Market News Today – US Equities at new closing highs on Friday, (4 consecutive weeks for USA500), USD remains weak with 10-yr yield now well under 1.60% at 1.56%. Asian markets higher and European FUTS up too. JPY seeing some buying in Asia – EUR weaker. BTC weekend collapse (65k – 51K) reason? – US regulators preparing move on money launderers? Power cut in China’s crypto mining hub Xinjiang? (Trades down 14% at 57k now). AUD-NZD air corridor open, European Football in revolt, Biden to reduce Corp. tax demands to 25%?, $5.4tn global savings stockpile – FT

Week Ahead – ECB, BOC, & PBOC rate decisions, more CPI data, PMIs, and more key Q1 Earnings reports. – including Netflix, AT&T, Johnson & Johnson, Intel and American Express.

The Dollar has remained soft in concert with heavy US Treasury yields. Ranges have been narrow, though the USDIndex still edged out a one-month low at 91.05, extending the decline from the five-month high that was seen in late March at 93.44. The 10-year Treasury note yield has at the same time settled on a 1.560% handle, just a couple of basis points above last week’s five-week lows. The benchmark yield remains down by nearly 20 bp from the 14-month highs that were seen in late March. Amid the dollar softening theme, which lifted EURUSD beyond 1.2000 to seven-week highs at 1.2036, there, was a side theme of moderate yen outperformance, which aided USDJPY to a seven-week low at the key 108.00, while EURJPY and AUDJPY printed respective 11- and five-day lows.

Asia stock markets have remained underpinned, though the MSCI Asia-Pacific index remained off recent highs. S&P 500 E-mini futures was showing a 0.3% decline in early London trading, correcting after the cash version of the index closed on Wall Street at a record peak on Friday in what was its sixth consecutive weekly gain. Incoming corporate earnings will remain a focus, especially those of cyclical businesses.

European stock markets are mostly higher, although the DAX is slightly lower and overall moves have been muted as investors look to the earnings season and this week’s central bank meetings for fresh catalysts.

The global Covid vaccine supply capacity continues to ramp higher, and continental Europe seems to be past the point of peak pessimism, with infection rates steadying and the vaccine rollout set to accelerate in the weeks and months ahead. The sharp spike in Covid cases in India and, increasingly, Pakistan, are cause for worry, however, as it’s been driven by variant B.1.617, which has two ‘escape mutations’ that make it able to dodge antibodies. This variant has been detected in 77 cases in the UK.

Today – Highlights include ECB asset purchases and earnings from IBM, Coca-Cola and United Airlines.

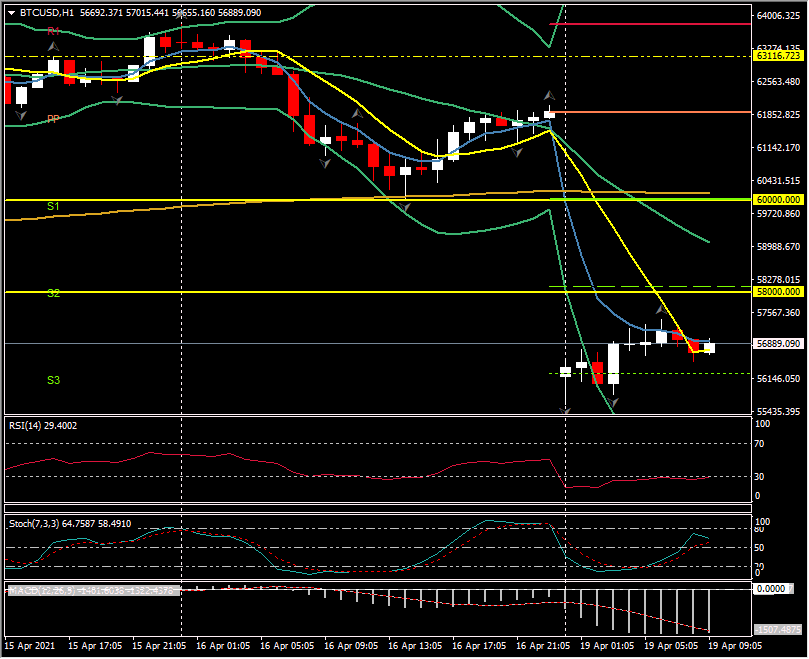

Biggest (FX) Mover @ (07:30 GMT) BTCUSD (-14.00%) Gapped on open – see news item above. Technically stalled at S3 56,150 from a close on Friday at PP 61,850. MAs remain aligned lower although 5 EMA now above 9 EMA, RSI OS (29 and rising), MACD histogram & signal line aligned lower and under 0 line from Friday morning. Stochs rising from OS zone. H1 ATR 970.00, Daily ATR 2860.

Disclaimer: Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.