Traders were not impressed by Trump's speech during his State of the Union Address late Tuesday as the dollar stayed muted. On the contrary, the dollar got a boost with comments from Fed officials who also spoke yesterday which brought the focus to the potential March rate hike. Fed Chair Janet Yellen will be speaking later this week on Friday and could shed more light on the Fed's intentions for rate hikes. SF Fed President, John Williams and NY Fed President William Dudley were both seen supporting the case for a rate hike during two separate TV interviews.

The economic calendar is busy with the start of a new month. UK's manufacturing PMI numbers along with data from Europe will be coming out during the day, while the Bank of Canada's monetary policy meeting is likely to be the main highlight. Data from the U.S. will see the release of the ISM manufacturing PMI numbers for the month of February.

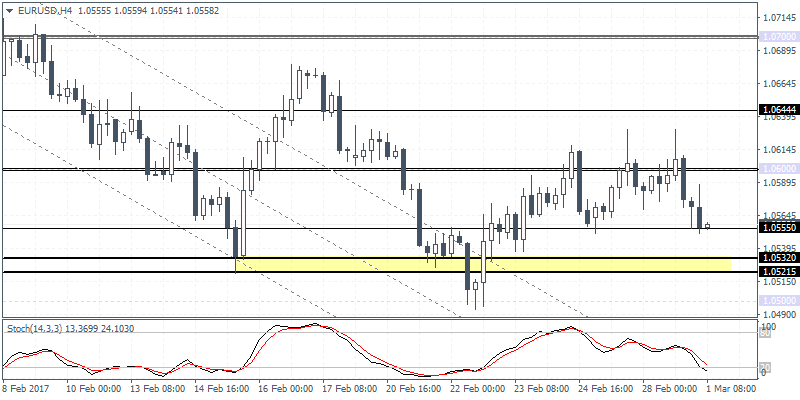

EURUSD intra-day analysis

EURUSD (1.0558): EURUSD continues to stay directionless with prices seen falling back after testing the 1.0600 resistance level. At the time of writing, EURUSD is testing the lower support at 1.0550, but a breakdown below this level could trigger further declines towards 1.0500. The U.S. dollar is looking bullish today and with a new set of economic reports coming out, expect to see some volatility in prices as the U.S. ISM manufacturing report data is due later this afternoon with expectations showing another increase in the index.

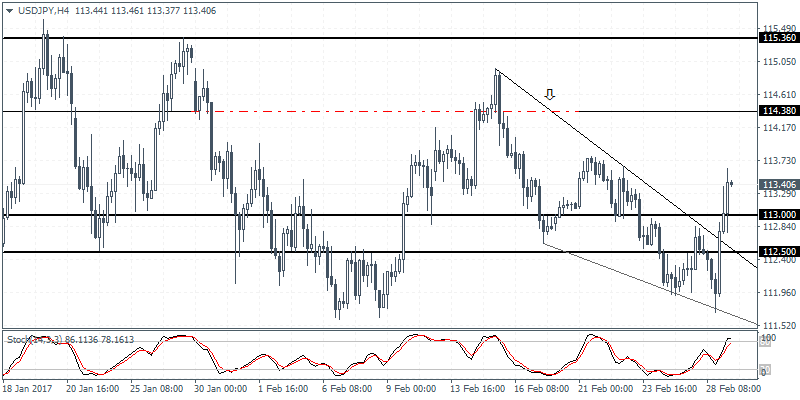

USDJPY intra-day analysis

GBPUSD (113.40): USDJPY formed a doji yesterday and prices were rejected near the 112.00 support level. At the time of writing, USDJPY is seen posting strong gains, but the price could likely struggle near the 114.00 resistance level. Further gains can be expected only on a breakout above 114.00, in which case we can anticipate the bullish momentum to continue pushing the dollar towards 118.00. Watch for any dips towards 113.00, which could see support being established, while in the near term, resistance at 114.38 will be the likely upside target for the dollar.

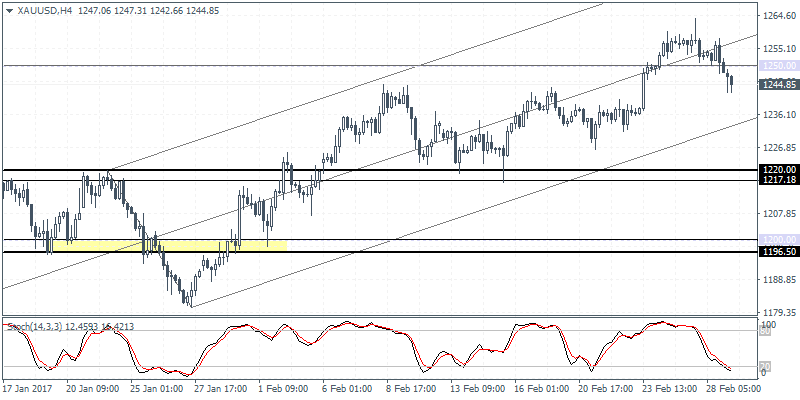

XAUUSD intra-day analysis

XAUUSD (1244.85): Gold prices extended the declines for two consecutive days with early Asian trading session already showing a bearish sentiment in the precious metal. With the technical support of 1250 being breached, Gold prices are likely to decline towards 1220.00 especially head of what could be a hawkish speech from Fed Chair Janet Yellen this Friday. Therefore, any pullbacks, especially to 1250 will be met with resistance while support at 1220.00 will act as the initial support for the prices. A breakdown below 1220.00 could signal further declines down to 1200.00 which remains elusive so far. However, watch for a daily break down below 1241.00 which marks the daily support level which could be the trigger for the downside.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.