North American markets will get plenty of attention on Wednesday, as traders evaluate fresh US jobs numbers and the final interest rate decision of the year from the Bank of Canada.

Action begins at 07:00 GMT with a report on German factory orders. Orders for manufactured goods are forecast to fall 0.3% in October, following a 1% increase the month before. However, that should still be good enough for a year-over-year gain of 7%.

Later in the morning, Switzerland will release the November consumer price index (CPI), a key barometer of inflation. CPI is forecast to flatline in November, translating into year-over-year growth of 0.9%.

On the monetary policy front, European Central Bank (ECB) official Yves Mersh is scheduled to deliver a speech at 10:30 GMT.

The North American session kicks off with the ADP private payrolls report. The monthly release could show the creation of 185,000 private sector jobs in November, following a net gain of 235,000 the month before. The official nonfarm payrolls report is due 48 hours later and is expected to show another month of solid jobs growth.

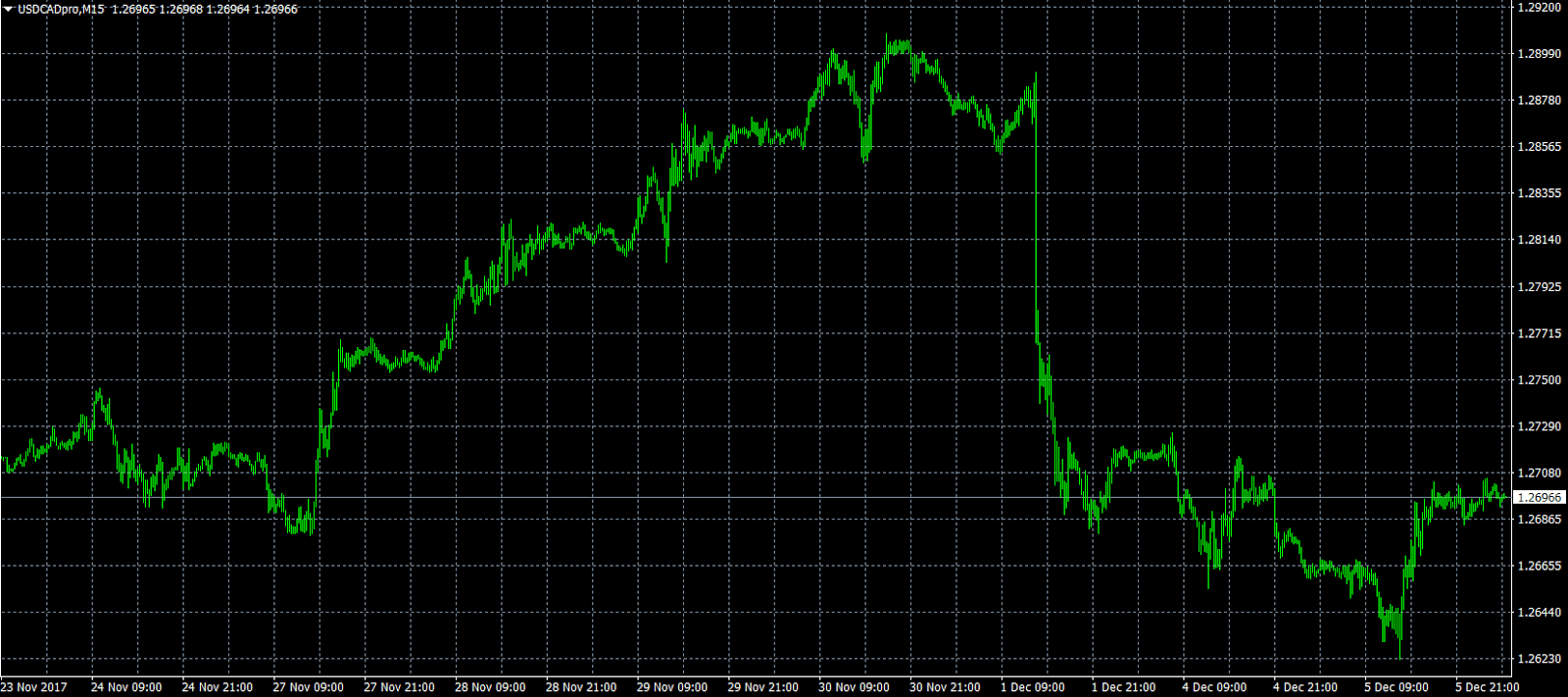

North of the border, the Bank of Canada (BOC) will deliver its final interest rate decision of the year on Wednesday. Policymakers are widely expected to stand pat for a second consecutive month as the Canadian economy adjusts to back-to-bate rate hikes. The benchmark lending rate is therefore expected to hold steady at 1%.

