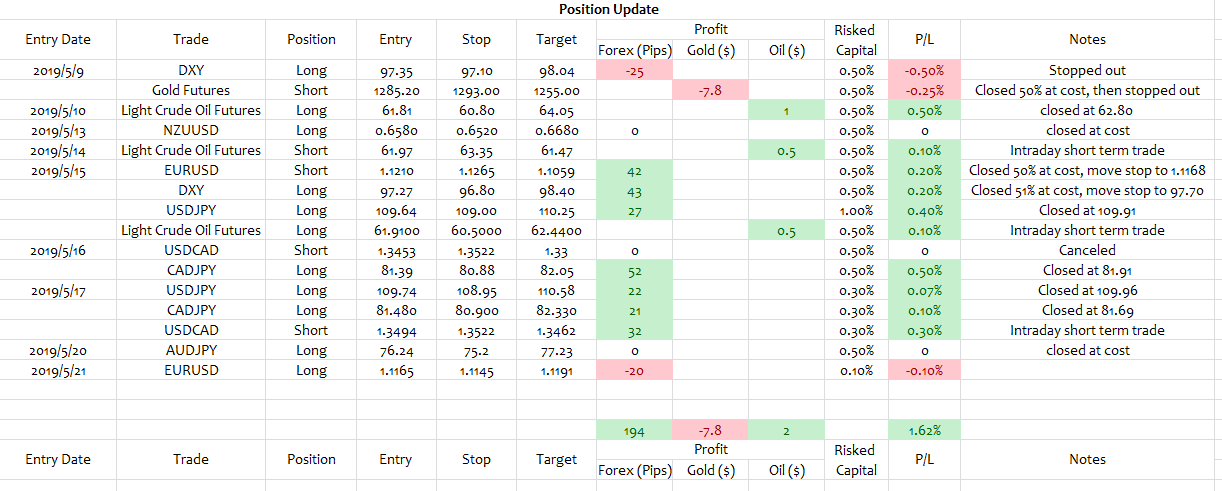

Position update

-

AUDJPY: In Asia Market, we closed the trade at cost before RBA Minutes and Lowe speech.

-

EURUSD: Hit profit stop at 1.1168.

-

DXY: Hit profit stop at 97.70.

