-

Supply chain disruptions are increasingly hitting production targets and adding to stagflation concerns.

-

The bond market is overlooking Wednesday’s CPI data and the prospects for a hot report and the FOMC Minutes tonight.

-

Global Yields grab helped underpin the long end- reflected in the solid 10-year auction results, while the 3-year evinced weaker metrics. The 2-year is 3.2 bps higher at 0.350%, the cheapest since mid-March 2020.

-

Equities down. JPN225 dropped back -0.2%, the ASX declined -0.1%, although other markets looked somewhat better. Hong Kong remained closed due to weather warnings, but mainland China bourses outperformed amid strong export growth and stabilising sentiment on property developers. Japan’s machinery orders unexpectedly contracted and sentiment hit a 6-month low.

-

Oil steadied in the $79.00-$81.00 area.

-

FX markets – USD eased against majors, GBP strengthened.

-

EURUSD is ranging 1.1522-1.1560, Cable rebounds to 1.3614, USDJPY 113.30-113.60.

European Open – The December 10-year Bund future is down 6 ticks, but the 30-year has rallied while US futures are little changed. GER30 and UK100 futures meanwhile are up 0.2% and down -0.1% respectively, with US futures also lower, after a cautious session across Asia overnight. China angst eased somewhat, but elevated energy prices, supply chain disruptions and delivery problems are keeping stagflation fears alive.

Today – US inflation data will be in focus today, as markets assess tapering risks. The EU calendar includes monthly GDP numbers and production data for the UK as well as final German inflation readings for September.

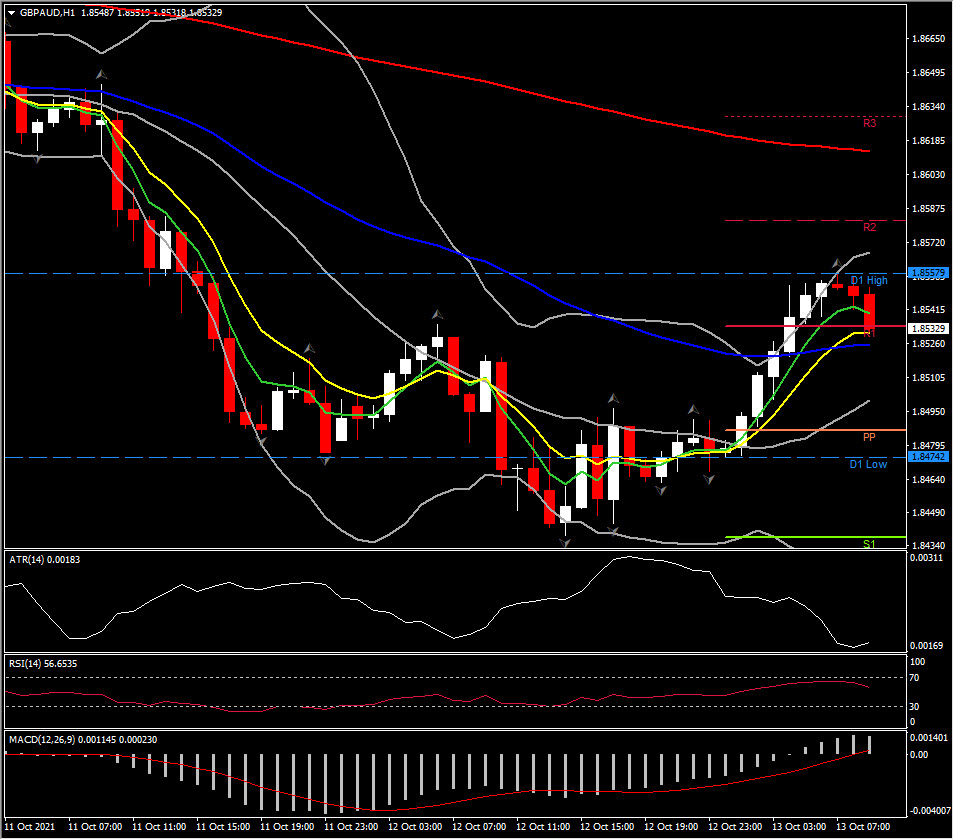

Biggest FX Mover @ (06:30 GMT) GBPAUD (+0.43%) Rebounded from 1.8435 to 1.8557. Currently faster MAs started pulling back, MACD signal line is at 0 & histogram trending higher. RSI 43 and slowing down, all indicating a correction after rally. H1 ATR 0.00184, Daily ATR 0.01096.

Disclaimer: Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter gross domestic product (GDP) data on Thursday.