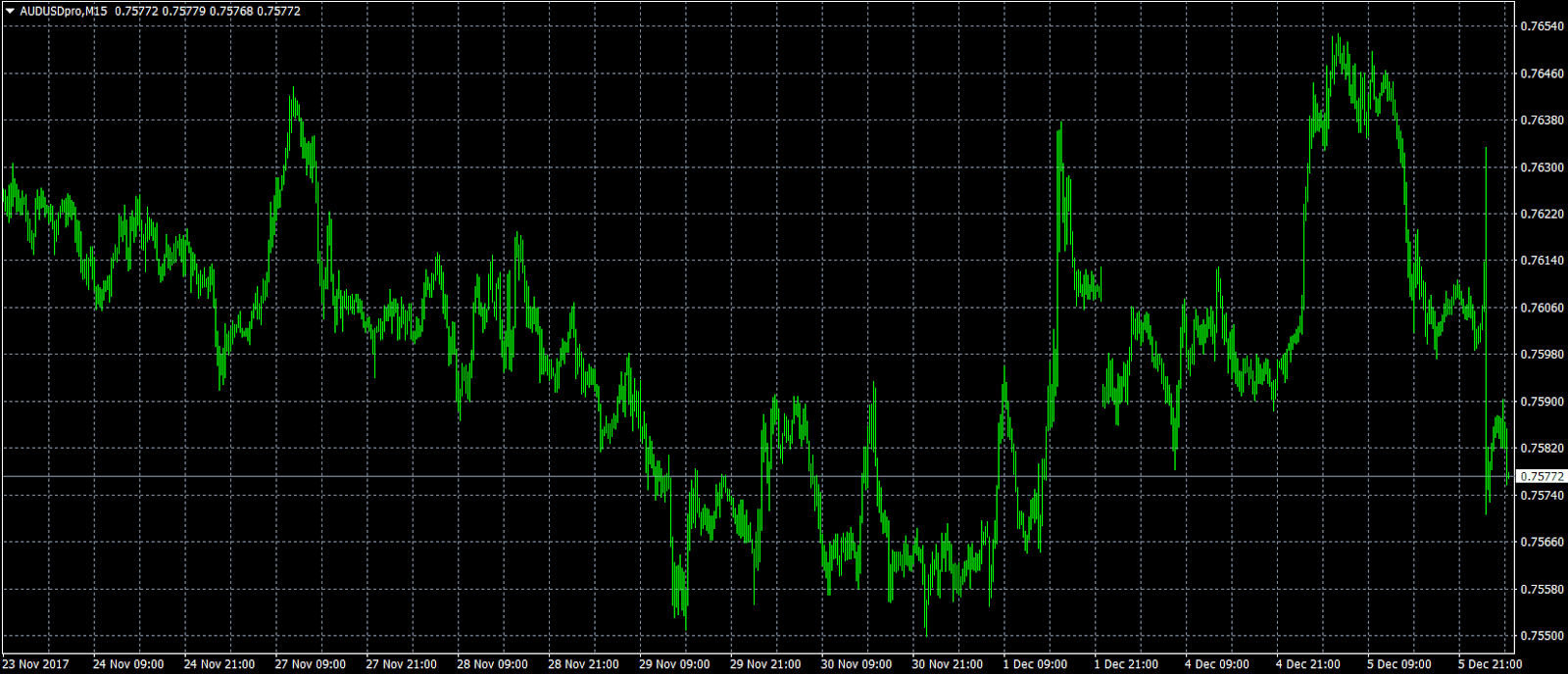

Earlier in the day, the Australian government reported a smaller than expected rise in third quarter GDP, signaling stronger headwinds for the domestic economy. The Australian economy expanded 0.6% in the third quarter, following an upwardly revised gain of 0.6% the previous quarter, the state-run statistics bureau said. Analysts in a median estimate called for a gain of 0.7%.

In annual terms, the Australian economy expanded 2.8%, which was higher than the Q2 rate but slightly below the consensus forecast of 3%.

