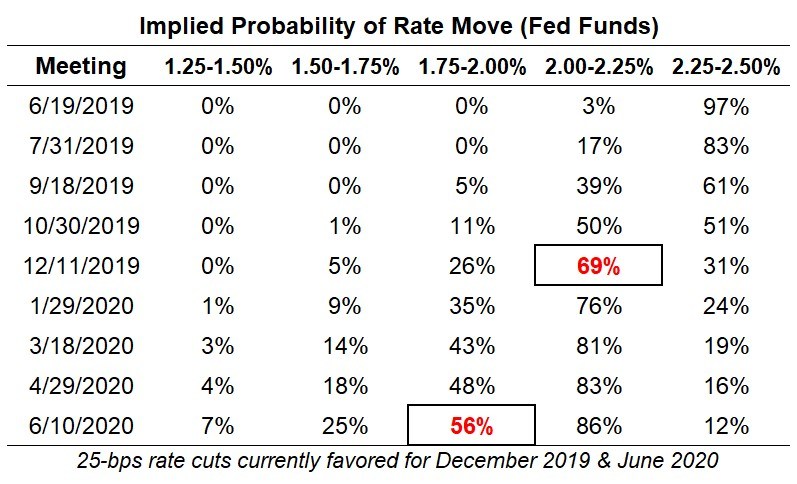

FOMC meeting minutes came out on Wednesday and confirmed the Central Bank’s neutral bias. In the report, we found detailed conversations among the policymakers who agree that patience on rate changes is the most appropriate course of action. The FOMC members believe that low inflation figures at the beginning of the year are no more than a “transition” to a more positive economic backdrop. They keep their neutral position on monetary policy, vouching for a wait and see point of view. The Fed’s March dot plot shows that the FOMC members remain neutral for the rest of the year with a one time 25 basis points rate hike in 2020. The Fed funds Futures are still pricing in a 69% rate cut by the end of the year (see the table below).

The dollar is at its local high and is going to move higher in the near future. Following the release of the meeting minutes, the DXY got somewhat volatile but ended the day on a higher note. The pattern on the chart resembles a flag and the data on New Homes Sales and Core Durable goods could be the dollar’s growth drivers. We can see that US companies are reporting strong earnings, and some companies are expecting growth. We can see trading opportunities in the dollar’s intersection with the franc, the CAD, the yen, and the euro as well as gold and the S&P500 due to rising trade war tensions and a possible strengthening of the dollar.

GBPUSD

We have seen the British currency taking a nosedive in the last two weeks. The GBPUSD currency pair has fallen by more than 5 cents since its high on May 3 and has had only one bullish day in the form of a falling star. Such strong declines are often followed by equally aggressive reversals or counter-trends.

There are many drivers that led to this fall but the Brexit uncertainty is the number 1 reason. We have no idea who will lead the UK in the coming months. Prime Minister Theresa May is likely to resign and Boris Johnson is likely to take her place. The problem with Mr. Johnson is that he is a stern Brexit supporter and doesn’t see any problems in leaving the EU without a deal. It is not clear where Boris will lead the country, and this kind of uncertainty scares the markets and erodes the pound.

We stick to the “Buy the rumor sell the fact” position. There is an opportunity to go short on the rumors of May’s resignation, but as soon as different news hits the wire, we will be ready to go long.

On the daily chart, the pound has entered into the oversold zone. The 1.2670 mark is a strong support level that has been in play time after time since the Brexit situation occurred. We could also see strong reversals from this level in August 2018 and January 2019.

After such a strong downtrend, there is an opportunity of a reversal. The US dollar could also be next in the line for a correction and the pound will gain strength and rebound. We recommend that you wait for a close above 1.2670 and enter the market when there is a good candlestick pattern, something like “three soldiers” or a “hammer”. To spot the reversal pattern ahead of the curve, use the 1 hour or 4 hour charts.

S&P 500

There could be a larger correction in the stock market as the dollar gains strength and the escalation of the trade war spooks investors. The local correction seems to have moved off the lows but there could be a further decline. The correction began at the same time when President Donald Trump tweeted about additional tariffs on China - 25% on $200 billion worth of goods. This led the Chinese to threaten to raise 25% tariffs on $60 billion worth of US products. Next, there was a ban on Huawei products in the US, which was a serious blow to the Chinese government as soon as the company is partially state owned and subsidized.

