China’s central bank, the People’s Bank of China (PBOC), attracted some attention this week after it was revealed that it has suspended using the counter-cyclical factor in calculating the daily fixing for the yuan. Having been introduced in May 2017 to counter speculative bets in forex markets, the surprise move is seen as a reflection by the PBOC that downside risks to the yuan have subsided substantially. However, although capital outflows no longer pose a major threat to the economy, many analysts remain concerned about the possibility of a bigger-than-expected slowdown in growth in 2018.

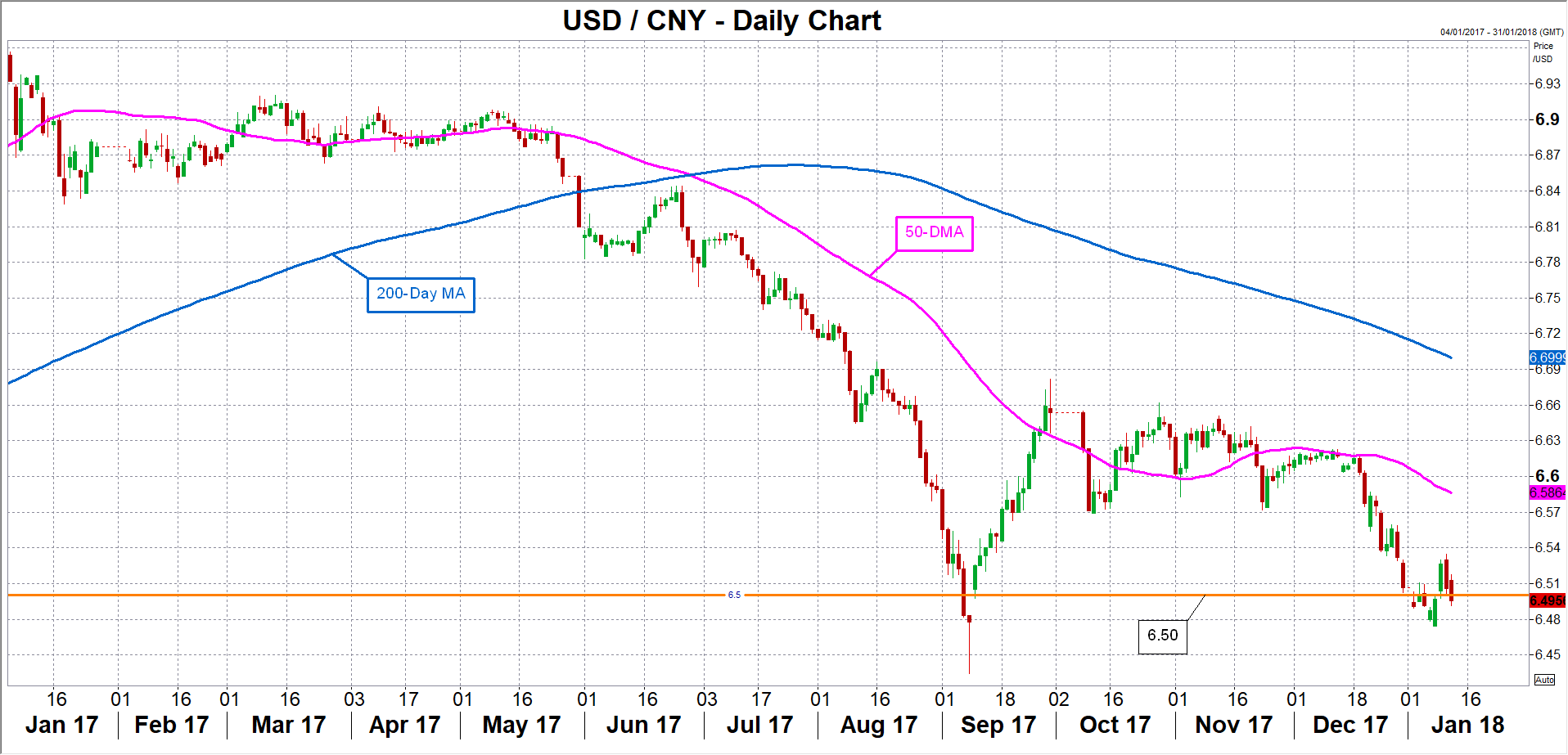

The yuan closed down by 0.5% versus the US dollar in onshore trading on Tuesday, with dollar/yuan reclaiming the 6.50 level after hitting a 4-month low of 6.4740 on Monday. It climbed further on Wednesday to reach a near 2-week high of 6.5346 before slipping back to around 6.50. The yuan’s advance in late December to back towards the 6.50 level may have been what triggered the PBOC’s move to loosen its control over the currency.

