Just when we think the markets can't get crazier...they do.

This newsletter is focused on financial futures, but it is worth mentioning the chaos going on in the commodity markets due to the implications of inflation. It is difficult (impossible) to argue there is no inflation. Copper is approaching an all-time high, many of the grain markets are near multi-year highs, even sugar has gone along for the ride. While each commodity has a story attributed to its rise they also have a few catalysts in common- the government injection of cash into the economy and a weaker dollar. Without these two factors, grain traders wouldn't be overreacting to dry planting conditions, nor would copper futures be flying higher on the prospects of electric car demand. Yet, here we are.

It is important to remind ourselves that commodity rallies, particularly in renewable assets such as corn and soybeans, have always been temporary because high prices lead to higher production. If this run is a repeat of those we have seen in the past, the Fed will be right in referring it to transitory. Accordingly, we could see the buoy removed from the Treasury market and I believe it will encourage speculators to take the froth out of stocks.

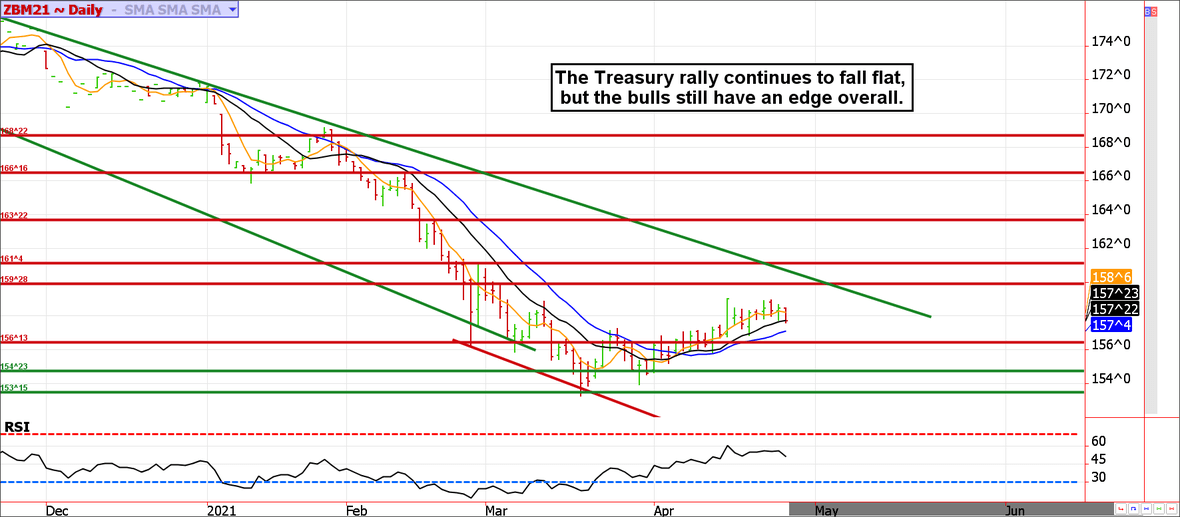

Treasury Futures Markets

Bond and note traders are holding out for the Fed's direction.

The Fed has painted itself into a corner and given the sensitivity of market participants and the fragine nature of the economy, they likely aren't going to try to ruffle any feathers. There is a good chance tomorrow's Fed meeting is a formality rather than a productive or informative event.

With that in mind, while we believe Treasuries will trend higher in the coming months, there is some risk of a slide in the coming days as traders digest the Fed meeting and content with signs of inflation.

Any large dip is likely an opportunity for the bulls.

Treasury futures market consensus:

The trend is higher, but we could see some near-term back and filling.

Technical Support: ZB: 156'13, 154'25 and 153'15 ZN: 131'25, 130'26 and 130'09

Technical Resistance: ZB: 160'0, 161'04, 164'23, 166'16, and 168'22 ZN: 133'01, 133'22, 134'30 and 136'31

