Outlook: We are back to the mantra earlier this year “It’s the pandemic, stupid.” The Moderna CEO Bancel is going down in history for shocking the public, the markets, the regulators and the industry itself for speaking truth. While other big pharma representatives and even the president say “cause for concern but not panic,” Bancel said, “yes, go ahead and panic--conditions warrant panic.” We’d bet someone from Washington is on the phone to him trying to curtail his First Amendment rights in the name of the greater good. After mealy-mouthed contradictions from the Establishment, Bancel is a breath of fresh air, even if it’s Arctic-cold. And even if he’s wrong and the new variant is a lot less lethal than the others.

As a general rule, markets cannot stand being freaked out for long. It’s literally physically exhausting. Besides, most traders are not equipped or qualified to be short-sellers, and shorting is what’s called for in today’s situation. We guess dismissing Bancel will take less than the two weeks he named to discover what’s needed about the Omicron variant. But it may take longer. Is Delta a meaningful historical precedent? Remember the 10-year yield fell hard in June and July to 1.129 at the low on Aug 4. We may well get a repeat.

Or not. Everyone seems to be forgetting that the chairwoman of the South African Medical Association said the Omicron variant does not cause severe symptoms and those last only a few days, They have first-class virologists in S. Africa, so why are we not listening? Still, the Western medical establishment wants to make up its own mind, even if we smell a little racist misogyny in the judgment. If the S. African verdict stands and is correct, we are going to look foolish–locking down borders, shorting stocks.

Economic data pales in comparison to the variant problem, even if we cannot expect meaningful facts today. We get housing prices, the Chicago PMI, and the Conference Board consumer confidence report–all of less interest when the new focus is on the future, not recent events. Canada is expected to report Q3 GDP at a nifty 3% (after -1.1% in Q2), but it’s not clear the CAD will respond happily–not with oil in the mix.

If there is a data offset to the Omicron nightmare, it’s nonfarm payrolls on Friday. Expectations are running high that payrolls will be a bit less than October, which normally would imply the Fed can pull in its hawkishness. Trading Economics reminds us that last month NFP was 531,000, a 3-month high. The current consensus forecast is 450,000, although TE’s own forecast is 400,000. Sure enough, the CME Fed Watch tool shows the percentage of traders expecting one hike by the June meeting is still fairly high, but the second hike is more doubtful–from 31% to 19%. A third hike by June–no. The percentage is down to 3% from 8%.

Speculation about data is not all that useful now. We need to twiddle our thumbs and wait for the science to tell us whether Omicron is more transmissible, more lethal, and not addressed by current vaccines. If the S. Africa docs are right, we are freaking out over something that doesn’t warrant it. That doesn’t mean a return to the status quo ante, but it does mean forecasts of stock market crashes, recession and endless QE are silly.

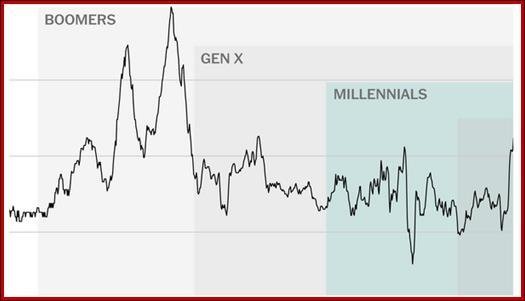

Inflation Watch: The NYT has a dandy chart showing you have to be a Boomer to remember inflation in your own life. What this means is a whole generation that doesn’t know how to evaluate inflation and who to blame. We already heard from the great wide public that inflation is being caused by wages increases, which is certainly not true. It may become a factor at some point, but so far inflation is caused by a surge in demand and a supply chain blockage.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery gains above 1.0650

EUR/USD stays in a consolidation phase following Wednesday's rebound and trades in a narrow range above 1.0650. The improving risk mood doesn't allow the US Dollar to gather strength as markets await mid-tier data releases.

GBP/USD clings to moderate gains above 1.2450

GBP/USD is clinging to recovery gains above 1.2450 in European trading on Thursday. The pair stays supported by a sustained US Dollar weakness alongside retreating US Treasury bond yields. Fed policymakers will speak later in the day.

Gold shines amid fears of fresh escalation in Middle East tensions

Gold trades in positive territory near $2,380 on Thursday after posting losses on Wednesday. The precious metal holds gains amid fears over tensions in the Middle East further escalating, with Israel responding to Iran's attack over the weekend.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.