- RBA rate cut expectations shoot through the roof following Chinese data.

- Coronavirus and bush fires a factor for consideration by the RBA.

- There are still valid arguments for the RBA to hold, fiscal stimulus potentially a preferred measure at this stage.

- RBA is reluctant to cut interest rates, but a coordinated measure by global central banks could be on the cards.

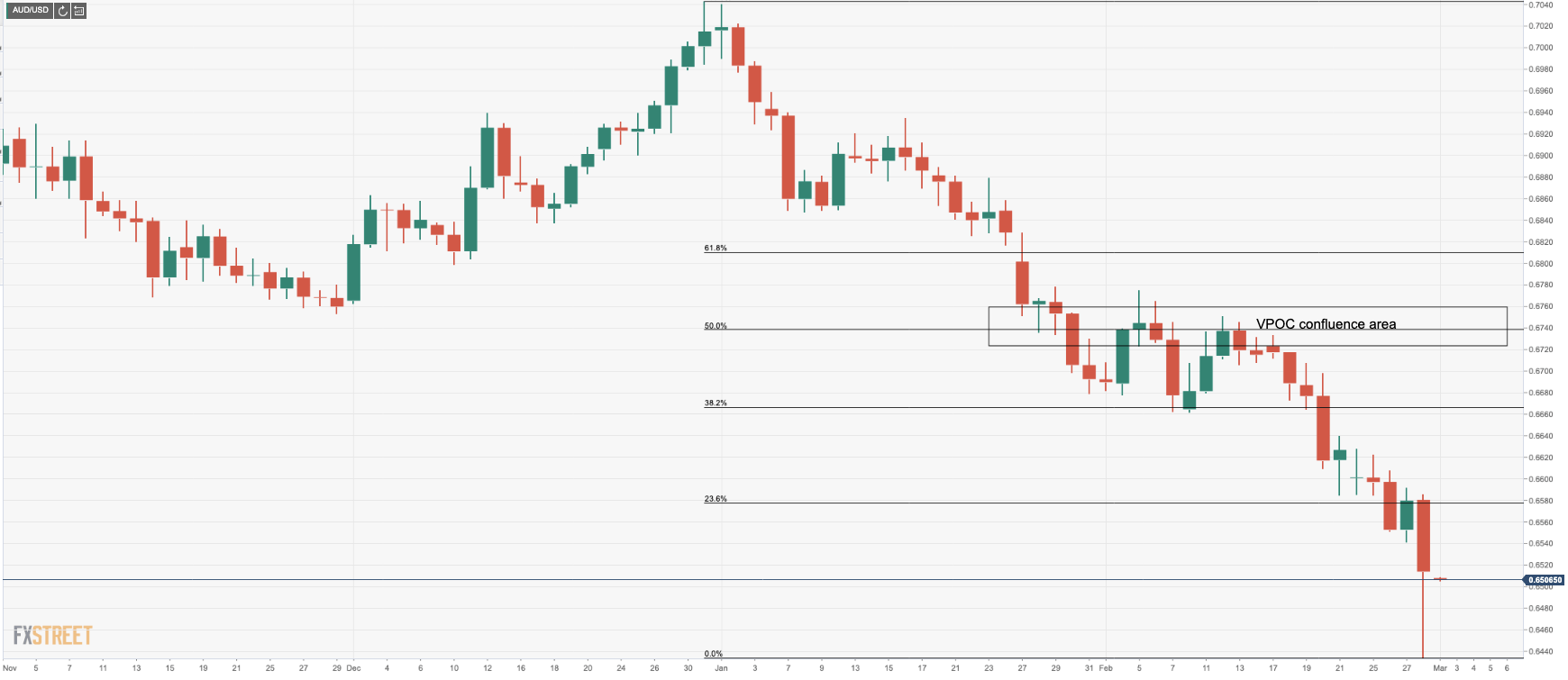

- AUD bulls to target the VPOC on RBA holding and/or US dollar weakness.

The Reserve Bank of Australia is due to meet on Tuesday to decide on its interest rate. The coronavirus and bush fires have been a likely catalyst for the market's higher pricing of a rate cut as soon as tomorrow from the Reserve Bank of Australia. Indeed, OIS is at 127% for a 25 basis point cut, pricing in some chance of a 50bp cut. The RBA cash rate is currently at 0.75%. Markets are in a panic, and rightly so, leading to global equities suffering their sharpest declines since the 2008 financial crisis last week, while commodities also plunged, weighing on the value of the correlated AUD to fresh monthly lows. At the time fo writing, we have seen the number of cases of the coronavirus jump by 1,739 new cases of the infection confirmed over the past 24 hours. The total globally is 87,137. More on that here:

Meanwhile, the RBA cut three times last year to spur firms to invest and hire in order to speed up economic growth and inflation. What makes this meeting so interesting is that the RBA's governor, Lowe, is very reluctant to cut and is stuck between a hard place and a rock. The RBA needs to see if unemployment rises ( in Jan, rose from 5.1% back to 5.3% –19th March will show the Feb issue) and if there is no progress toward their inflation target – only then will Lowe pull the trigger, but that was before the recent escalation of coronavirus risks to the global economy.

