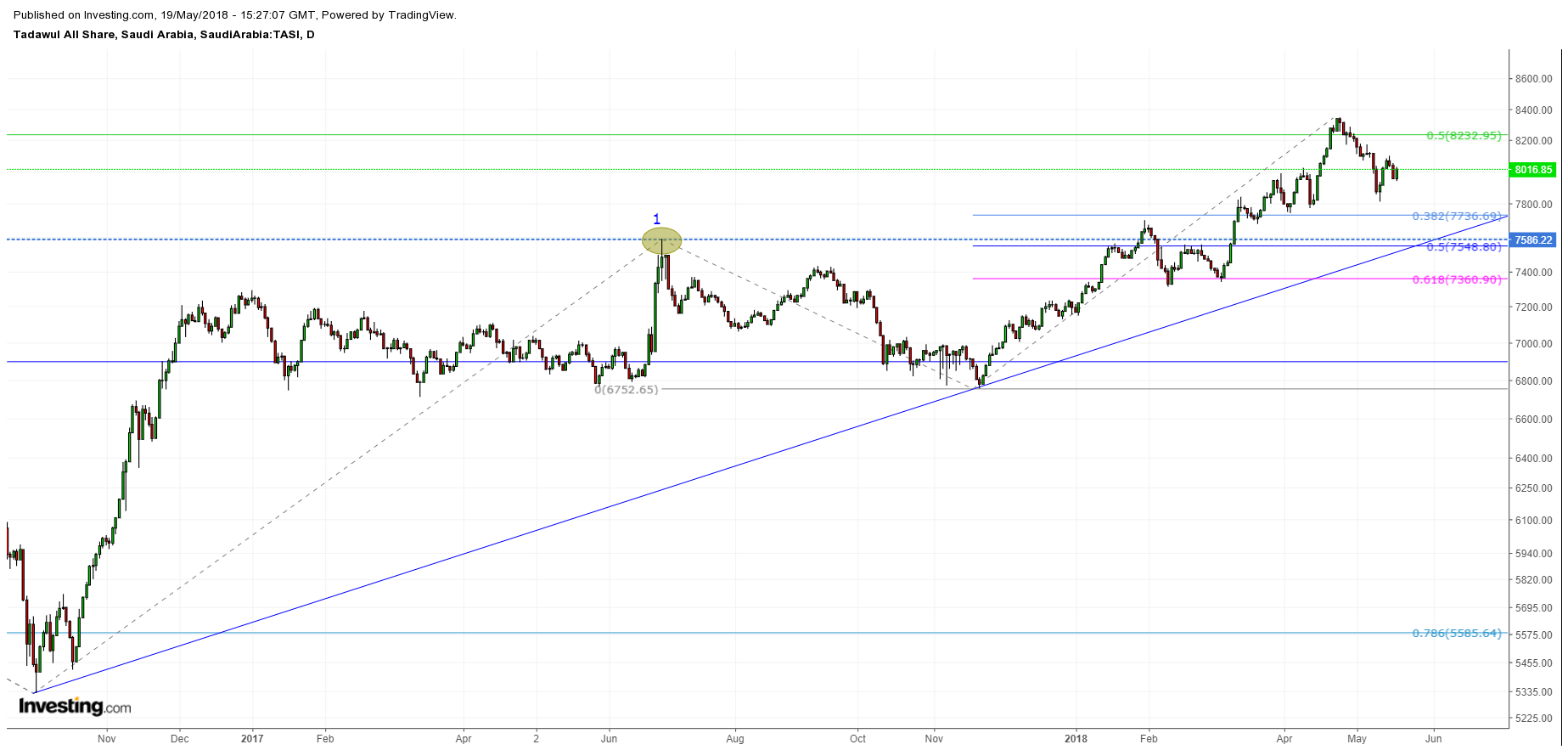

- Larger advance stalls at the 50% retracement zone.

- Deeper short-term pullback may occur.

- Followed by advance to new highs.