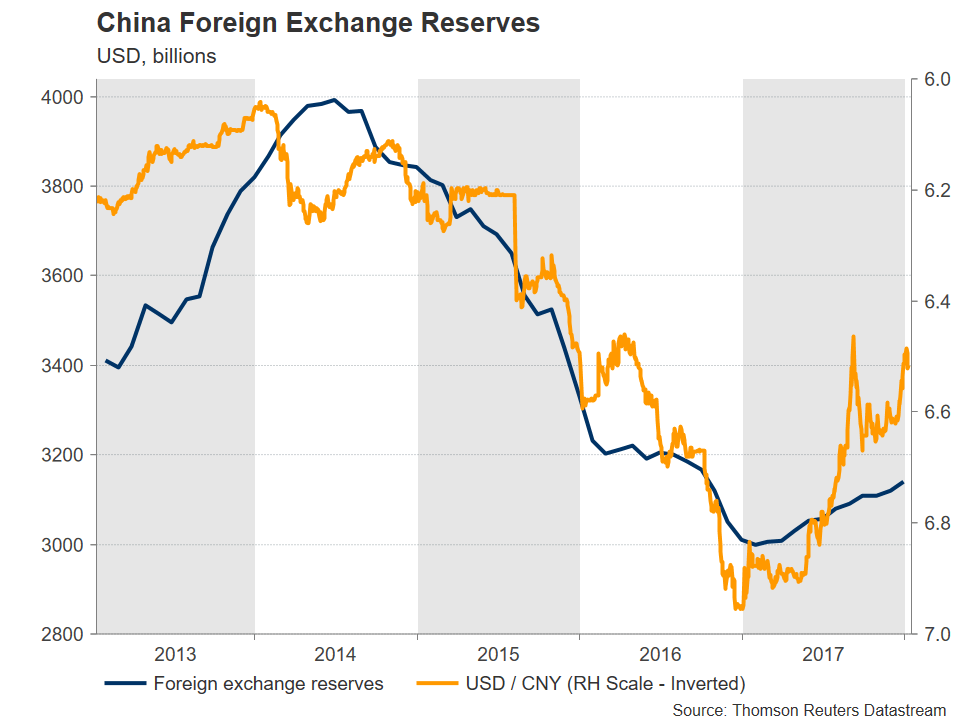

The greenback fell by about 6.3% against the yuan in 2017, more than erasing its gains of 2016. While it’s possible that discomfort at the rate of the yuan’s appreciation may have been a factor for the PBOC to revise its formula for fixing the midpoint, most market participants do not consider exchange rate devaluation as being the aim of the PBOC. In fact, China’s foreign exchange reserves fell sharply during 2015 and 2016 as the central bank intervened heavily to limit the yuan’s slide. The most likely reason is that this is another step by the PBOC to make the yuan a more flexible currency as part of its market-oriented reforms, which were derailed when it had to intervene to halt the flood of capital outflows out of the country.

It should be noted however that the decision by the PBOC is a ‘suspension’ of the counter-cyclical factor and is not abandoning it completely just yet. This keeps the prospect open of it being reintroduced should the move lead to more volatility than the PBOC bargained for. A short-term depreciation for the yuan is very probable after the unexpected decision and shouldn’t upset policymakers as long as the fall is limited. However, a longer-term decline could unnerve the PBOC, especially with the large trade surplus with the US still being a hot topic between the two countries.

