U.S. refining makes a rapid comeback in a supportive development for WTI in particular.

Oil traded positively on Friday with WTI, in particular, the star, pulling itself up off the floor as U.S. refining production restarts in earnest following the passing of Hurricane Harvey. With the storm having passed, it appears that damage to refining capacity is minimal and with only 5.50% now offline from fully 25% a week ago, traders are hopeful that crude backlogs will be cleared, taking the pressure of both WTI and gasoline futures. The Brent/WTI spread has also closed from a six dollar premium to an only four dollars this morning.

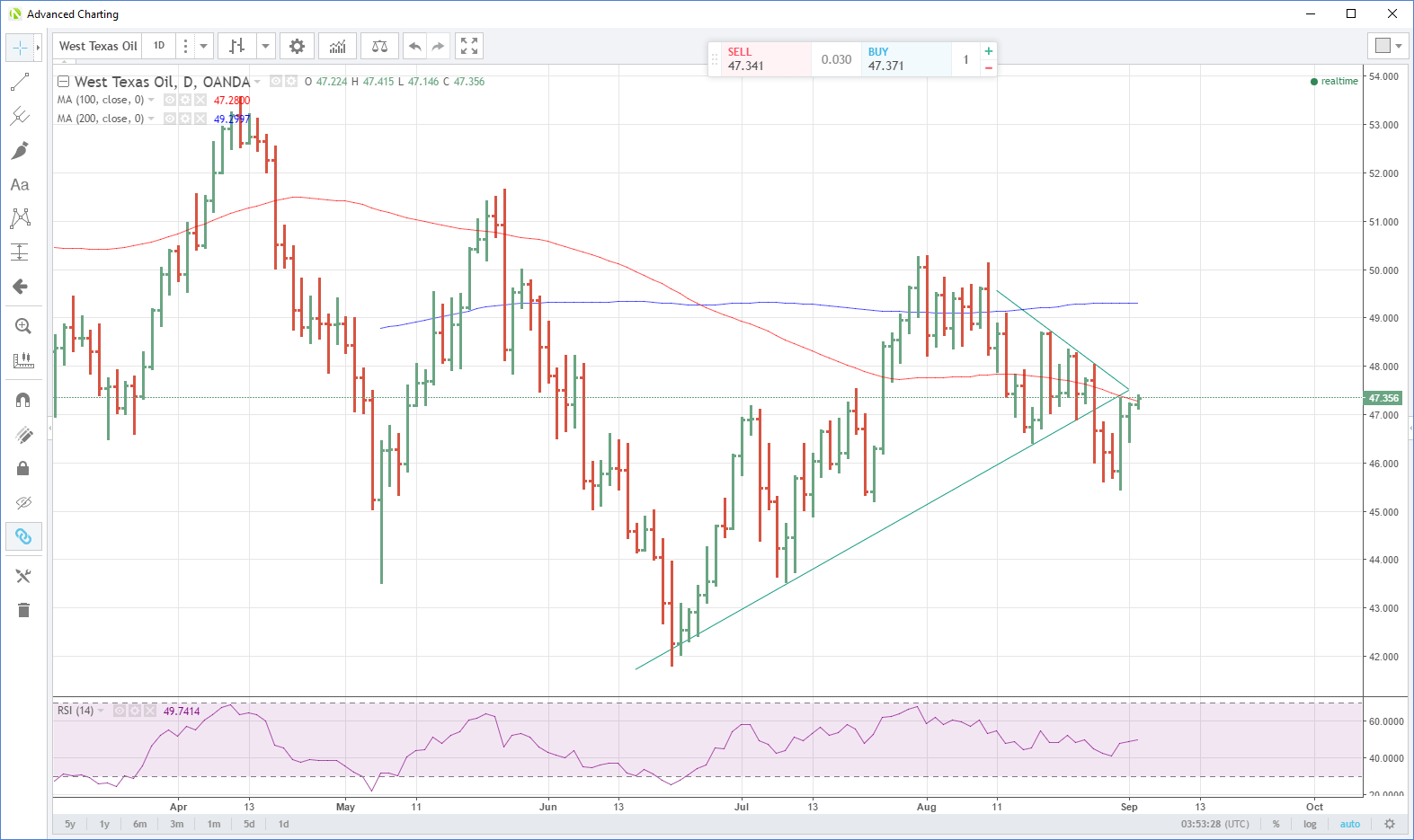

WTI

WTI spot trades unchanged in Asia at 47.50 having regained its 100-day moving average at 47.30 in a positive technical development. Support is at 46.50 with resistance at 48.70.