China has several avenues for action now, but many US based businesses are already thinking about moving their production out of the US. Chinese bans could reach such companies as Boeing, Pfizer and Coca-Cola. All of this is bad for the US stock market and for the currencies in Asia, including the AUD and the CNY.

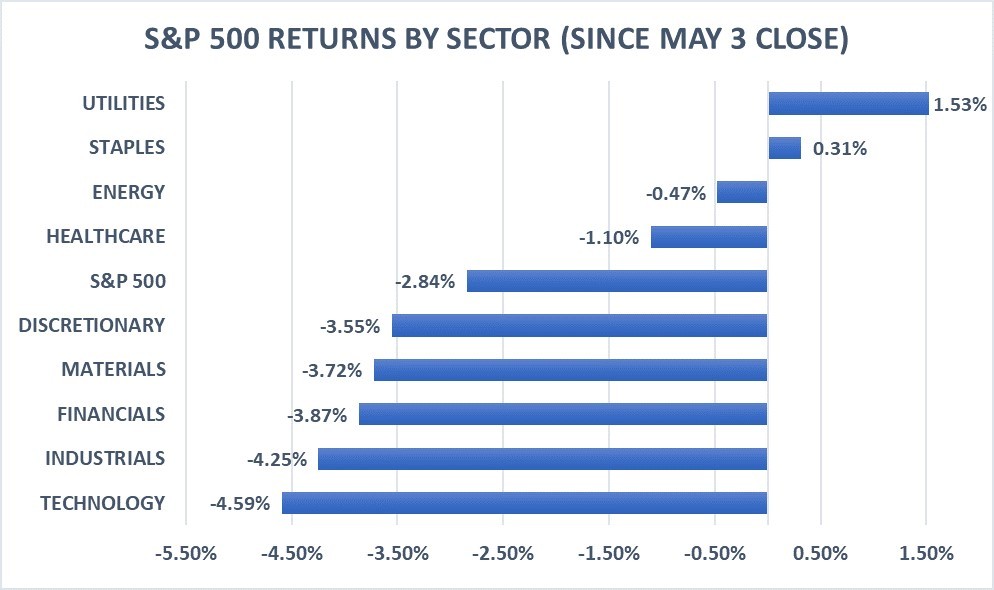

In the US, the technology sector has started to underperform the broader market. This is a huge contrast considering that the tech stocks have been the best investment option since 2008. In fact, tech stocks make up the largest amount of the S&P500 index. We could see further weakness of the companies like Apple, Microsoft, and Alphabet (Google). Due to the fact that these stocks take up a lot of the index, the total returns of the market could also suffer.

All the tension in the market affects the investor sentiment. We can see that safe haven sectors like utilities and consumer staples are taking the lead. This happens because these sectors provide stable cash flow and cheap valuations and tend to outperform in the periods of elevated market uncertainty. This atmosphere of risk aversion will also take gold and the Japanese Yen to all-time highs.

If China chooses to retaliate on the US tech sector as a push back after the Huawei ban, supply chains for American tech companies could be in trouble. Also, the possibility of a snowball effect to continue the index selloff is very high.

The information provided by Olymp Trade does not constitute a recommendation to carry out transactions. When using this information, you are solely responsible for your decisions and assume all risks associated with the financial result of such transactions.

Recommended Content

Editors’ Picks

EUR/USD tests the major level of 1.0650; followed by the nine-day EMA

EUR/USD remains lackluster during the early Tuesday, hovering near 1.0650. From a technical perspective, analysis suggests a bearish sentiment for the pair as it struggles below the pullback resistance at the 1.0695 level.

GBP/USD: Flat lines around mid-1.2300s, bearish potential seems intact

GBP/USD holds steady on Tuesday amid subdued USD demand, albeit lacks bullish conviction. The divergent Fed-BoE policy expectations turn out to be a key factor acting as a headwind. The technical setup suggests that the path of least resistance for the pair is to the downside.

Gold could see a rebound before resuming the correction

Gold price sees a fresh leg down in Asia on Tuesday even as risk flows dissipate. Receding fears over Middle East escalation offset subdued US Dollar and Treasury bond yields. Gold remains heavily oversold on the 4H chart, rebound appears in the offing.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle price is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

After Monday's relief rally, attention shifts to earnings and policy fronts

With the easing of tensions in the Middle East, safe-haven demand reversed course; global stock markets experienced a modicum of relief. Indeed, in a classic relief rally fashion, Monday saw a rebound in the S&P 500, snapping a six-day losing streak.