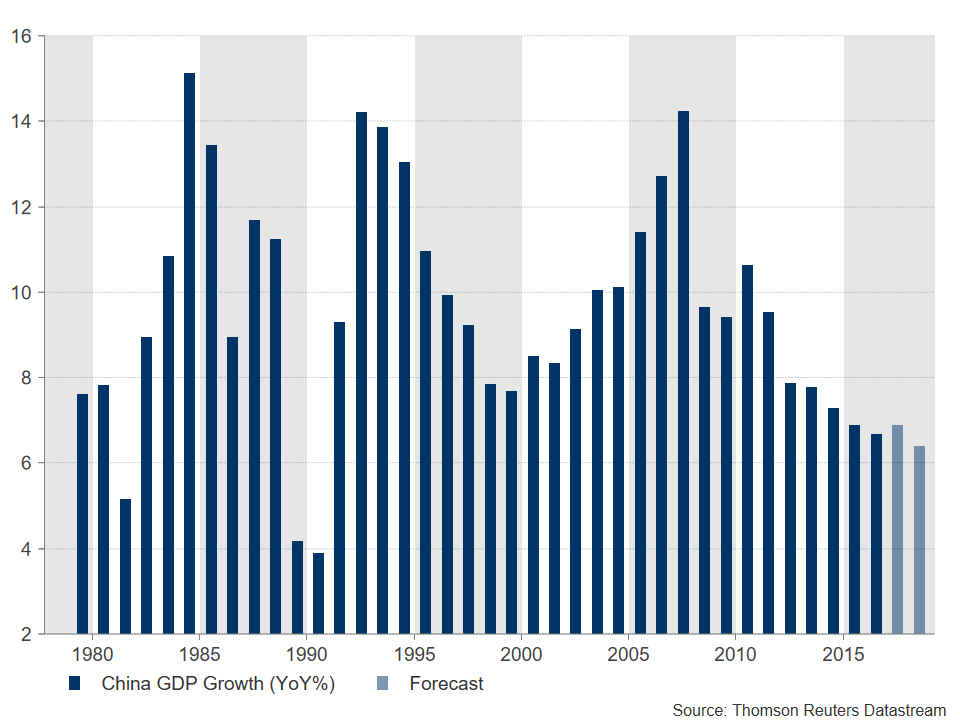

But even if the more market-friendly fixing of the yuan goes smoothly in the initial months, there are several risks that could create fresh downside pressure for the Chinese currency later in the year. The biggest potential risk is the economy, which until now, has managed to avoid a steep slowdown. However, as the Chinese government continues with its efforts to reform the economy and acts to reign in risky lending, a sharper slowdown in 2018 is possible.

In December, the country’s leaders decided at the annual Central Economic Work Conference that in the coming year, the focus should be on ‘high quality’ growth. This could result in short-term pain as authorities try to reduce excess industrial capacity and clamp down on shadow banking, which has contributed to China’s mounting debt problem. According to the IMF, banking assets now stand at 310% of GDP, which is above the average of advanced economies and significantly higher than the average of emerging market economies.

Concerns about the rising debt have already led Moody’s and S&P to cut their long-term credit ratings for China in 2017. However, low inflation means the PBOC is unlikely to tighten liquidity by too much, and even if the tougher deleveraging efforts by Chinese authorities were to trigger a surge in credit defaults, the government would likely step in to support the economy just as it did in 2015.

Should China manage to keep its economic transition on a smooth path, growth will likely continue to moderate at only a slow pace. In 2017, GDP growth outperformed most expectations and is estimated at between 6.8%-6.9%, an improvement on 2016’s 26-year low of 6.7%. However, it is expected to ease to 6.4% in 2018 as the economy loses the stimulus being provided by infrastructure spending as debt-ridden local governments find it harder to borrow to finance their construction projects.

The other big risk for the yuan in 2018 is a stronger-than-expected performance of the US dollar. Despite three rate hikes in 2017 and three more projected by the Fed in 2018, the greenback had its worst year in 2017 since 2003 as markets aren’t convinced that the Fed will be able to raise rates as aggressively over the current business cycle as it is predicting.

However, there is a danger that the boost to growth from the Republican tax plan, which was passed in December, will be much bigger than what has been priced in by the markets. There are also signs that inflationary pressures in the US have recently started to build up even before the tax cuts come into effect. All this could lead to a faster pace of rate increases by the Fed, which in turn could generate a fresh dollar rally, adding renewed pressure on its peers, including the yuan.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

AUD/USD defends 0.6400 after Chinese data dump

AUD/USD has found fresh buyers near 0.6400, hanging near YTD lows after strong China's Q1 GDP data. However, the further upside appears elusive amid weak Chinese activity data and sustained US Dollar demand. Focus shifts to US data, Fedspeak.

USD/JPY stands tall near multi-decade high near 154.50

USD/JPY keeps its range near multi-decade highs of 154.45 in the Asian session on Tuesday. The hawkish Fed expectations overshadow the BoJ's uncertain rate outlook and underpin the US Dollar at the Japanese Yen's expense. The pair stands resilient to the Japanese verbal intervention.

Gold: Buyers take a breather below $2,400 amid easing geopolitical tensions

Gold price is catching a breath below $2,400 in Asian trading on Tuesday, having risen over 1% in the US last session even on a solid US Retail Sales report, which powered the US Dollar through the roof. Easing Middle East geopolitical tensions and strong Chinese data could cap Gold's upside.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

Israel-Iran military conflict views and takeaways

Iran's retaliatory strike on Israel is an escalation of Middle East tensions, but not necessarily a pre-cursor to broader regional conflict. Events over the past few weeks in the Middle East, more specifically this past weekend, reinforce that the global geopolitical landscape remains tense.