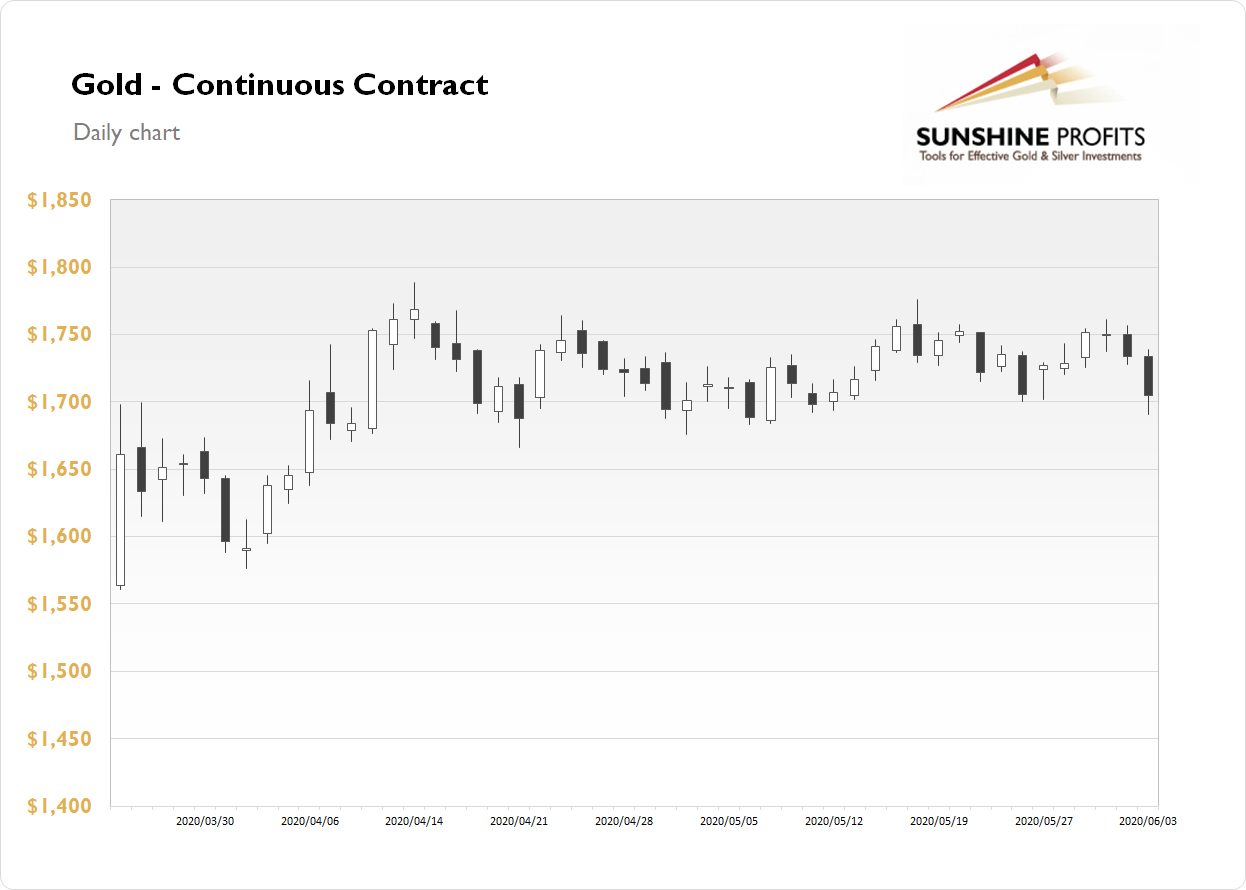

The gold futures contract lost 1.68% on Wednesday, as it got back to $1,700 price level. The market has retraced its recent advance despite weakening U.S. dollar. On Monday the price has reached slightly above $1,760 and yesterday’s daily low fell at $1,690.30. Gold is still trading within a medium-term consolidation, as we can see on the daily chart:

Gold is trading 0.6% higher this morning. Financial markets remain in risk-on mode, as stocks continue to hover along their medium-term highs. What about the other precious metals? Silver lost 1.65% on Wednesday and today it is 0.5% higher. Platinum lost 0.9% and today is 0.3% higher. Palladium lost 1.23% and today it is 0.2% higher. So precious metals are rebounding after their yesterday’s decline.

The recent economic data releases have been confirming negative coronavirus impact on global economies. However, yesterday’s ADP Non-Farm Employment Change and the ISM Non-Manufacturing PMI releases came out better than expected. Today, we are getting the European Central Bank’s monetary policy updates. But markets’ attention will be focusing on tomorrow’s U.S. monthly jobs data.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Thursday, June 4

7:45 a.m. Eurozone - Main Refinancing Rate, Monetary Policy Statement

8:30 a.m. U.S. - Unemployment Claims, Revised Nonfarm Productivity q/q, Revised Unit Labor Costs q/q, Trade Balance

8:30 a.m. Eurozone - ECB Press Conference

8:30 a.m. Canada - Trade Balance

Friday, June 5

8:30 a.m. U.S. - Non-Farm Employment Change, Unemployment Rate, Average Hourly Earnings m/m

8:30 a.m. Canada - Employment Change, Unemployment Rate

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

GBP/USD slides to its lowest level since November, eyes 1.2400 ahead of UK jobs data

GBP/USD drifts lower for the third straight day on Tuesday and drops to its lowest level since November 17 during the Asian session. Spot prices trade around the 1.2420 region as traders now look to the UK monthly employment details for a fresh impetus.

EUR/USD falls toward 1.0600 on higher expectations of the Fed prolonging higher rates

EUR/USD continues to lose ground for the sixth successive session, trading near 1.0610 during the Asian hours on Tuesday. The elevated US Dollar is exerting pressure on the pair, potentially influenced by the higher US Treasury yields.

Gold price holds steady below $2,400 mark, bullish potential seems intact

Gold price oscillates in a narrow band on Tuesday and remains close to the all-time peak. The worsening Middle East crisis weighs on investors’ sentiment and benefits the metal. Reduced Fed rate cut bets lift the USD to a fresh YTD top and cap gains for the XAU/USD.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

The week ahead: Key economic and earnings releases to watch

The market’s focus may be on geopolitical issues at the start of this week, but there is a large amount of economic data and more earnings releases to digest in the coming days.