WTI Daily

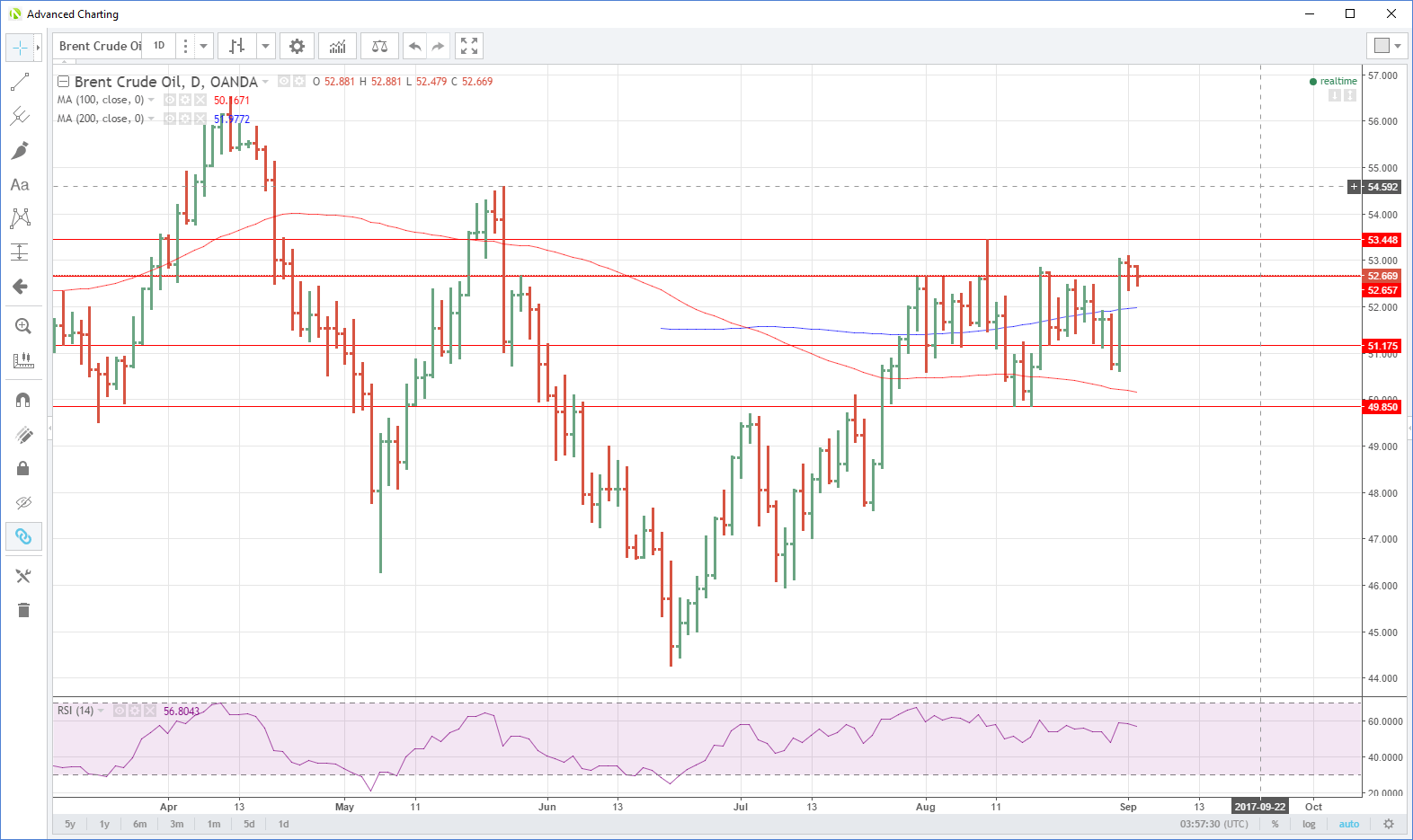

BRENT

Brent spot continues to trade constructively to start the week, opening at its previous longer term resistance at 52.70. It now appears poised to attack resistance at 53.50 which could begin a move to the 55.00 area. Support appears at 52.40 initially.

Brent Daily

Both contracts will be vulnerable to North Korean headlines this week, with any signs of escalation from this weekend’s events potentially giving the oil a significant tailwind.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price is defending support at $1.80 as multiple technical indicators flash bearish. 21.67 million MANTA tokens worth $44 million are due to flood markets in a cliff unlock on Thursday.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.