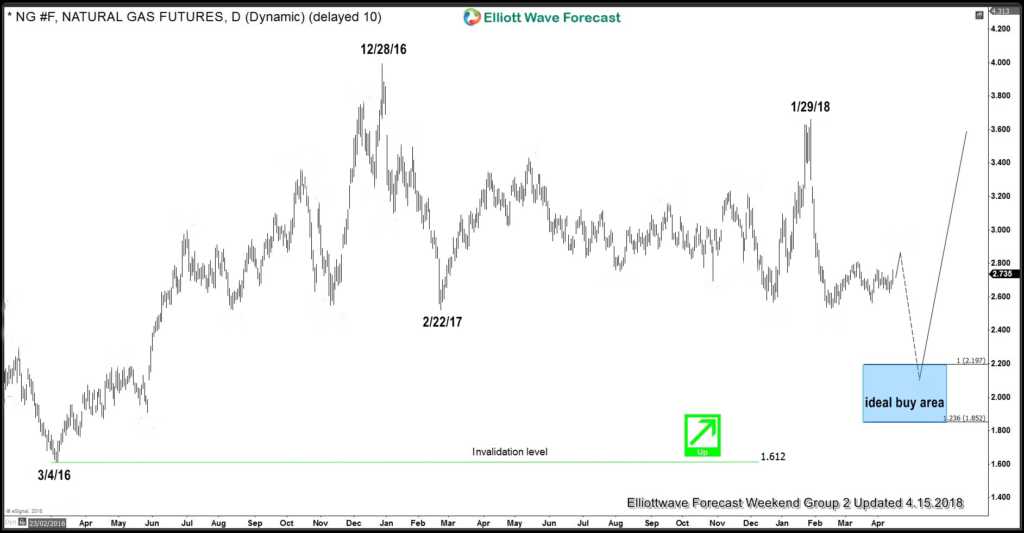

As seen in the daily graphic below you may notice it is absent of an Elliott Wave count. However the important dates with the swing highs and swing lows are highlighted that suggest the target area for buying that can be seen later. Currently Natural Gas is only showing a three swing move lower from 12/28/16 down to the 2/22/17 lows. From there it did another three swings higher into the 1/29/18 highs earlier this year. The sharp dip lower from there failed to give a clean break of the 2/22/17 lows. We have reason to think the commodity will follow through lower and complete seven corrective swings from 12/28/16. This reasoning is due to other correlated instruments in the markets. The longer term analysis is continued below the chart.

$NG_F Natural Gas Daily Chart

As mentioned earlier the commodity has not broken below the 2/22/17 lows as of of now. That break needs to be seen while the current bounce continues to show it will remain below the 1/29/18 highs. This bounce began from the 2/15/18 lows and shows a Fibonacci extension area at 2.838-3.011. As of now that is what should be seen in the near term before the expected break and swing lower.

Regarding some of the further back technical history of Natural Gas. The commodity made an all time high back in December 2005. This of course is not on the daily chart shown above. What is shown on the chart are the 3/14/16 lows that are of importance. Those lows are favored ended the larger cycle lower from the 2005 highs.

In conclusion, the cycle from the all time lows up to the 2005 highs is by most anyone’s standards seen as a bullish cycle. As mentioned earlier the dip to the 3/4/16 lows corrected that cycle. That became apparent it ended when Natural Gas bounced to the 12/28/16 highs. From there the correction lower shows an extension area on the daily chart at the 2.197-1.852 area. That has two conditions to happen while the commodity remains in a no trade area. The Fibonacci extension area remains the same while showing it will remain below the 1/29/18 highs. Lastly of course it has to break the aforementioned 2/22/17 lows.

Become a Successful Trader and Master Elliott Wave like a Pro. Start your Free 14 Day Trial at - Elliott Wave Forecast.

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.