The weakness in the NZD after the last RBNZ meeting had been a little puzzling. With so many positive revisions higher for the outlook of the New Zealand economy, it was reasonable to expect some NZD buying. Now, with the emergence of the omicron variant fears NZD selling is much more understandable. As a high beta currency, alongside the CAD and the AUD, it is normal to see it drop during times of risk aversion. However, where next for the NZD? Let’s look at two outlooks for if the variant fades or if it doesn’t fade.

If the omicron fears fade?

This is the most straightforward outlook. The NZD should immediately gain against the safe havens of the CHF and the JPY. So, NZDCHF and NZDJPY should put in strong gains.

If the omicron fears don’t fade

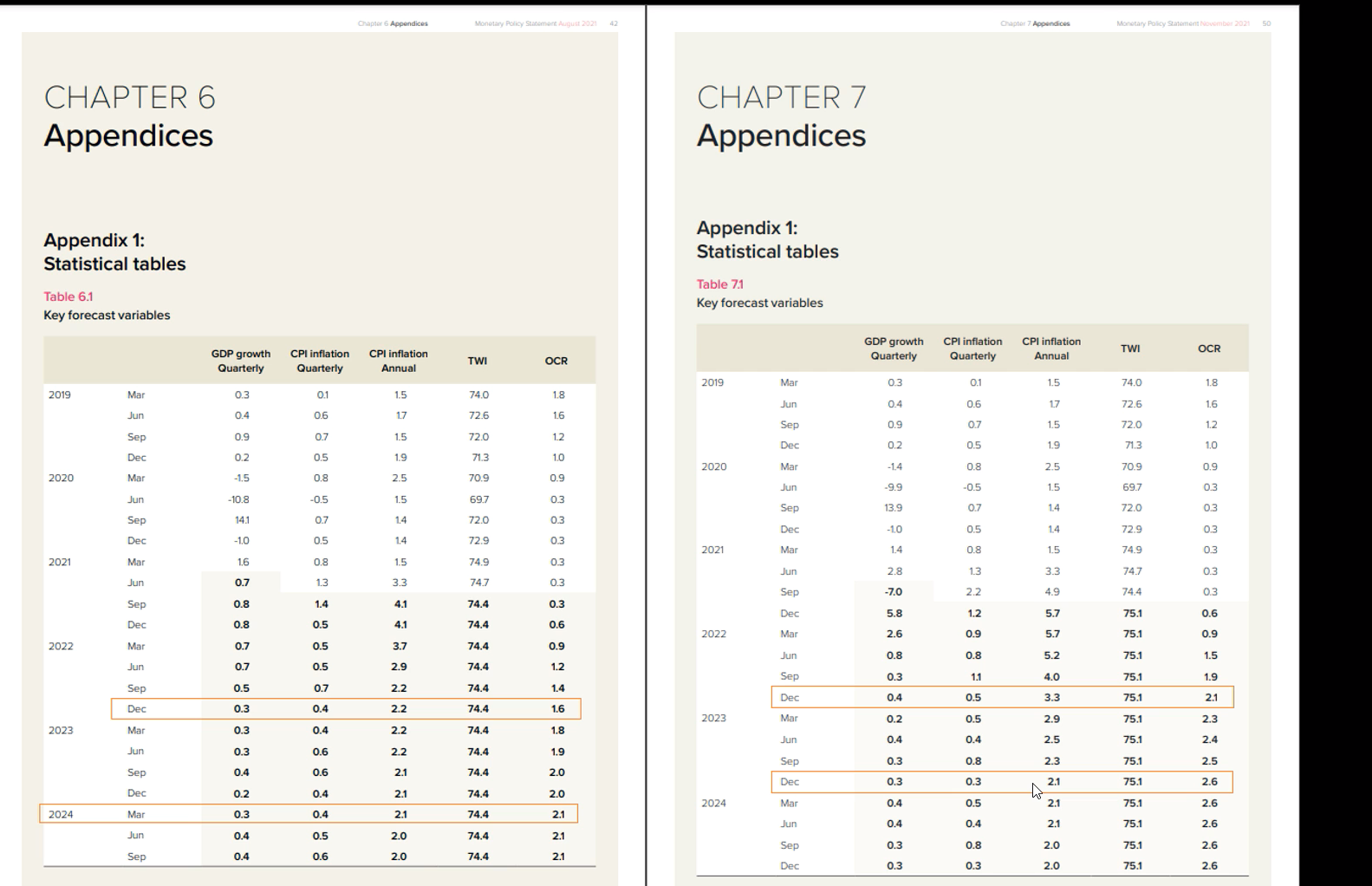

This is where it gets more interesting. The Chief Economist, Young Ha, said that “markets had correctly read the data developments and shifted interest rates in a way that’s broadly consistent with the RBNZ’s projected trajectory for the cash rate”. The current rate is 0.75%. The rate path is for the OCR (Official Cash Rate) to be at 1.5% for June 2022, 2.1% for Dec 2022 and 2.6% for Dec 2023. This was revised higher after the last rate meeting as the RBNZ looked to respond to record-high inflation and low unemployment. You can compare the updated rate path projection on the right-hand side of the page with the previous projection on the left-hand side.

So, it was interesting to read that the Chief Economist Ha is not expecting this emerging omicron outlook to massively change things. He said in a Bloomberg interview: “From where we sit, the outlook is demand might be a bit weaker, it might be a bit stronger depending on how households behave in this new world.” “But it is still a world where inflation pressures are rising, capacity pressures are going to stick around for a while and hence you probably need to be removing monetary stimulus rather than maintaining it.”

So either way, the case for upside for the NZD over the medium term still remains. This is one narrative to watch, but even if the omicron variant is a threat then it becomes a question of time before the next ‘omicron variant vaccine is released’. Moderna’s Chief Medical Officer said a new vaccine variant could be ready early next year.

So, buying the dip or buying the even deeper dip seems to make sense at this stage. Just make sure that risk is managed well.

Both NZD CHF and NZDJPY currency pairs are available to trade at HYCM, as well as other instruments in forex and other asset classes.

Our products and commentary provides general advice that do not take into account your personal objectives, financial situation or needs. The content of this website must not be construed as personal advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.