The Australia dollar slipped back below 0.7600 US cents on Wednesday following the GDP report. The AUD/USD was last down 0.4% at 0.7583, which is a stark reversal from Tuesday’s highs near 0.7660. The Aussie is now struggling to maintain support at 0.7570. On the opposite side of the spectrum, resistance is likely seen near the Tuesday high.

The USD/CAD attempted at a recovery Tuesday, but prices fell short of the 1.2700 level. The pair had regained momentum early Wednesday, where it was trading at 1.2699. The BOC statement could hold the key to the next move in the USD/CAD.

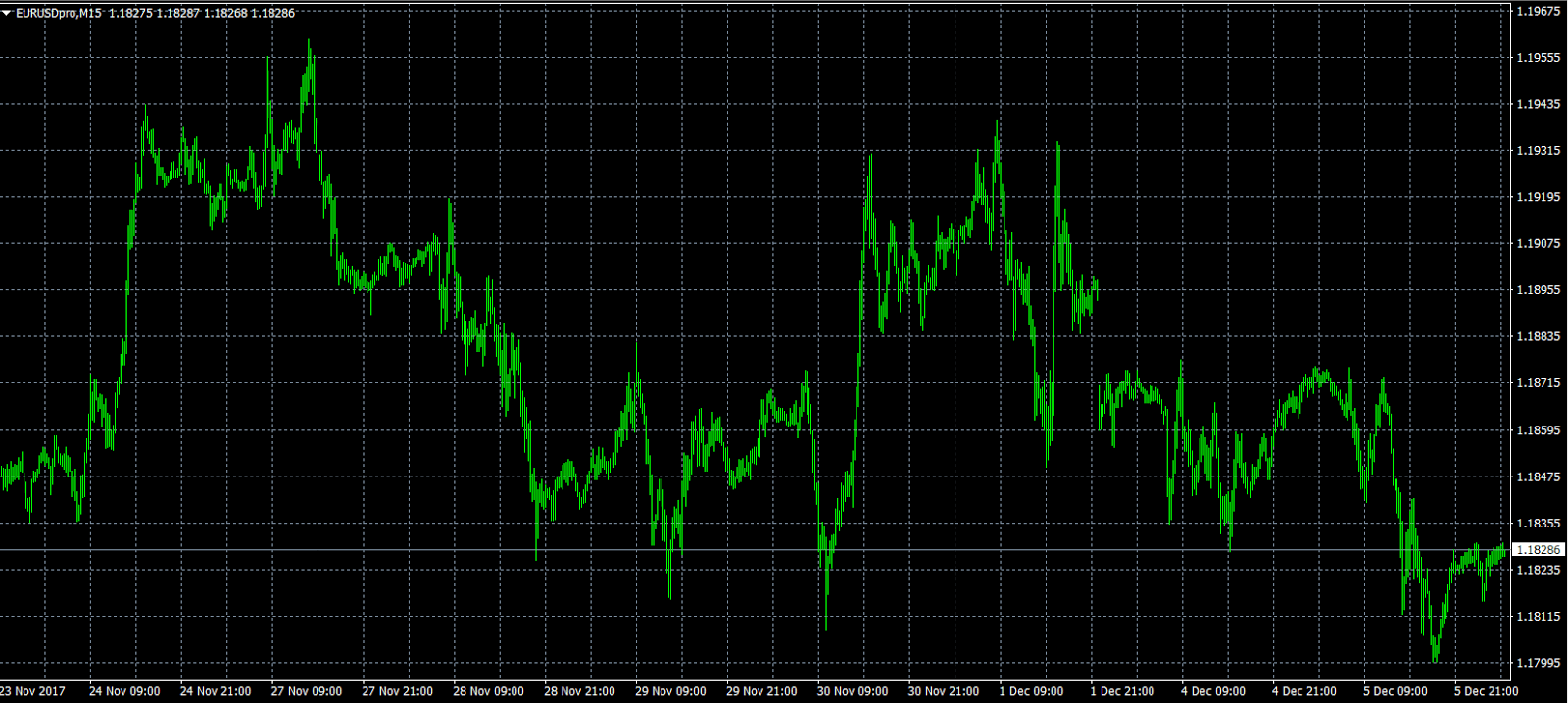

The euro made another sharp down move against the dollar on Wednesday, with prices falling 0.6% to 1.1830. The pair is showing weakness below 1.1840, putting it on a collision course with the 1.1800 support level. On the flipside, resistance is found at 1.1900.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.