A renewed sense of positivity is sweeping across financial markets this morning amid signs of easing trade tensions between the United States and China.

Encouraging reports of China placing it first major order of U.S. soybeans in more than six months is a symbolic move seen elevating global sentiment and boosting appetite for riskier assets. The trade optimism was clearly reflected in Asia this morning with stocks closing broadly higher, following the positive lead from Wall Street overnight. European markets are seen benefiting from the risk-on vibe, with the bullish momentum trickling down into Wall Street later this afternoon.

Although easing trade tensions are positive for stock markets, the upside is poised to face obstacles down the road. Global equity bulls remain threatened by concerns over plateauing global economic growth, Brexit turmoil and political risk in France among many other geopolitical risk factors.

Pound steadies after May survives confidence vote

The battered Pound breathed a sigh of relief after Theresa May survived a vote of no-confidence in her leadership. While this development removes an element of uncertainty amid the Brexit turmoil, it certainly is a major blow to her authority and power.

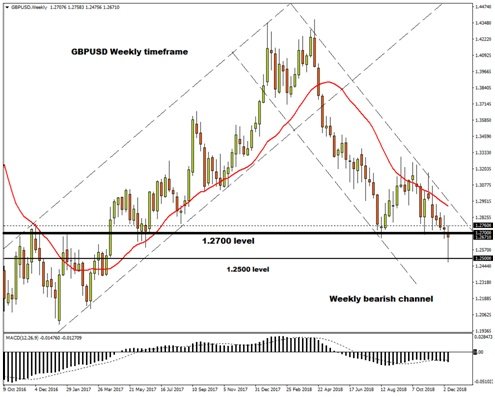

With May heading off to Brussels for the second time this week, investors will be closely watching to see if she is able to gain concessions from the EU on the Brexit deal. If May returns back to the United Kingdom empty-handed, a second referendum to stay in the European Union could be an option on the table. In regards to the technical picture, the GBPUSD is staging an impressive rebound with prices trading back towards 1.2700 as of writing. A solid breakout above this level will open a path towards 1.2760 in the near term.

Euro higher ahead of ECB meeting

All eyes will be on the European Central Bank meeting this afternoon where the bank is set to officially end its Quantitative Easing (QE) program.

With QE officially ending and no rate moves expected, investors should not be quick to label this meeting as a potential non-event. Given the disappointing economic figures from Europe lately, heightened political risk in France and Italy’s budget dramas, it will be interesting to hear European Central Bank President Mario Draghi’s thoughts. Much attention will also be directed towards the latest economic forecasts to see if the European Central Bank is concerned over the developments in Europe. The Euro is likely to depreciate if Draghi strikes a dovish tone and expresses concerns over the health of the Eurozone.

Currency spotlight – Dollar

Widening interest rate differential between the Federal Reserve and other major banks across the world empowered Dollar bulls for the most part of 2018. Investor optimism over the health of the U.S. economy boostedappetite for the Dollar in times of uncertainty. With expectations over higher U.S. rates and safe-haven demand supporting the Dollar, the currency was king of the hill in the FX arena.

However, there has been a change of attitudein recent weeks with dovish comments from Fed officials and disappointing economic data clouding the Dollar’s outlook for 2019. With expectations mounting over the Fed taking a pause on raising interest rates next year, the sentiment pendulum is seen swinging to the favour of the bears. Focusing on the technical picture, the Dollar Index has the potential to slip towards 96.60 if 97.00 acts as a firm resistance.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.