Stock and commodity markets are moving bullish on Friday after the first day of talks between the United States and China.

Stock indices scale pending the second day of negotiations. In Asia Nikkei 225 rises 0.45% to 21,955 pts, Hang Seng rises 2.25% to 26,286 pts. In Europe, the German DAX 30 index scales 1.25%, reaching 12,314.5 pts.

Commodities, meanwhile, also move bullish on Friday. Gold regains ground advancing 0.57% and moves again over $ 1,500 per ounce, while silver climbs 1.27% to $ 17,725 a troy ounce.

The bullish sentiment of the markets comes after the first day of talks between negotiators between the United States and China. President Trump called this first day, "very, very good."

An officer close to the White House said the talks have been proving "probably better than expected." Also, a U.S. Chamber of Commerce said that both countries had increased the possibility of a currency agreement this week.

Technical overview

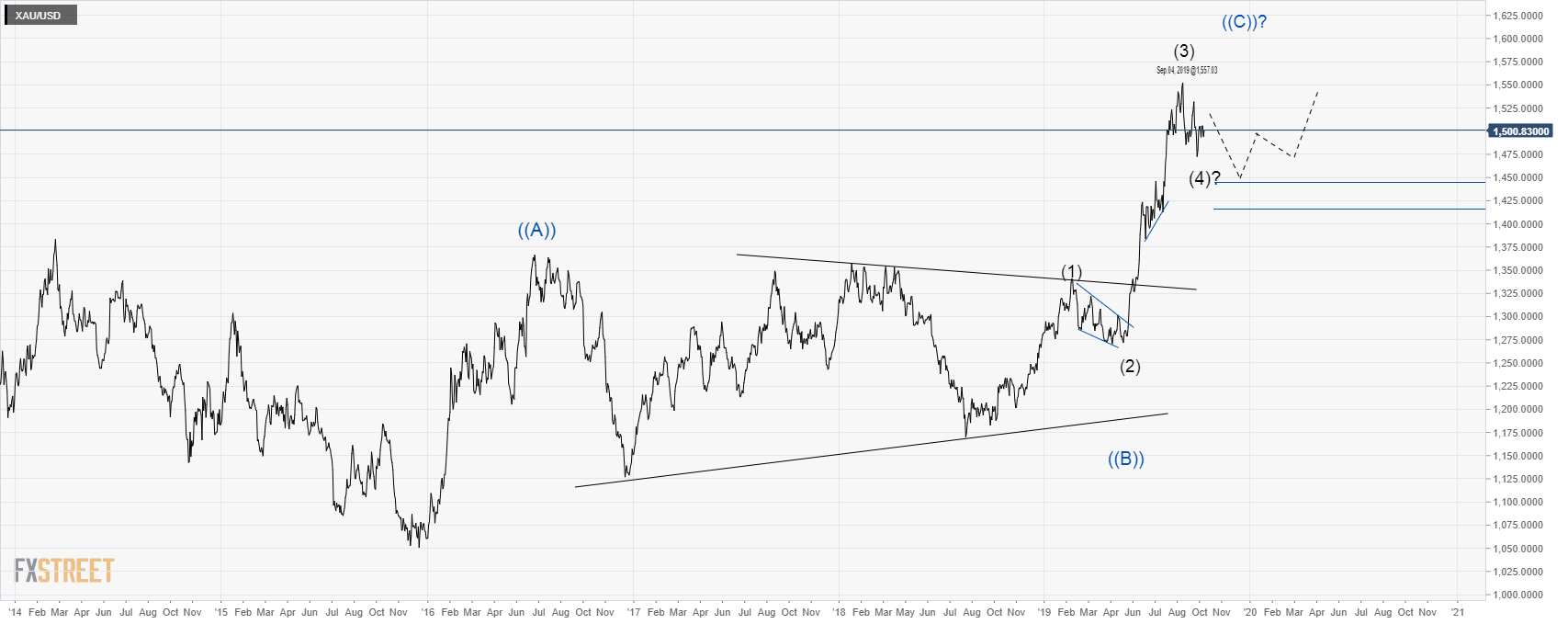

Gold price continues developing a corrective structure. The yellow metal in its weekly chart moves in a potential wave (4) in progress. In the near-term, we expect a triangular correction or a complex corrective sequence.

Long-term, we foresee a potential correction that could extend its decline to the area between1,445 and $1,435 per ounce.

