The €64,000 Question:

Yet another break down in talks between Greece and their European overlords bodes me to ask the question, is a Grexit actually a blessing for the Euro? Going one step further, does current EUR/USD strength reflect confidence in a deal or are the long term benefits of a stronger Euro without Greece driving trade?

Some brilliant quotes from IMF Chief, Christine Lagarde overnight:

“There is an urgent need for dialogue with adults in the room.”

“We can only arrive at a resolution if there is a dialogue. Right now we’re short of a dialogue.”

The current bailout for Greece expires on June 30 (yes, next Tuesday) when Athens is also due to repay the IMF around €1.6 billion. Most scary for markets craving certainty was Lagarde saying if the payment is not made on time, Greece will be declared to be in default and would disqualify itself from receiving any further IMF funds.

“There would be no grace period or possibility of delay to loan payments that are due on 30 June.”

With these quotes, The IMF has taken a stance that we haven’t yet seen. One of no more garbage. This highlights just how close to the end we are and a huge contributing factor to why trading in EUR/USD has been so unpredictable.

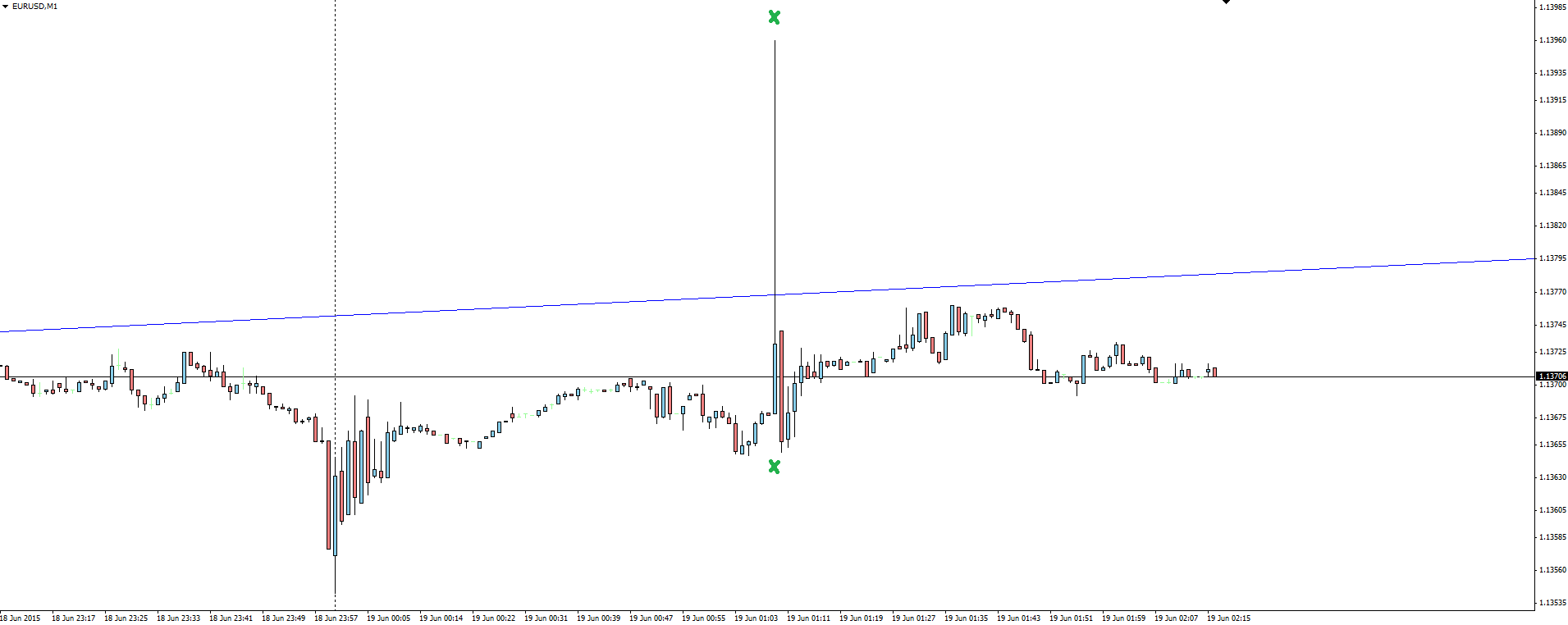

EUR/USD 1 Minute:

Take a look at the 1 minute price action of EUR/USD as already thin US/Asian session crossover trade was exacerbated by the current climate.

