Market Overview

Although a Brexit deal has finally been agreed between the EU and UK, market sentiment is cautious today. The overnight disappointment in Chinese GDP is certainly playing a role here. Economic growth for Q3 slipped to a 27 year low at +6.0% and below the consensus of +6.1%. Although there was a glimmer of light coming from better than expected September Industrial Production (Retail Sales and Fixed Asset Investment were as expected), the Chinese economy is slowing more than expected. This of course raises the prospect of additional stimulus to manage the slowdown, but the immediate impact is to leave markets a tad cautious. This is likely to continue through today as good news regarding the newly agreed Brexit deal is likely to be in short supply as focus turns from Brussels (although the EU-27 still needs to rubber stamp the deal) to a rather more toxic Westminster. Prime Minister Johnson’s political opponents (and even some more friendly) have been quick to denounce his deal. Parliament is set to debate the Brexit deal and likely vote tomorrow, but the chances of the deal passing are looking shaky after the DUP (Northern Irish unionists) came out in opposition. There are still a raft of permutations on how this will play out, but there will likely be a significant reaction across sterling markets for Monday’s trading. Sterling is slipping back initially today, although not decisively so yet. Positive newsflow is unlikely to feature today either, so this is adding to a tentative look across major markets today.

Wall Street closed a shade higher with the S&P 500 +03% at 2998, however, US futures are giving this all back initially today. Asian markets were mixed, with the Nikkei +0.3%, but the Shanghai Composite was -1.3% in the wake of the Chinese GDP disappointment. European equities look under pressure in early moves, with the FTSE futures -0.5% and DAX futures -0.4%. In forex, there is a continuation of the slippage on USD, whilst the underperformance of GBP is the main mover. NZD is the main outperformer. In commodities, there is a mixed outlook on gold and silver trading around the flat line, whilst oil is giving back some of yesterday’s rebound and again lacks sustained direction.

It is a light economic calendar to finish the week. The EU Current Account for August is at 0900BST and is expected to once more see the surplus increase to +€21.3bn (from €20.6bn in July).

The final batch of Fed speakers for the week comes with Esther George (voter, major hawk) at 1500BST and FOMC vice chair Richard Clarida (voter, mild dove) at 1630BST. There will also be a speech by the Bank of England Governor Carney at 1845BST.

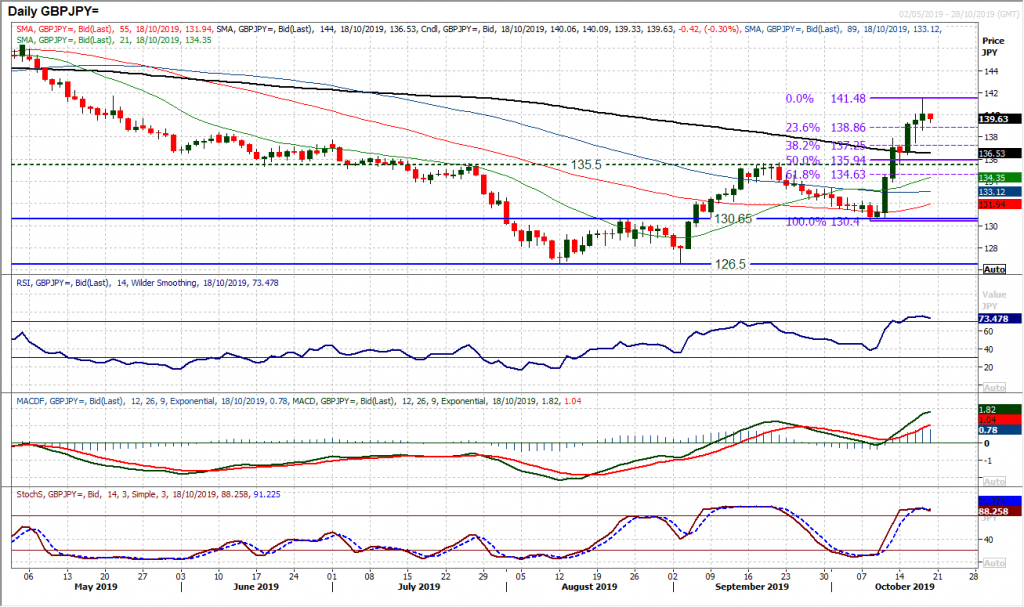

Chart of the Day – GBP/JPY

The pair of the biggest major outperformer (GBP) and underperformer (JPY) has added a huge rally since the middle of last week. At this week’s 141.48 high, the market has added over 1100 pips since the key low at 130.40 and the volatility is not likely to end there. Political wrangling now in Westminster (especially on Saturday) will be a key factor and the market will move on the newsflow today too. Taking yesterday’s spike high at 141.48 and yesterday’s rather uncertain candle could means that the 23.6% Fibonacci retracement at 138.85 becomes a support to note. The 38.2% Fib level at 137.25 but more importantly the 50% Fib at 135.95 become key retracements on any signs of disappointment over the Brexit deal. Give the importance of the breakout at 135.50 (medium term pivot) which also caught Monday’s higher low (hit almost to the tick) this is a key confluence area of support now. The hourly chart today shows a five day uptrend and the 55 hour moving average as a near term basis of support to watch today. A breach of 138.60 (yesterday’s low) would be a corrective signal, but the real action will be on Monday where gaps are highly likely. A market to trade not for the feint hearted.

