The cable suffered the loss for the 8th consecutive session on Thursday as the ECB’s jawboning of the EUR kept EUR and other European currencies under pressure. The losses in the cable were capped around 1.5219 due to the drop in the EUR/GBP cross. The slight rise in the US weekly initial jobless claims and drop in the monthly trade deficit failed to have an impact on the cable. However, a better than expected US ISM non-manufacturing data for August did ensure the bid tone on the USD remained intact, ensuring the spot closed lower at 1.5255.

NFP above 200K is positive

The Non-farm payrolls report due tomorrow is expected to show the US economy added 217K jobs in August, compared to 215K in July. The unemployment rate is seen dropping to 5.2% from 5.3%. The average hourly earnings are seen rising at 2.1% in August. Considering August usually produces a drop in the payrolls number – seasonal weakness and given the pessimism in the markets, an NFP print above 200K would be enough to push up September and December rate hike bets. The probability of September rate hike may not matter much, since we are just two weeks short of September meet and still do not have any clear hint from Fed. However, a print above 200K would be enough to bolster December rate hike bets and strengthen the US dollar.

In case, the actual figure is above 200K, the GBP/USD may drop below 1.5219 and extend losses to 1.5170 (June 1 low)

Above 240K and GBP/USD could easily take out 1.5170 and extend the fall to 1.5089 (May 5 low).

Print below 200K and we could see a quick fire correction to 1.5350 (expanding triangle resistance)

Technicals – Strong support at 1.5219

Sterling’s eight day drop has led to oversold RSI conditions on the hourly chart. Consequently, a technical correction looks possible, especially if the spot manages to hold above 1.5219 (100% Fib extension of June high-July Low-Aug high). A technical correction is likely to face stiff resistance at 1.5330 (July 8 low)-1.5340 (expanding triangle resistance). On the downside, a 4-hour close below 1.5219 could open doors for a sell-off to 1.5088 (May 5 low). Only a daily close above 1.5340 could halt the bearish momentum in the pair.

EUR/USD Analysis: Strong NFP to highlight policy divergence, push EUR to 1.10

The dovish ECB press conference yesterday weakened the EUR/USD pair to an intraday low of 1.1087 and set the stage for a dollar rally. The focus is now on the employment report from the US today. THe payrolls report is expected to show the US economy added 217K jobs in August, compared to 215K in July. The unemployment rate is seen dropping to 5.2% from 5.3%. The average hourly earnings are seen rising at 2.1% in August.

ECB QE is more flexible now

The ECB announced an increase in the issue share limit of bonds included in QE purchases to 33% from 25%. The increased limit means the ECB can buy a higher share of an individual nation's bond issue, providing it more flexibility to concentrate on more issue. This, coupled with the downward revision of the GDP and inflation forecasts is a clear signal that the size of the QE program could be increased further in case the risk aversion, Chian slowdown and CNY devaluation leads to rise in imported inflation (strong EUR) and lower exports.

The dovish signals from the ECB could further take its toll on the EUR/USD pair if the payrolls report prints above 200K. Moreover, any number above 200K could be enough to push the EUR lower. On the other side, an NFP print below 200K could trigger a minor technical correction.

The Fed hike bets dropped quite notably in recent weeks as the financial markets were in turmoil. At At this point, fed fund futures are implying 30% odds of rate hike in September, 40% in October and 55% by December. Given the pessimism, an NFP print above 200K may be enough to trigger a fresh USD rally.

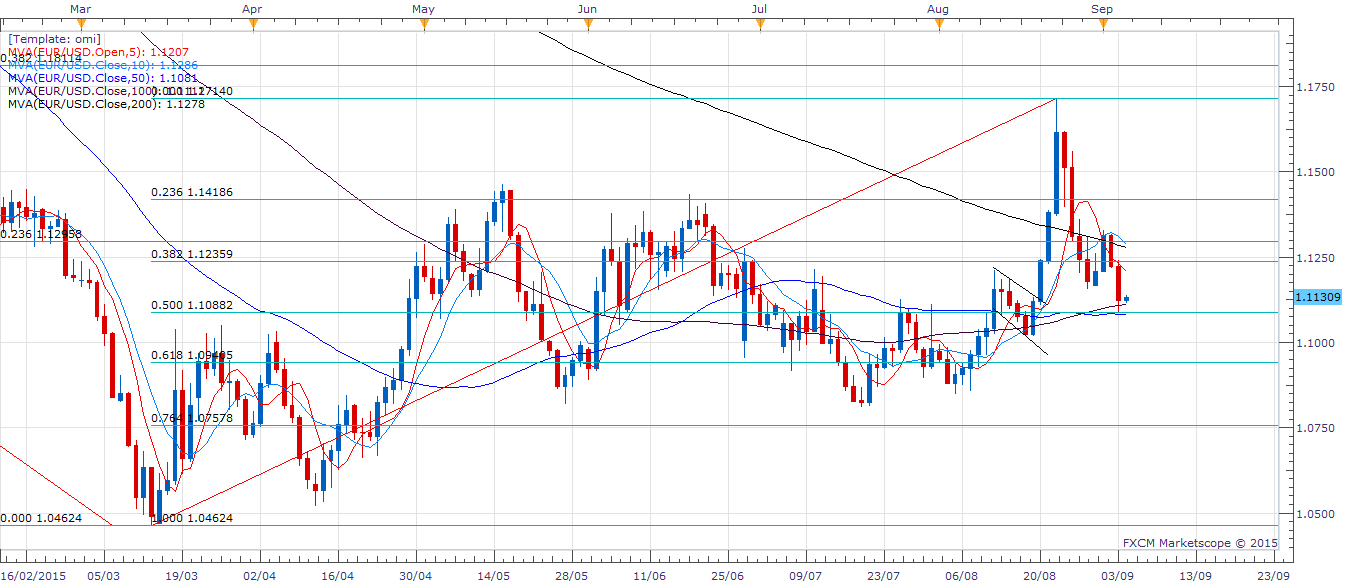

Technicals – Eyes 1.10

Euro’s daily close below 1.1236 (38.2% of Mar-Aug rally), followed by a repeated failure to take out the same on Thursday, followed by a sell-off to 1.1088 (50% of Mar-Aug rally) indicates the falling trend from the high of 1.1714 has resumed. A break below 1.1088 would open doors for a drop to 1.1017 (Aug 19 low)-1.10 levels. On the upside, only a daily close above 1.1236 could encourage bulls to bid the EUR higher.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.