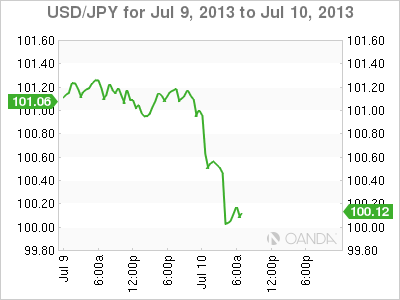

There are times when the markets seem to make little sense. It’s moments like these that investors usually start to grasp for reasonable answers to fit their own equations. US yields have traded lower for two days and yet the dollar remained reasonably bid for the most part. Equities have gone from ‘tapering’ is bad, to ‘tapering’ means that the US economy is “good” bottom line. Maybe the Fed’s message is finally beginning stick, that ‘tapering’ does not mean higher overnight rates. This morning there has been no ‘real’ fresh USD news to trigger the slippage – it’s looking more like a long dollar squeeze play.

The global equity markets have bounced to such an extent that they have erased the selloff that occurred after the June FOMC meeting. This would suggest that investors have progressively become more comfortable with ‘helicopter’ Ben and his sidekicks tapering QE. It seems that few are now concerned that higher yields are not considered a real threat to the wider economy. “Normalization” is underway in the various asset classes, as they adjust in terms of price/yield and trading patterns (volatility) when the Fed will “not” be a big buyer of treasuries. US policy makers should be welcoming this move as the market looks to stay the course towards tapering of QE in September. Obviously, all of this is data dependent – persistently weak data will lead to “no taper”.

All of this should become much clearer in today’s FOMC minutes released this afternoon. Analysts are expecting the June FOMC minutes will likely sound more hawkish with regard to QE, than the subsequent public comments from the plethora of Fed officials of late. A more dovish tone for the longer-term outlook for policy will probably be expected. The “Summary of Economic Projections” released last month indicate that US policymakers seem to have pushed out their preferences for the timing of the first rate hikes and for the pace of tightening once the formal exit strategy has begun. Expect Ben to address questions on the topic in a Q&A session after a speech late afternoon. Despite the market having priced in a taper, investors will be scanning the minutes for any clues as to whether July is a possibility. No matter, last Friday’s strong NFP reading coupled with a dovish ECB/BoE should allow the dollar to “outperform” its G10 neighbors and EM foes.

It’s apparent that the global economy remains highly dependent on the US. After the IMF’s realigned growth predictions yesterday, the US remains the best hope for a return to relatively strong growth over the coming year. The country’s outperformance and higher yields favor a stronger dollar against most of its trading partners currencies. The divergence in performance between the US and the rest of the world and the related “fight for monetary independence” may suggest we could be entering another multi-year USD bull market. The greenback overall strength will depend on how deep other countries will go to fight for “monetary independence”.

Christine Lagarde and company at the IMF yesterday trimmed their global growth forecast for this year to +3.1%, from the +3.3% forecasted three months ago. They also reduced this years projections for the US to +1.7% growth from +1.9%, while next year’s outlook was trimmed to +2.7% from +3% initially reported in April. They are not as optimistic as some, as they noted the possibility of a “longer growth slowdown in emerging market economies, especially given risks of lower potential growth, slowing credit, and possibly tighter financial conditions if the anticipated unwinding of monetary policy stimulus in the US leads to sustained capital flow reversals”.

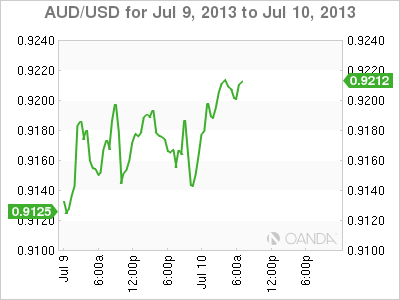

This market attitude towards China and their softer data of late is more palatable. Unlike before, there seems to be a less “immediate” market meltdown. Last night, Chinese exports fell -3.1%, y/y in June, compared with the median estimate of a +3.7% gain and a previous rise of +1.0% in May. Analysts note “export growth has slowed sharply since the government’s crackdown on fraudulent invoices”. On the flip side, imports declined -0.7%, y/y in June, after a -0.3% drop in May – the market was looking for a whopping +6% rise. The net result, Chinese trade surplus has risen to a high of +$27.12b versus +$20.42b in May. The market should expect any key commodity exporters to China, namely Australia and Brazil, own currencies to be eventually come under some pressure.

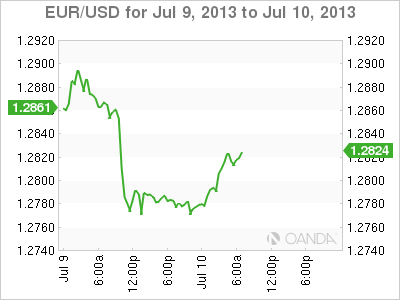

Italy’s long-term credit rating cut to BBB by S&P, with a negative outlook, along with the dovish ECB’s Asmussen comments yesterday, certainly provides more support to short the 17-member currency on upticks. Currently, the net-EUR shorts recorded on the IMM/FX remains negligible by historical standards. Underweight net-shorts may be one of the biggest factors to lead the ‘single’ currency lower again. The EURO techs prefer to fade any EUR rallies towards 1.2850. They are looking for 1.2740 to eventually open up towards 1.2680. At the moment reserve managers are better buyers. But, how far can their appetite hold up?

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.