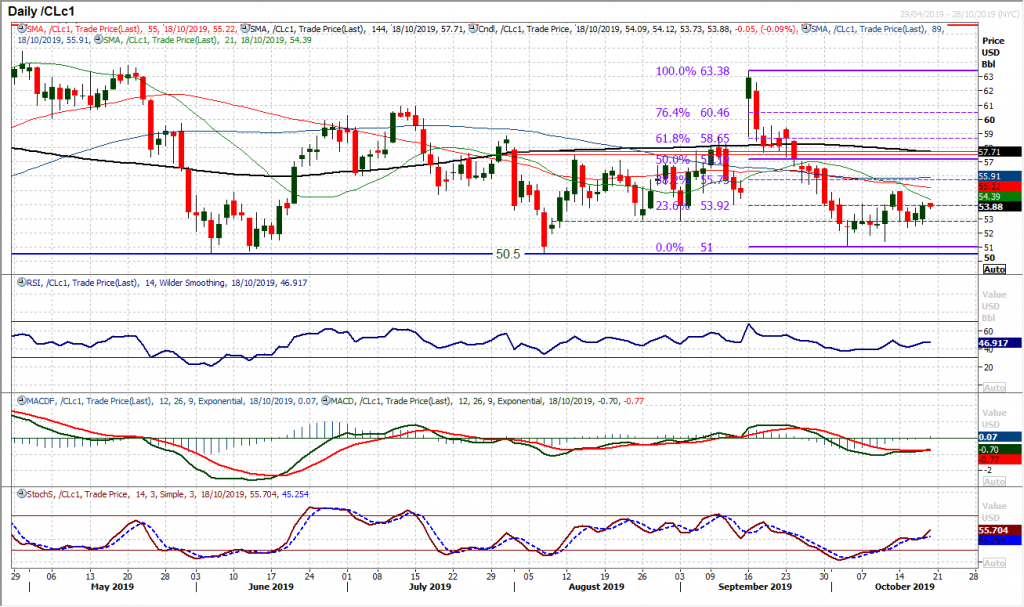

WTI Oil

Although WTI ticked higher to leave a bull candle yesterday, there is still little real direction of any conviction in the market right now. There is a mild improvement in the Stochastics, but this is a market still throwing off a range of signals. It means that it is very difficult to take yesterday’s positive candle on trust. This is a market trading between the key support starting at $51.00 and up towards last week’s high of $54.95. The hourly chart shows that yesterday’s run higher has been dragged back overnight to leave initial resistance at $54.15. Hourly momentum also reflects ongoing ranging conditions. Support is forming at $52.80 but the bulls have a lot of work to convince about any sustainable recovery.

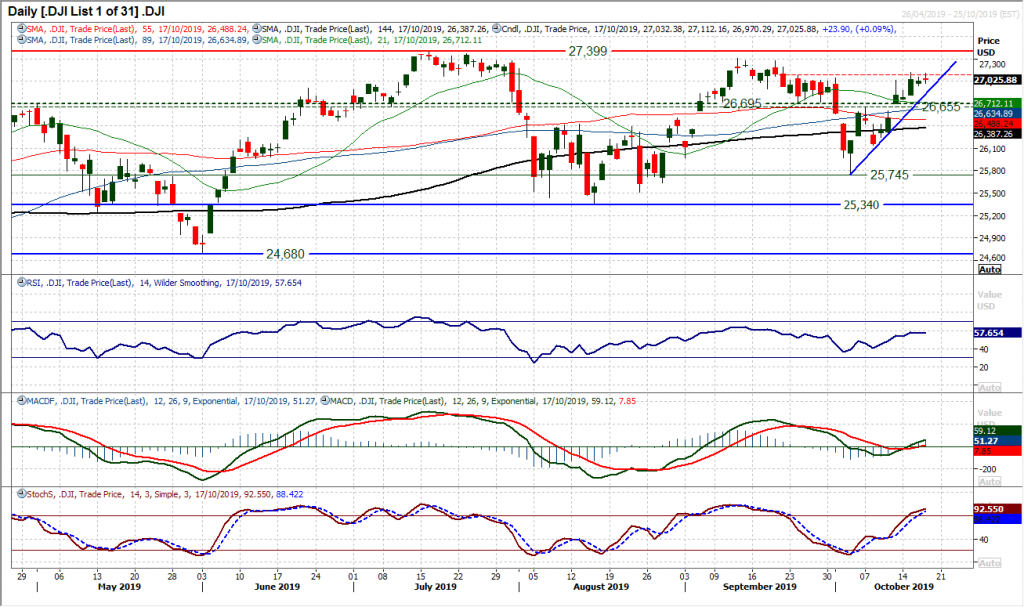

Dow Jones Industrial Average

The Dow is just looking a little bit cautious suddenly as the rally has stalled over the past couple of sessions. The resistance band 27,045/27,120 has held up the market for the past week now, but this is still for now just a consolidation within the developing two week uptrend. Momentum indicators are still progressing in a positive configuration with MACD lines rising above neutral (just) and Stochastics above 80. However the RSI is getting a little stuck in the high 50s and the market now needs to push through this resistance band 27,045/27,120 otherwise this rally will become a little stale. Futures are again a shade lighter today, so there is no imminent breakout, however, we remain positive on the Dow whilst the market trades above the 26,655/26,695 multi-week pivot. A close above 27,120 opens the all-time highs again at 27,399. The near term uptrend comes in to support the market at 26,940 today. The hourly chart suggests that this is just a pause in the run higher and the bulls are still in control to buy into weakness.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.