-

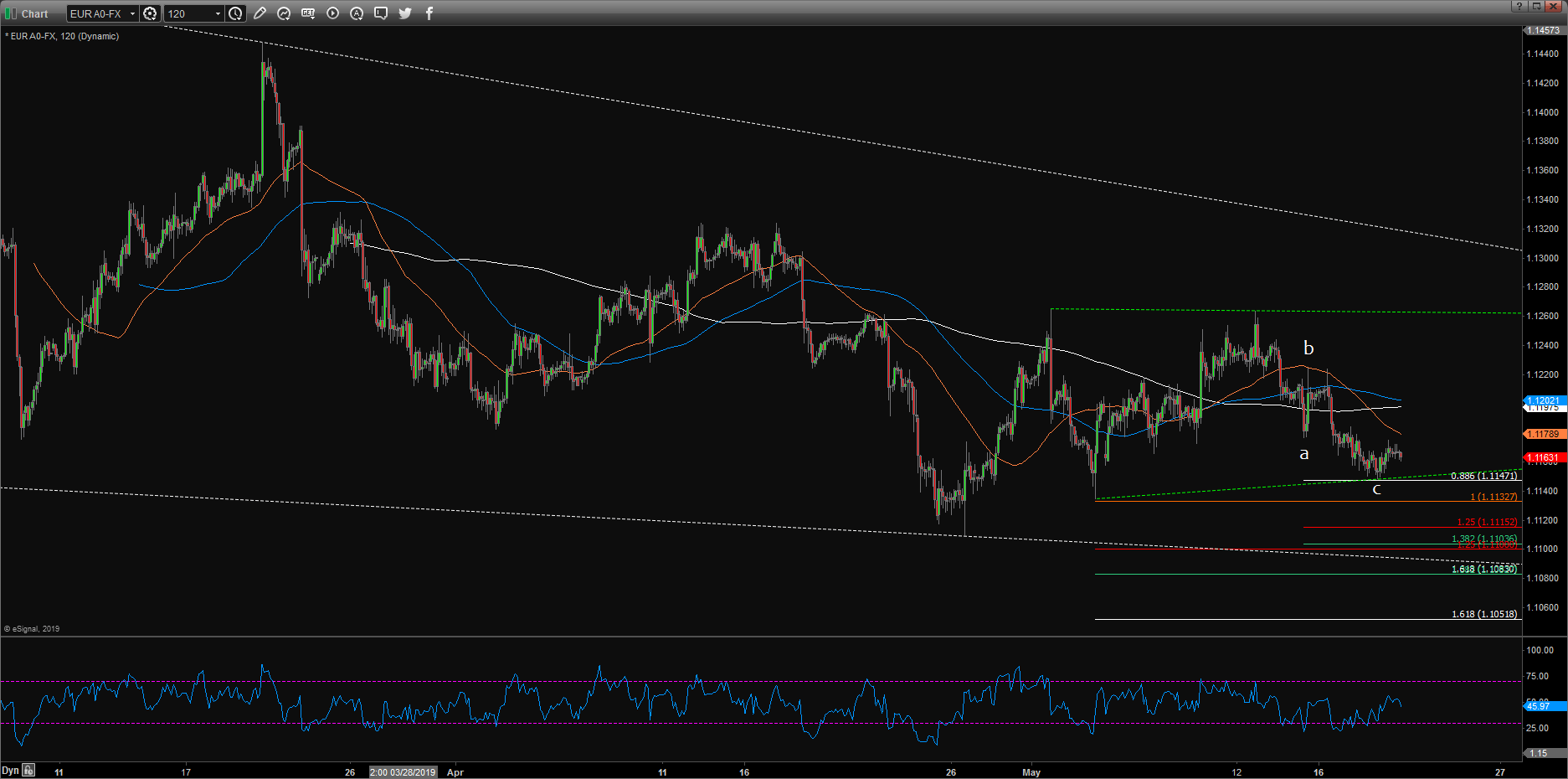

EURUSD: Today we entered a short term trade to go long EURUSD at 1.1165, unfortunately already stopped out at 1.1145.

For now we keep position flat.

The price consolidated in a narrow range, 1.1134/28 is the next level to watch.

FOMC Minutes should be the next catalyst.

The price was just rejected by the bottom of daily Ichimoku cloud.

