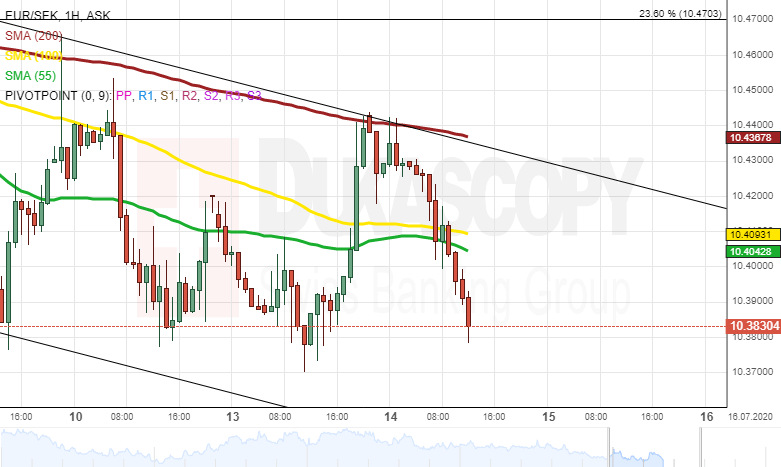

EUR/SEK 1H Chart: Short-term decline expected

The EUR/SEK currency pair has been trading within a descending channel since the beginning of July.

From a theoretical point of view, it is likely that the exchange rate could continue to trade within the given channel in the nearest future. In this case the rate could decline to the 10.30 by the end of current month.

Meanwhile, note that the currency pair could gain support from the monthly S1 and the Fibo 38.20% in the 10.34 area. If the given support holds, it is likely that a reversal north could occur, and the pair could target the 10.60 level.

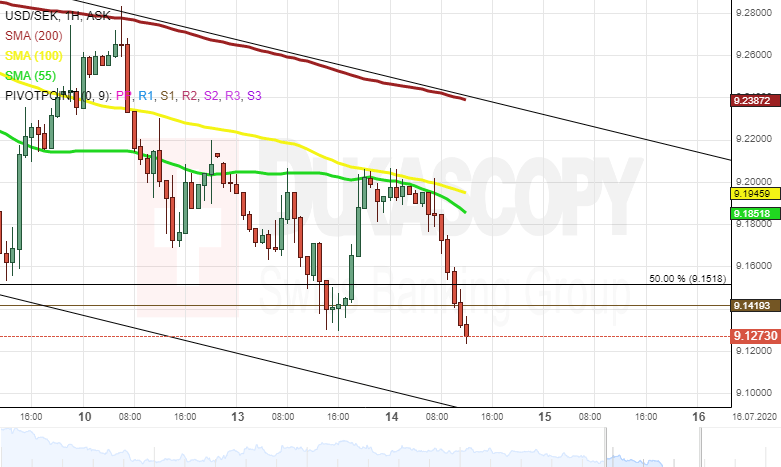

USD/SEK 1H Chart: Descending channel in sight

The USD/SEK exchange rate has been declining within a descending channel since the beginning of July.

From a theoretical perspective, it is likely that the currency pair could continue to tumble within the given channel in the medium term. It is likely that that the pair could decline below 9.0000 by the end of July.

Meanwhile, note that the exchange rate would have to surpass the support formed by the monthly S1 and the Fibo 50.00% at 9.1518. If the given support holds, it is likely that a reversal north could occur, and the rate target the Fibo 38.20% at 9.4643.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.