With uncertainty keeping the market not positioned one way or the other, any post event moves are unlikely to be fueled by the liquidation of positions but market depth is certainly going to be interesting. Heck, I’ve read analysts not being surprised to see 1000 pip EUR/USD SWINGS between parity and 1.2000 if Greece does in fact default and is forced out of the Euro. Insanity!

So no, I can’t answer either of the questions I asked at the top of this blog and anyone that tells you they can is lying. It’s all a wait and see.

On the Calendar Today:

Friday:

JPY Monetary Policy Statement

JPY BOJ Press Conference

CAD Core CPI

CAD Core Retail Sales

USD FOMC Member Williams Speaks

Chart of the Day:

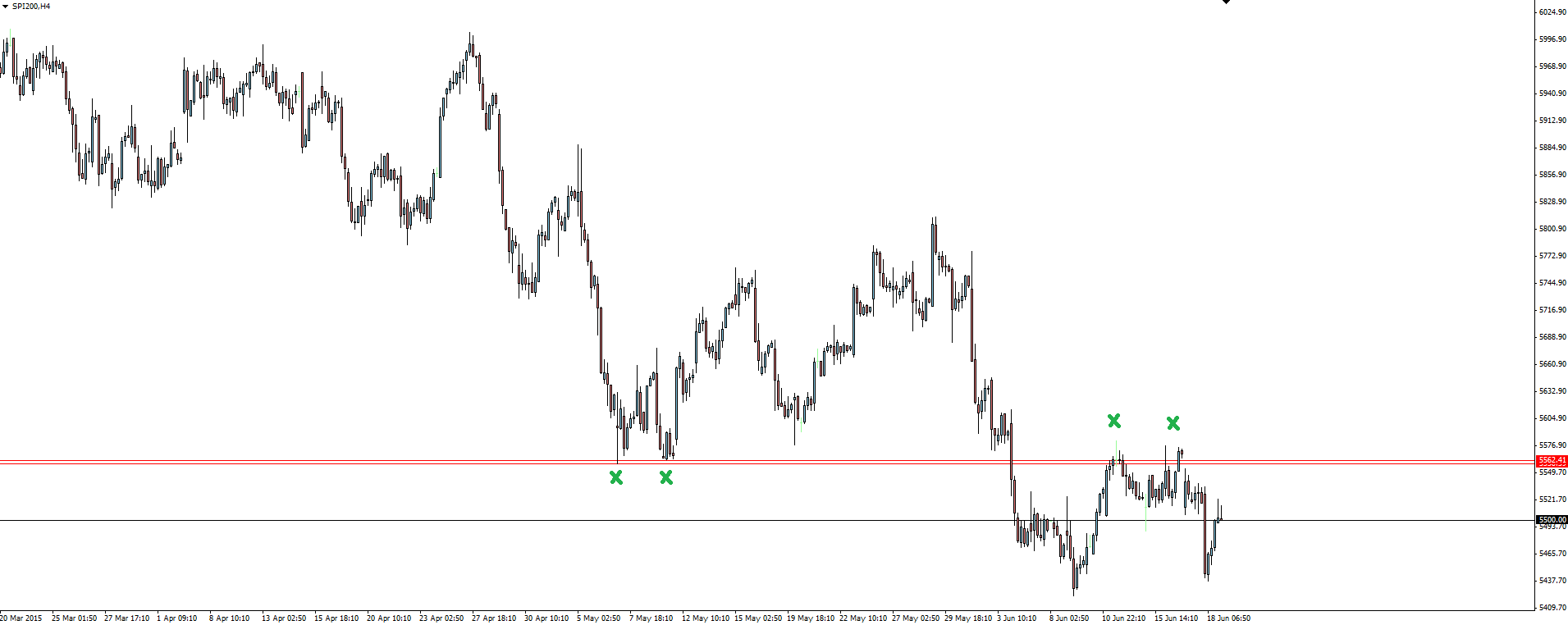

SPI200 4 Hourly:

A simple and effective technical setup on the Australian SPI200 which we brought up inside Friday week’s Morning View.

Zooming into the 4 hour chart, we can see after a major support level was broken, price retraced to cleanly re-test it as resistance. Textbook stuff on a market that not many outside of Australian futures traders generally trade. I highly recommend taking a look for yourself and adding this one to your watch list.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price flat lines above $2,300 mark, looks to US macro data for fresh impetus

Gold price (XAU/USD) struggles to capitalize on the previous day's bounce from over a two-week low – levels just below the $2,300 mark – and oscillates in a narrow range heading into the European session on Wednesday.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.