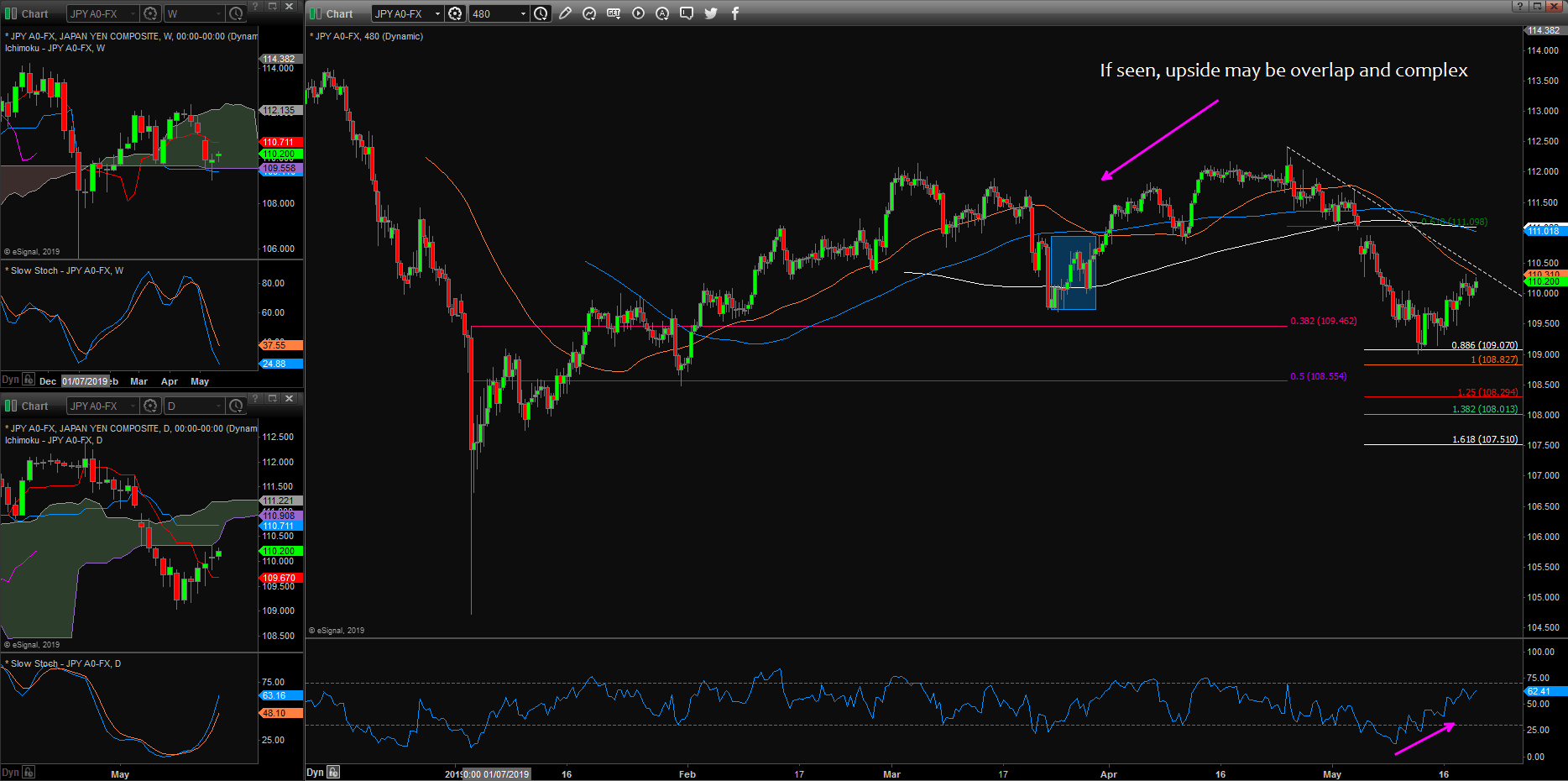

If seen, the upside may be overlap and complex. We'll look for better buying opportunities.

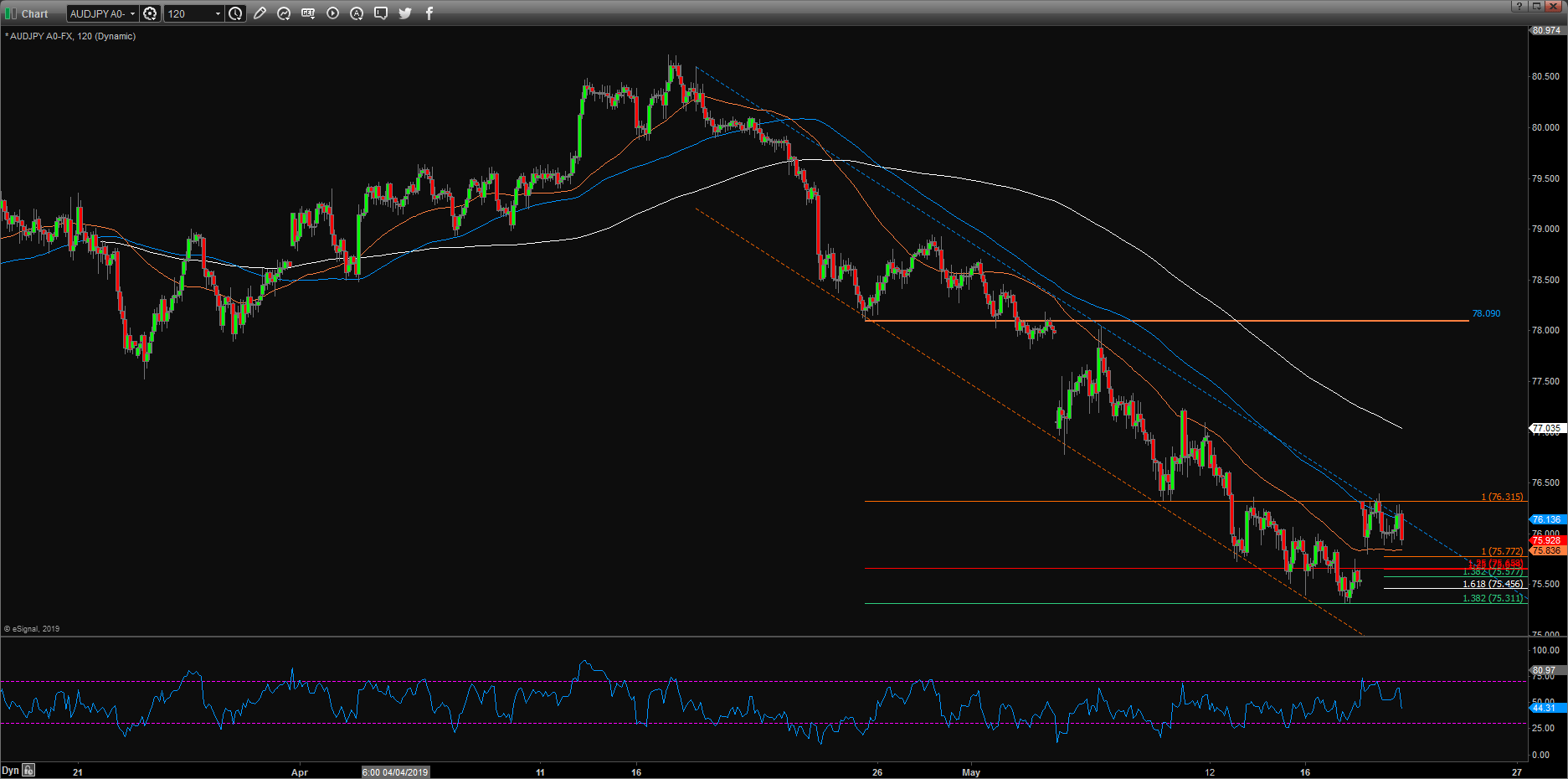

AUDJPY

The price failed to close above the downtrend channel.

RBA expressed clear easing bias, we have to stand aside for now.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.9% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.