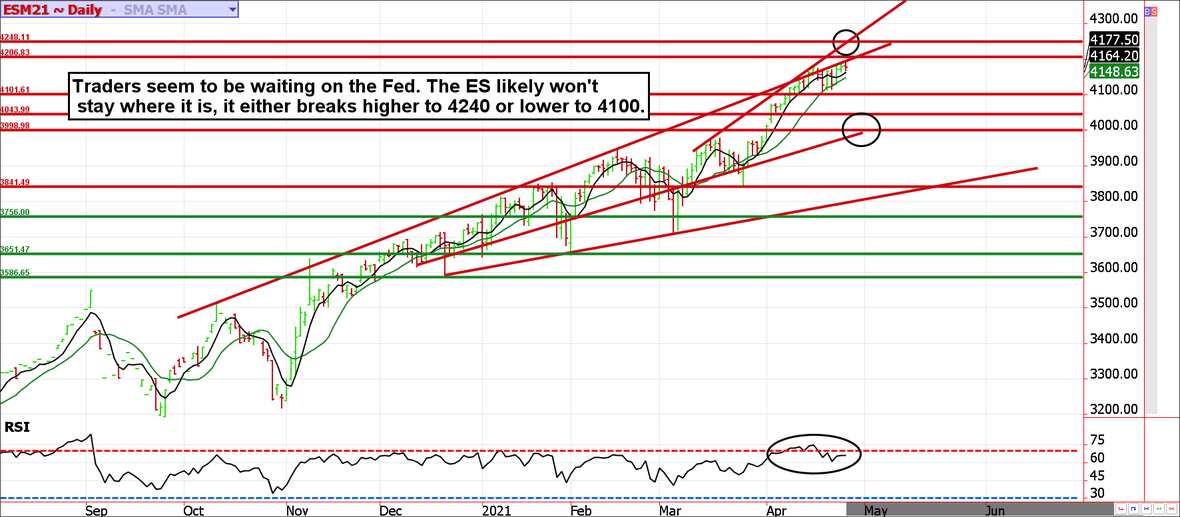

Stock index futures

The ES is a sitting duck.

The S&P 500 has waffled aimlessly in recent weeks but that probably won't last beyond tomorrow's Fed meeting. Fed meetings are often met with glee then eventually buyer's remorse, but even risk can go either way. If you are a bear, consider looking for a quick probe to the 4240ish range to get aggressively "short". If you are a bull sitting on profits, protect the position. We are optimists but these valuations are hard to justify with a straight face.

We are also hearing the call buying fad could be ending its final stages. Newbie traders had been buying call options with reckless abandon, which lured several key stocks higher (Tesla, Gamestop, AMC, etc.); but they have been getting burned as of late which could work against the speculative furvor. Accordingly, even if we are wrong and the market continues higher, the pace will be tapered.

Stock index futures market consensus:

4100 was resistance on the way up, at least it was supposed to be. It will be supportive on the way down. A break below it could change the landscape.

Technical Support: 4101, 4040, 3998, 3838, 3756, 3651, 3580

Technical Resistance: 4195 and 4240E-mini S&P Futures Day Trading Levels

These are counter-trend entry ideas, the more distant the level the more reliable but the less likely to get filled

ES Day Trade Sell Levels: 4195 and 4238

ES Day Trade Buy Levels: 4106, 4079, 4053, 4006, 3932,3889, 3838, 3787, 3750, and 3710

In other commodity futures and options markets...

January 4 - Go short the BCI (Bloomberg Commodity Index) near 78.6.

January 15 - Buy May ZN 136/137.50 call spread near 38 ticks.

January 28 - Buy May corn 5.10/4.70 put spread.

February 23 - Buy April copper 400/385/370 put butterfly.

February 26 - Buy April hog 88/83 put spread.

March 8 - Buy June crude oil 61/58 put spreads near 85 cents.

March 15 - Roll March BCI into June.

March 23 - Lock in gain on June crude oil put spread.

March 25 - Exit copper spread to lock in moderate gain ahead of expiration.

March 30 - Buy July wheat 610/660 call spread for about 15 cents.

March 31 - Buy July sugar 15.50 call for about 44 ticks.

April 8 - Exit wheat spread to take a small profit.

April 8 - Buy the June 100/90 hog put spread for about 1.70.

April 9 - Take a moderate profit on the sugar call option.

April 16 - Lock in a quick profit on the hog spread.

April 21 - Go long June live cattle 120 calls near 1.50.

April 23 - Buy July wheat put spreads using the 6.75/6.25 strikes for about 17 cents.

Due to the volatile nature of the futures markets some information and charts in this report may not be timely. There is substantial risk of loss in trading futures and options. Past performance is not indicative of future results. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed and the giving of the same is not to be deemed as an offer or solicitation on our part with respect to the sale or purchase of any securities or commodities. Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.