Following the celebration of Thanksgiving, liquidity remains thin whilst volatility is very low. This is likely compounded by the fact we had large moves on the US Dollar following the Fed minutes in the hour leading up to traders hanging up their gloves for the week. So this seems like a good time to step back and look at some potential moves for next week, assuming they don’t present themselves sooner.

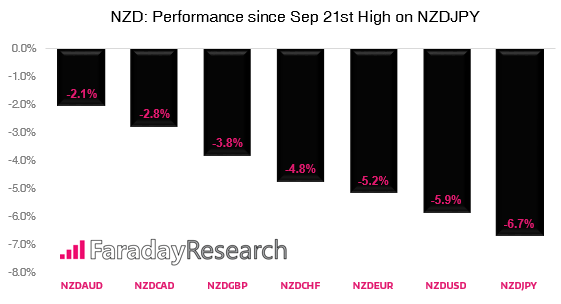

Focusing on NZD crosses, NZDJPY has provided the most bearish momentum among the group since printing a prominent high on 21st September. Whilst there have been two clear pullbacks, is has been a powerful downtrend which could still make a move for the April lows.

Weighing up conflicting signals

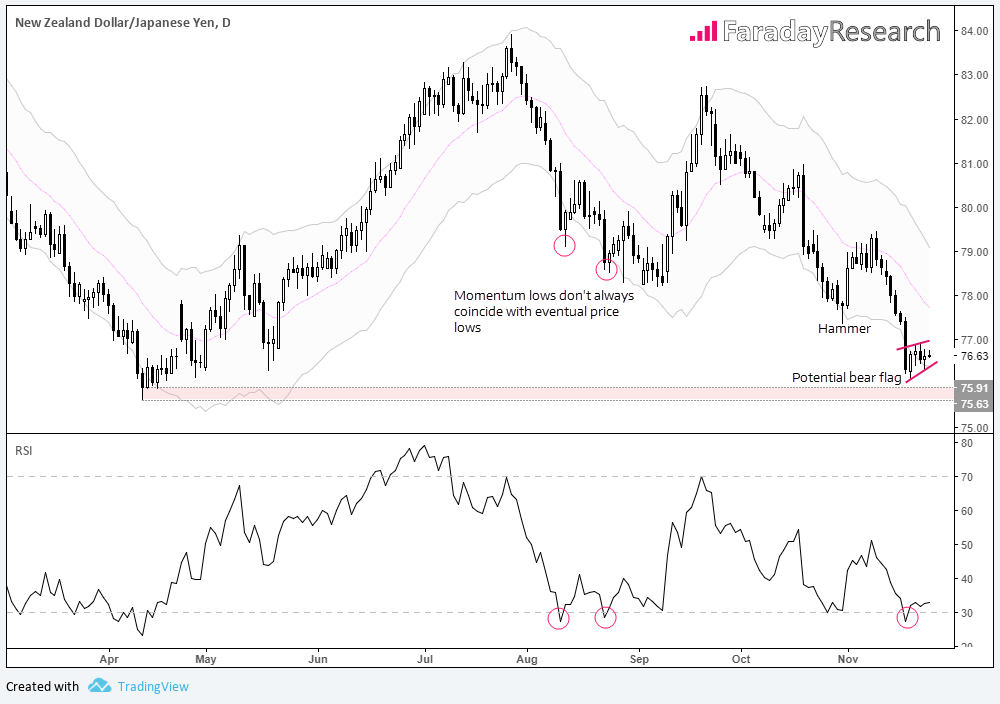

Price action of the past five days suggests a bearish flag could be forming, and that compression is underway. That these tend to be continuation patterns and they follow on from a bearish range expansion and predominantly bearish momentum, we’re looking out for potential short opportunities. Assuming volatility is to remain low until next week, this allows for a relatively low volatility pullback to finalise before attempting another leg lower. However, this is where patience is key as the threat for this to rebound higher is also present.

The bearish range expansion last week took NZDJPY outside of the lower Keltner band before making a mild rebound back inside the band. The last time we saw price action test the lower band was on 31st October which sparked the beginning of a deep correction. That said, there is a stark difference between the two examples. October’s low provided a bullish hammer before momentum switched and provided a bullish range expansion the following day. However, price action this time around is showing signs of compression and has merely drifted back inside the bands. Assuming the dominant bearish momentum remains intact, trend theory assumes a move lower is more probable than a move higher, with the potential bear flag being the icing on the cake (if confirmed).

Another consideration for bears to weigh up is that RSI reached its lowest point since April beneath the 30 level (oversold). This could indeed mark a significant turning point for NZDJPY like it did in April, yet we should also point out that a momentum low doesn’t always mark the eventual price low. Two examples are the swing lows of August which saw prices move lower in line with the trend.

How is one to approach these conflicting signals?

The simple answer is to wait and let price action confirm a decisive break in either direction.

As long as volatility remains low whilst prices move higher, an eventual downside move could still be favoured. The upside to this scenario is it increases the potential reward to risk ratio, and the trigger would be for price on the hourly to break a key level, trendline or compression candle. Alternatively, we could consider shorting NZDJPY if bearish momentum is to return around current level, but the theoretical reward to risk ratio would be smaller. Both scenarios assume we are targeting the 75.63-91 lows.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.