Yesterday, after 5 days of declines, we saw a corrective upswing, which took crude oil to an intraday high of $104.20. Did this show of “strength” invalidate any of bearish technical factors that we noticed in recent days?

Although crude oil moved higher after the market’s open, this improvement was only very temporarily and light crude reversed as fears that military conflicts in the Middle East will disrupt supplies continued to wane. Additionally, oil investors also avoided the commodity ahead of the release of the Federal Reserve's minutes from its June policy meeting. Taking into account the fact that the above-mentioned circumstances had a negative impact on the price, let’s check the technical picture of light crude. Are there any factors that could drive the price of crude oil higher in the near future? (charts courtesy of http://stockcharts.com).

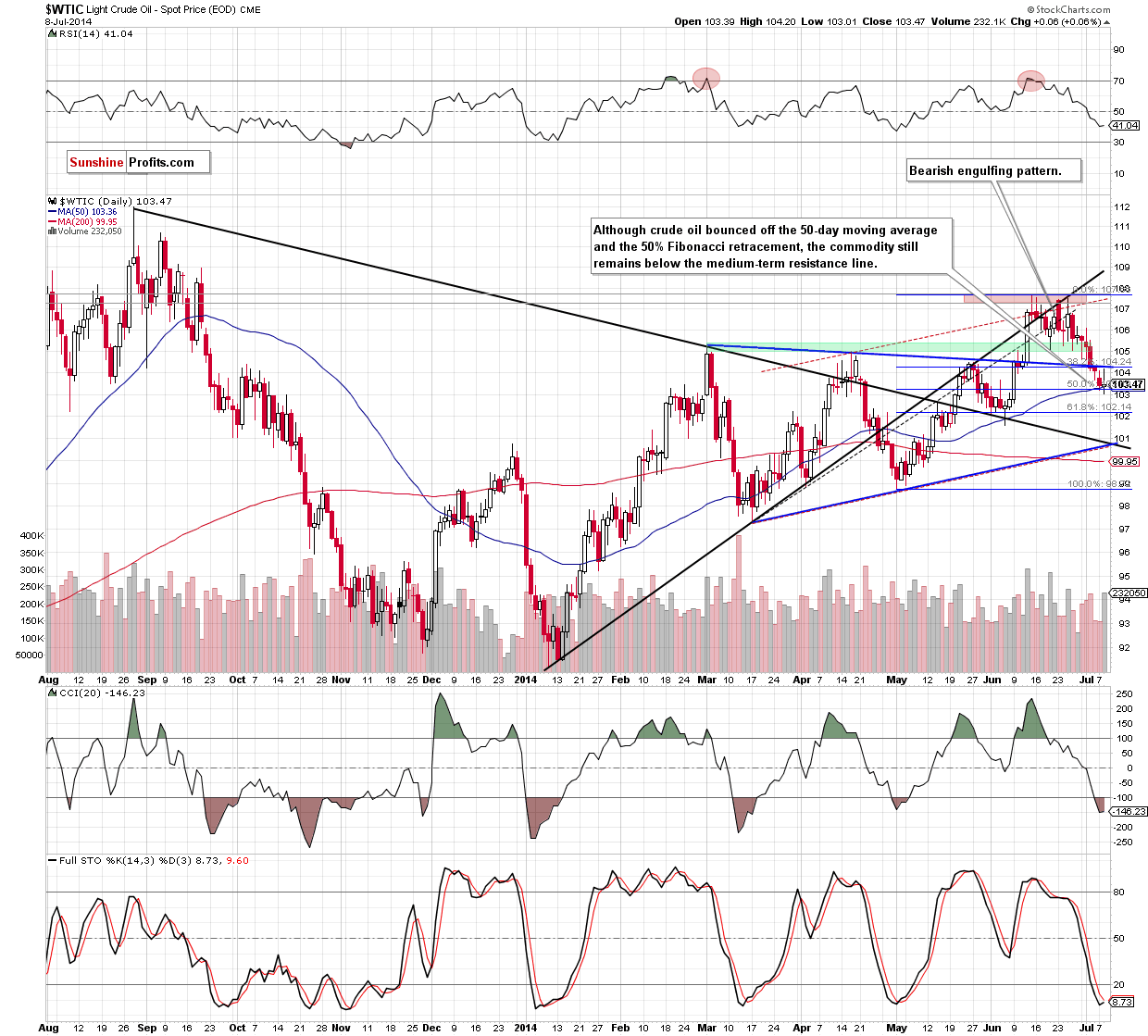

From the medium-term perspective the situation hasn’t change as crude oil still remains below the previously-broken upper line of the blue triangle, while sell signals generated by the indicators favor oil bears. Therefore, we are convinced that our last commentary is still up-to-date:

(…) crude oil will extend the current correction and the initial downside target will be around $101.60, where the June low is. At this point it’s worth noting that slightly below this level is a strong support zone created by the 50-week moving average (currently at $101.26) and the lower line of the trend channel (and lower border of the blue triangle), which may pause further deterioraion.

Once we know the medium-term picture, let’s check the very short-term outlook.

Quoting our last oil Trading Alert:

(…) if (…) crude oil moves lower, the initial downside target will be the 50-day moving average (currently at $103.27). (…) this area is supported by the 50% Fibonacci retracement (based on the Apr.-June rally). Therefore, if it holds, we’ll likely see an attempt to move above the blue resistance line.

Yesterday, the situation developed in line with the above-mentioned scenario as crude oil rebounded to the blue line after a drop to its downside target. As you see on the daily chart, despite this upswing, the overall situation hasn’t changed much as light crude is trading in a narrow range between the medium-term resistance line and the support zone. If oil investors push the buy button and the commodity climbs above its nearest resistance later in the day, crude oil will invalidate the breakdown (which would be a strong positive signal) and we’ll see an increase to the previously-broken green zone, which currently serves as resistance (around $105-$105.50). However, if oil bulls fail, we’ll see another attempt to break below the support zone. If it happens, the next downside target will be around $102.14, where the 61.8% Fibonacci retracement is. Please keep in mind that sell signals generated by the indicators remain in place, supporting the bearish case at the moment.

Summing up, although crude oil bounced of its support zone, the previously-broken medium-term support/resistance line stopped further improvement. In our opinion, yesterday’s move might be nothing more than a verification of the breakdown and if this is the case, we’ll see another attempt to break below the 50% Fibonacci retracement and the 50-day moving average. Connecting the dots, we are still bearish and think that further correction and lower values of crude oil are still ahead us. Therefore, short positions (which are already profitable) are still justified from the risk/reward perspective. We realize that keeping a short position when the market moves even a bit higher is not a pleasant thing to do, but let's keep in mind that the hardest investment decisions that one makes are often the most profitable ones.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short. Stop-loss order at $109.20.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.