The USD eased back on Tuesday as investors grew cautious about the U.S. and China trade talks which entered the second day. The parties are focusing on producing an outline for the agreement which could be then signed off by the respective leaders. Failure to reach a deal by March 1st could potentially mean that either a new deadline must be set or the new tariffs will hit the tariffs on $200 billion worth of goods from China.

The British Prime Minister, Theresa May said that there was no breakthrough on the Brexit negotiations with the EU. However, she ruled out a no-Brexit deal and said that talks would continue.

Economic data on the was relatively quiet. New Zealand's inflation expectations for the quarter remained unchanged at 2.0%. Japan's tertiary industry activity declined by 0.3% against forecasts of a 0.1% decline. The declines were slower compared to the previous month's fall of 0.4%.

The European trading session was quiet.

The Brexit Situation

Bank of England Governor, Mark Carney gave a scheduled speech where he highlighted that trade uncertainty and the slowdown from China as the most significant risks. However, Carney said that the global economy would most likely avoid a recession. The British pound did not record any significant movement on the day.

The NY trading session which saw no significant economic releases was seen highlighted by the speech of the Fed Chair, Jerome Powell. Powell delivered a speech titled Economic Developments in High Poverty Rural Communities in Mississippi.

Answering questions during the speech, Powell said that the U.S. economy looked strong. He did not make any further references to the Fed's rate hike plans or on monetary policy.

The overnight session saw the Reserve Bank of New Zealand holding its monetary policy meeting. As widely expected, the central bank left the official cash rate unchanged at 1.75%. The RBNZ's policy statement suggested a dovish tone as the Governor said that while the chance of a rate cut is not in the books, a rate cut could happen if growth did not pick up.

The NZDUSD managed to post strong gains after the RBNZ's meeting. The Kiwi is currently up over 1.68% against the USD.

Looking ahead, the UK's inflation figures will be coming out today. Economists forecast that inflation fell to 1.9% on the year ending January 2019. The core inflation rate of 1.9%, matching forecasts.

Industrial production data from the Eurozone should fall by 0.4% on the month following a 1.7% decline from the month before.

The NY trading session will see the release of the monthly consumer price index data. Reports should show that the headline inflation rate rose by 0.1% reversing the 0.1% decline from the month before. The core inflation rate should remain steady, rising at a pace of 0.2% during the month.

Later in the evening, the RBNZ Governor, Adrian Orr will speak.

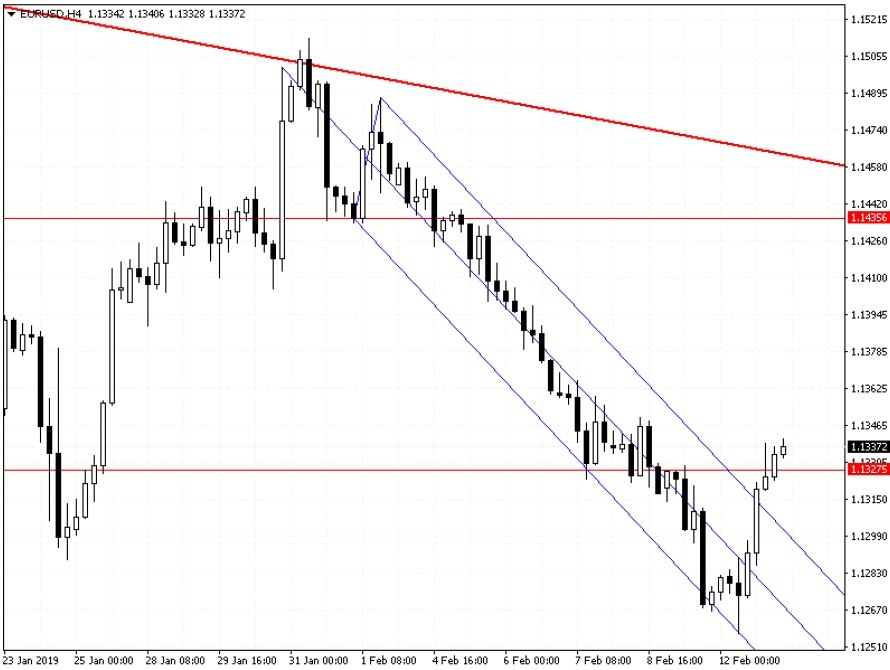

EURUSD Intraday Analysis

EURUSD (1.1337): The EURUSD currency pair closed on Tuesday with a bullish engulfing pattern. This comes after prices fell to a 3-month low of 1.1256 before prices recovered. On the 4-hour char time frame, the EURUSD currency pair attempts to close above 1.1327. This marks a minor support level that was breached.

Failure to hold the gains and the higher close above this level could potentially trigger a correction to the upside. The EURUSD could test the next main resistance level of 1.1435 if the bullish bias keeps in place.

USDJPY Intraday Analysis

USDJPY (110.60): The USDJPY currency pair has been maintaining a solid bullish momentum since the past two trading sessions.

Last Friday's strong bullish close above 109.78 has triggered the move that is likely to see prices testing the main resistance level of 111.21. This also comes with price action breaking out to the upside from the ascending triangle pattern. The support at 109.78 could be tested in the near term.

XAUUSD Intraday Analysis

XAUUSD (1313.09): Gold prices attempted to reverse the losses from Monday. Price action tested intraday highs of 1313.28 before easing back but closing on a bullish note. A bullish follow through today which could close above Monday's open of 1314.07 will potentially set the upside bias in motion.

On the daily chart, gold prices have been consolidating, and the gradual decline has formed a bullish flag pattern. Price will need to break past the highs of 1321.58 to confirm the upside. The minimum upside target at 1347.23 is a successful breakout of the bullish flag pattern.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.