Since the beginning of the August, the price of the WTI Oil is declining. Interestingly, since the beginning of the August, USD started the appreciation. So is the decline in the Oil a result of a stronger Dollar? Well, yes and no. Definitely it has an influence there but for example if we look at gold or other commodities we do not see this weakness. There must be something else here.

First of all, let us look at the macro data. What we got this week was Wednesday EIA Crude Oil Stocks change. The number came very bullish. The draw was much bigger than expected and the number of -8.9M should be normally a very good sign for the buyers. It was the largest draw in over a year! What is more, the actual number was lower than the expectations in the last 6 out of 7 weeks. So why the price of the WTI went lower? The answer in this case is the supply. Report showed a rise in gasoline inventories by 22,000 barrels and rise in distillate stockpiles by 702,000 barrels. Not to mention the fact that crude oil production increased to 9.502 million barrels per day. In other words: supply is huge and is still growing.

That is EIA but we also do have an OPEC, which does not have any good idea to stop the price from falling apart from the more jawboning and other verbal interventions. To wrap the fundamentals up, it does not look good for the buyers.

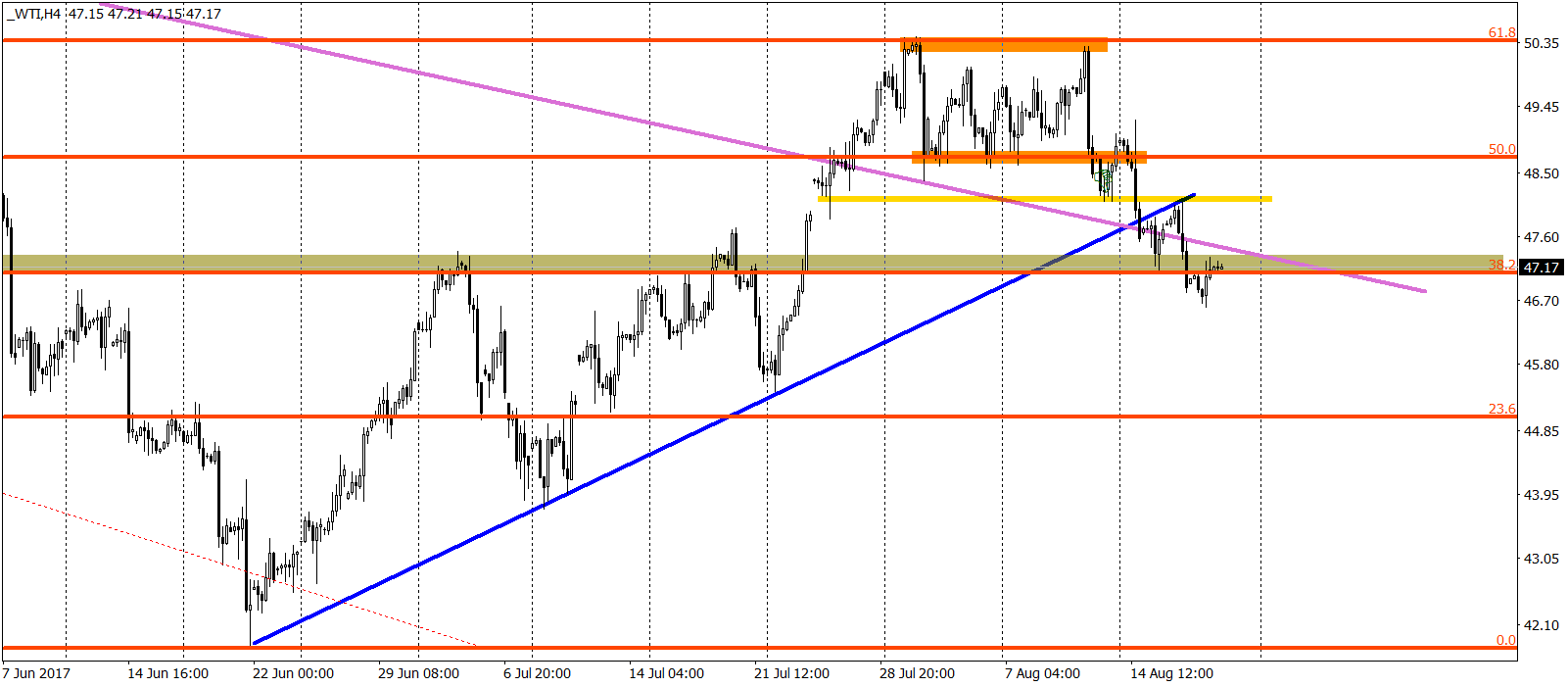

From the technical point of view, the situation is not great either. What we do have here is the breakout of the up trendline (blue), which was later used as a closest resistance. What is more, we went below the 38,2% Fibonacci and used that as a resistance as well. Before that we bounced of the 61,8%, broke the 50% and 48.15 USD/bbl slightly below. Those supports were crashed quite easily, showing a bullish weakness.

The sentiment stays bearish as long as we are below the 48,15 resistance (yellow). Chances for a further downswing are now much bigger than for a rise.

Follow us on Twitter @wisniewskifx and @AlpariRA

Trading FX/CFDs on margin bears a high level of risk, and may not be suitable for all investors. Before deciding to trade FX/CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. You can sustain significant loss.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.