Market news

-

The Treasury market holds a modest bid except in Australia and New Zealand.

-

RBA’s Lowe pushed back against rate hike expectations in a bid to separate QE tapering plans from the outlook on interest rates.

-

Australia house price data & Business confidence data came in higher than expected, and coupled with Lowe’s assuring words on rates the numbers still helped the ASX to gain 0.2%.

-

Bonds were supported by the strength seen in last week’s 3-, 10-, and 30-year auctions, as well as by expectations the FOMC will not announce a QE tapering next week.

-

Equities are mixed with solid 0.76% gains on the USA30 amid strength in energy as oil stocks surged. The USA500 posted a 0.23% increase, while the USA100 was weaker, slipping -0.07% amid declines in Chinese ADRs amid further crackdowns, this time on ANT Group. Japanese indexes are near 31-year highs and JPN225 is also currently up at 0.5% and 0.7% respectively. GER30 and UK100 futures are up.

-

The AUD and NZD declined along with yields after Lowe’s remarks. USDJPY lifted to 110.08, amid a largely weaker Yen.

-

USOil up to $70.88, as a storm hitting the Gulf of Mexico was upgraded to a Hurricane.

-

Today’s UK labour market report presented an unemployment rate down to 4.6% in the three months to July – as expected. Earnings growth eased somewhat, but remained very strong. –Strong numbers that will add to the arguments of the hawkish camp at the BoE as officials ponder strategies to exit from QE.

Today –US inflation numbers today will be in focus for markets and investors are likely to hold back ahead of the release.

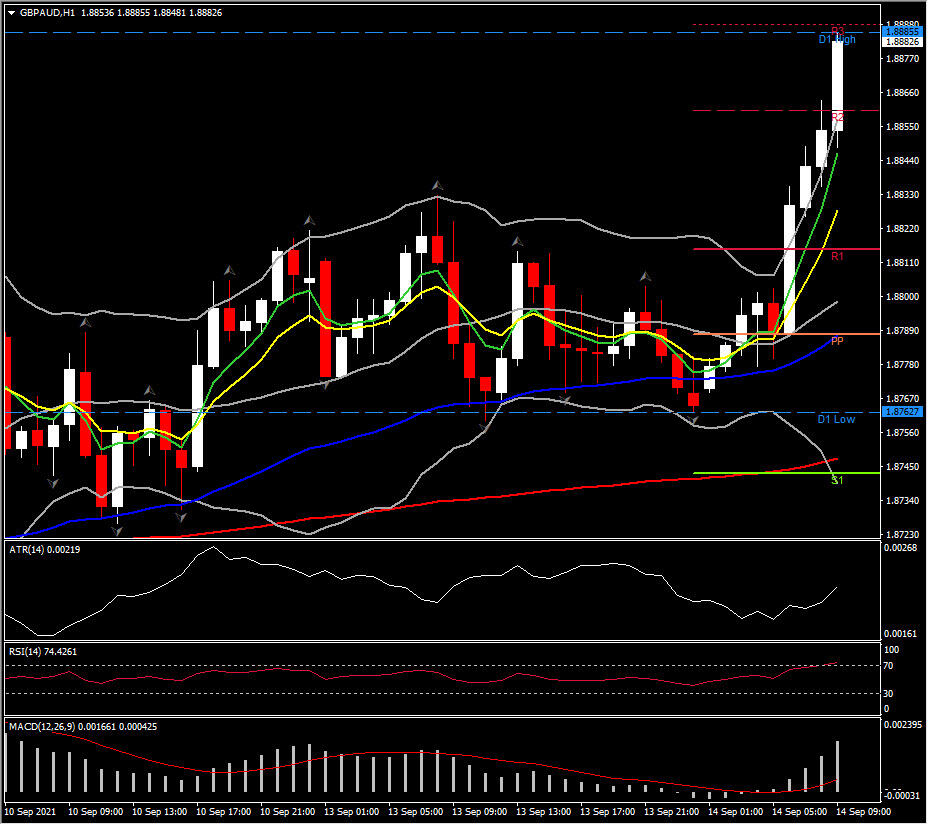

Biggest Mover @ (06:30 GMT) GBPAUD (+0.61%) spiked to 1.8890 from 1.8760. Faster MAs aligned higher, MACD signal lines are positively configured as RSI broke above 70 barrier, suggesting that bullish bias strengthens. H1 ATR 0.0022, Daily ATR 0.01063.

Disclaimer: Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.