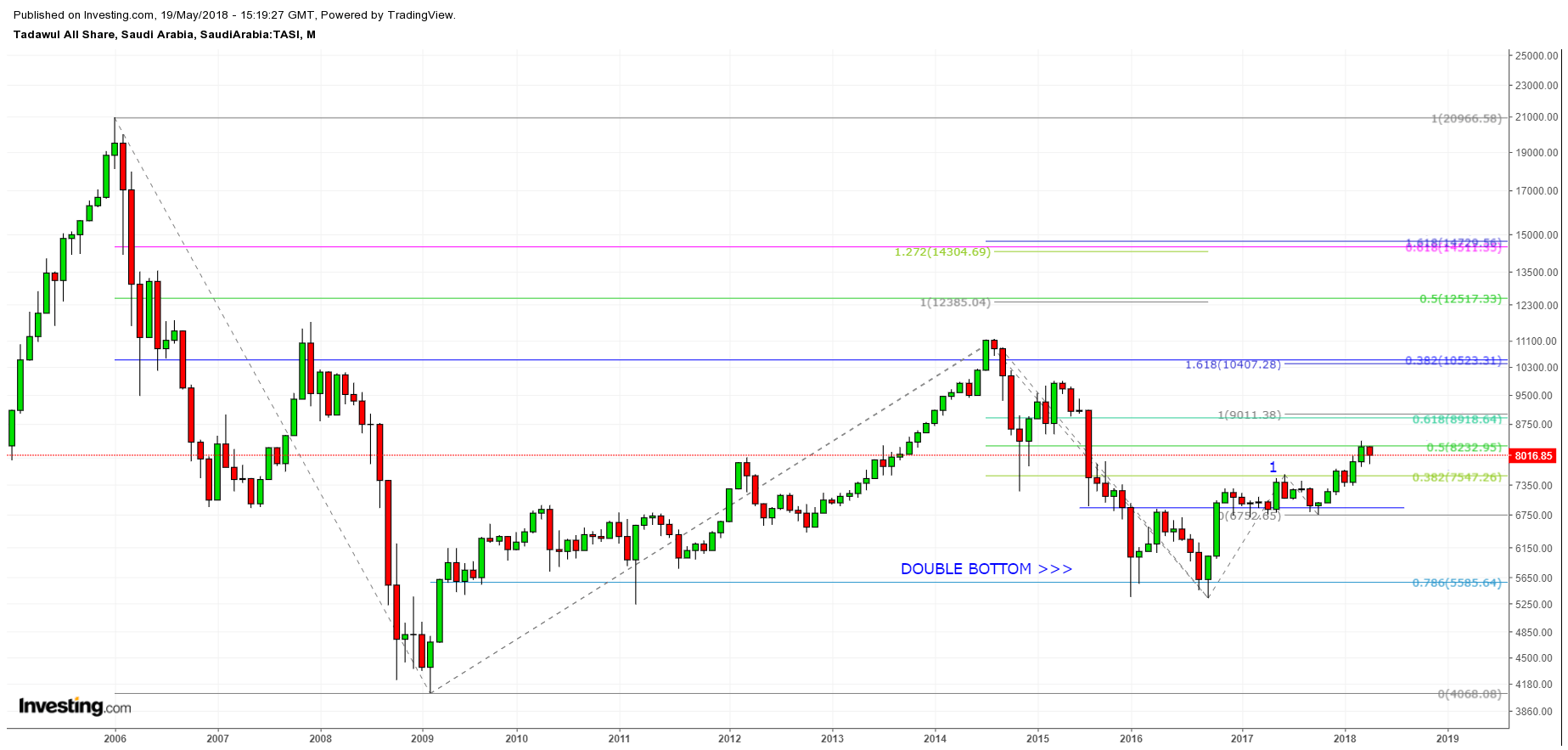

In the monthly chart below we see the big picture for the Tadawul All Share Index (TASI) (Saudi Stock Exchange) with future potential targets denoted by Fibonacci confluence, where at least two Fibonacci measurements identify a similar potential resistance zone. In addition, we are seeing further short-term resistance around the most recent high of 8,345.19. That’s a 33-month high.

Note that resistance was seen at the 38.2% retracement level at point 1 on the monthly chart, which led to a four-month pullback. Subsequently, the advance continued reaching the 50% retracement of 8,232.95 last month. The index has since stalled its advance around that resistance zone. It’s certainly possible that a deeper retracement may ensue before the larger uptrend kicks in again. It is expected that the uptrend will continue higher given the higher price targets and the structure of the advance so far off the double bottom trend reversal pattern that formed from January 2016 to October 2016.

Potential intermediate to long-term target zones:

- 8,919 – 9,011

- 10,407 – 10,523

- 12,385 – 12,517

- 14,305 – 14,729

This next chart below is a daily chart of the TASI. Here we take a closer look at the near-term uptrend. Fibonacci retracement levels are drawn from the most immediate uptrend coming off the November 2017 low. Along with the uptrend line they can provide some guidance as to where to look for support levels that might hold to the point to turn the TASI back up.

The views and opinions expressed here are solely those of the authors / contributors and do not necessarily reflect the views of Marketstoday.net. Neither Marketstoday.net nor any person acting on its behalf may be responsible for information contained herein. The content posted here may have been edited to conform to Marketstoday.net policies, terms and conditions. Any investment / trading related article, analysis or commentary are by no means a guarantee of present or future performance and should not be relied upon solely when buying or selling a financial instrument. Every investment no matter how appealing, involves risk and the investor should conduct their own research, consider personal risk tolerance, preference and needs when making an investment or trading decision.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.