Australia's top trading partner, China, slumps to record territories

However, we are now starting to see negative effects in the global economy after a key manufacturing gauge in Australia's top trading partner China slump last month. Heavy losses are seen in US equity futures which declined by around 3%, while oil futures also weaker around 2.6% following the dismal Chinese PMI data over the weekend which printed the worst on record. China’s official manufacturing purchasing managers’ index (PMI) dropped to 35.7 in February from 50.0 in January, below the 38.8 figure reported in November 2008. The non-manufacturing PMI – a gauge of sentiment in the services and construction sectors – also dropped to 29.6 from 54.1 in January, the lowest since November 2011. This is a factor that has been the nail in the coffin as far as markets are concerned. Investors are looking to the Federal Reserve and other major central banks – despite their limited ammunition – to contain the fallout from the outbreak. Fed Chairman Jerome Powell in a statement on Friday said the US central bank is ready to cut rates as the epidemic “poses evolving risks” to the American economy. Such rhetoric is leading the market to believe rate cuts from all the central banks is imminent, including from an otherwise cautiously optimistic RBA that was expecting progress to be made towards the inflation target and full employment.

Zhejiang province gets back to work

The weekend's data from China is an alarming reality for the RBA to consider, but, always the optimist, Lowe will also find comfort in knowing that the National Development and Reform Commission spokesman Cong Liang said that over 90 per cent of industrial enterprises in Zhejiang province, one of the country’s top manufacturing bases, has, in fact, resumed operation. According to Cong, over 70 per cent of production in the manufacturing and export hubs of Guangdong, Jiangsu, Shandong and Liaoning had also restarted. With hopes that the virus will be contained and that the worst is behind China, in terms of the rate of infections. In this case, the most optimistic of observers might regard any immediate measures taken by authorities are that of a precautionary measure only, due to the higher chance of global recession. Casting minds back, RBA officials’ commentary in recent months had highlighted that global developments could be an important driver of policy outcomes.

The narrative across most central banks is to hold

On the other hand, the latest rhetoric from the board was not so dovish which leads some to believe that Tuesday's RBA Board Meeting should see the Bank keep the cash rate on hold at 0.75%. "So far the Bank's message has been that the hurdle to cutting is high, pointing to the long and variable lags of policy. While we don't expect the Bank to express coronavirus concerns yet, the Bank's take on the rise in the unemployment rate will be worth noting," analysts at TD Securities argued.

This seems to fit in with the narrative across most central banks. Late on Friday Fed Chair Powell made the comment that the Fed would “act as appropriate” to support the economy. Markets took that as a tip of the hat for a rate cut, perhaps even as soon as this month on the 17-18 March. We have also hard from Europe, with central bankers noting downward risks to growth forecasts due to the virus. However, Europan Central Bank President Lagarde and Bundesbank President Weidmann both indicated that the situation does not warrant an immediate cut. So, perhaps markets are getting too ahead of themselves. But then again, that was all before the weekend's data where a key manufacturing gauge in China slumped last month, although this should come at no surprise to the RBA board.

RBA to hold, but here is the twist

Should the RBA hold and surprise many, it could be due to the fact that a coordinated effort from a collective of central banks is being but together behind closed doors at the moment. In the weekend press, reading an article by Reuters, a top economist for the US bank lobby - a former Fed insider - was cited to issue a remarkably specific prediction in a blog titled "Don't keep your powder dry". Written by Bill Nelson, chief economist at the Bank Policy Institute who worked on the Fed's responses to the 2007-2008 financial crisis, it is predicted that a "coordinated global interest rate cut by the top central banks, such as the one executed at the height of the crisis in October 2008 by the Fed and five other central banks. They will possibly include in this action the People's Bank of China and the Hong Kong Monetary Authority, the two banks whose economies have so far suffered most from the outbreak. Key notes:

- It will happen this Wednesday, March 4. Nelson noted that the previous big coordinated actions in December 2007, October 2008 and November 2011 all occurred on a Wednesday.

- It will happen before the US stock market opens, either 7 a.m. or 8 a.m. ET (1200 or 1300 GMT).

- It will be big: half a percentage point at least. The Fed’s current benchmark lending rate is set in a range of 1.50-1.75%, and rate futures markets are pricing in a cut of at least a quarter percentage point at the Fed’s next scheduled meeting March 17-18. “The only way to get a positive market reaction is to deliver more than expected,” he wrote.

Fiscal measures more appropriate at this stage?

While RBA's Lowe could prove a reluctant cutter, we have to consider the alternative measures that a nation could take at this juncture, whereby central banks are already close to zero and thus, monetary policy can’t actually do much to revive growth in the current context. The ECB has been one of the most well-known advocates for fiscal spending and last week, we hard the same from the Bank of Korea and a nation badly affected by the virus. Lee Ju-yeol, governor of South Korea’s central bank, surprised markets when he refrained from a knee-jerk cut. He said the appropriate response at this stage was targeted fiscal support for the companies most affected by the biggest virus outbreak outside China. It should be noted that Australia’s government is also considering targeted stimulus for the worst-hit sectors after a horror summer of wildfires that engulfed an already drought-stricken east coast.

Exchange rate considerations

The Australian economy’s traditional shock absorber, the currency, has fallen about 7% this year and is trading at its weakest rate since 2009. AUD/USD got down to as low as 0.6434 last week. This is another channel helping the RBA and trade-related industries and should be a factor to consider as well.

AUD/USD levels to consider

From a volume profile analysis, last week's point of control is located at 0.6600 as an immediate upside target for the bulls. 0.6712 comes as the 2020 range's point of control so far and has a confluence of a 50% retracement of the range YTD. These will be likely levels to target should the RBA remains on hold where the market equilibrium pulls price into a balance between bears and bulls. To the downside, 0.62 and 0.6000 are a focus although the daily Average True Range is only at 54 pips currently, thus considering that, the 0.64 handle could prove resilient, (2X ATR). On the other hand, should the US dollar strengthen in a correction of last week's sell-off from oversold territory, any subsequent reactions to the RBA cutting rates could be exaggerated by USD flows supporting commodity-FX which would likely see a test below the 0.64 handle over time.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.