- The Reserve Bank of Australia is expected to maintain its monetary policy unchanged.

- Investors hope for positive hints about progress in economic developments.

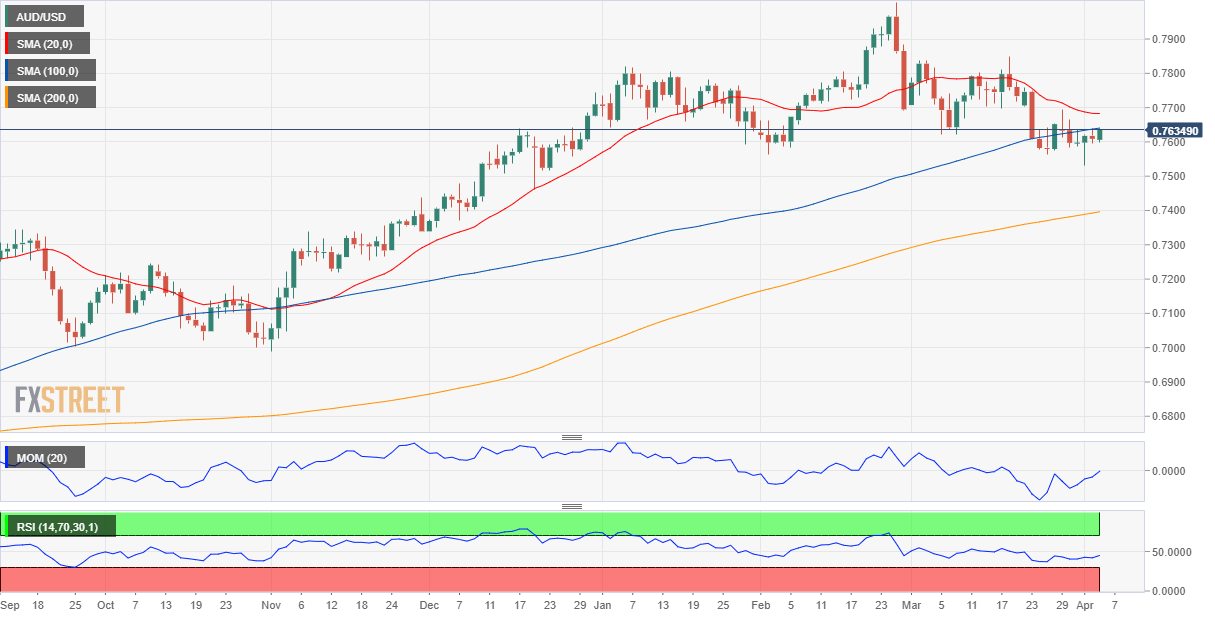

- AUD/USD has a limited bullish potential according to long-term technical readings.

The Reserve Bank of Australia is having a monetary policy meeting early on Tuesday, although it is widely anticipated to maintain rates at a record low of 0.1% and its commitment to yield-curve control, maintaining the target for the three-year government bond also at 0.1%.

Rising government bond yields amid hopes for an economic comeback, not only affected the US, as Australian yields also soared. However, policymakers were quick to respond, ramping up bond purchases in March. "The Bank is prepared to make further adjustments to its purchases in response to market conditions," RBA Governor Philip Lowe said back then.

RBA looking at the employment sector

The central bank is expected to maintain its optimistic economic outlook unchanged. Policymakers have repeated multiple times that the economy is doing better than anticipated, but the high levels of uncertainty remain.

Vaccine developments have boosted hopes for further economic improvement, although, in Australia, vaccine rollout was set to a slow start. The country has kept the virus under control amid a strong political will, saving lives but at the cost of hurting mainly small business. Punctual and strict lockdowns ever since the pandemic started, has brought the country to report 909 total deaths, and 58,173 cases of COVID-19.

Speculative interest is waiting for any hint on increased economic strength that may result in a sooner-to-come tightening announcement. However, chances are quite limited. The RBA has said that the employment sector would not recover before 2024. Until the sector comes back, rates are meant to remain at record lows.

AUD/USD possible scenarios

The AUD/USD pair is recovering in the near term, but in the daily chart, the bullish potential is quite limited. The pair is incapable to advance beyond a bullish 100 DMA, while the 20 SMA develops below it, although without directional strength. Technical indicators, in the meantime, advance just modestly within negative levels.

Markets are optimistic about their return after a long weekend, weighing on the greenback. US Treasury yields are on the rise, which may end up benefiting the American currency in the next few hours.

Ahead of the RBA, the pair is mildly bullish in the near term but overall neutral. In the 4-hour chart, it is above a flat 20 SMA, while the longer moving averages head modestly lower above the current level.

The pair could advance towards the 0.7730/70 price zone on a break above 0.7675, while a disappointing outcome and a break below 0.7600 could see the pair retesting the year low at 0.7531.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.