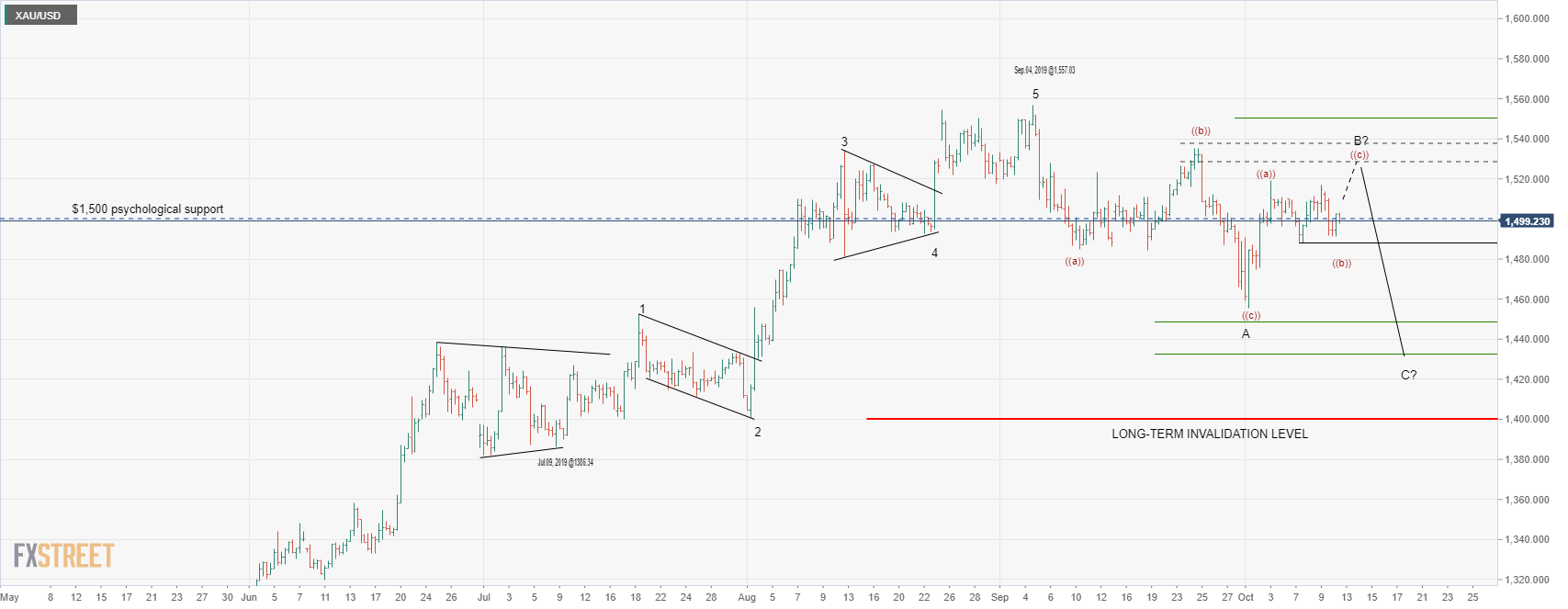

The Gold in its 8-hour chart shows a first corrective sequence labeled as ((a)), ((b)), and ((c)) in red degree. The first bearish leg started on September 04, when the price found sellers at $1,557.03 per ounce.

Once the price action found a short-term bottom at $1,455.50 per ounce, the golden metal began a bounce. The current move should be developed in three waves. Until now, the upper degree Elliott wave structure could be a flat pattern.

In consequence, a short position could be active if Gold breaks down and closes below the last swing ((b)) in red from the wave B labeled in black at $1,487.80.

The potential profit target is between $1,448 and $1,437 per ounce. The invalidation level could be above the end of wave B labeled in black degree.

Risk Warning: CFD and Spot Forex trading both come with a high degree of risk. You must be prepared to sustain a total loss of any funds deposited with us, as well as any additional losses, charges, or other costs we incur in recovering any payment from you. Given the possibility of losing more than your entire investment, speculation in certain investments should only be conducted with risk capital funds that if lost will not significantly affect your personal or institution’s financial well-being. Before deciding to trade the products offered by us, you should carefully consider your objectives, financial situation, needs and level of experience. You should also be aware of all the risks associated with trading on margin.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'