The financial markets continued trading in a risk-on mode last week, as China virus fears were easing and economic data was supporting Fed’s easy monetary policy. This week we will have another series of quite important economic data releases. Let’s take a look at the details.

The week behind

The corona virus fears have almost disappeared last week, as investors’ sentiment has been improving following record-breaking U.S. stock market rally. Tuesday’s-Wednesday’s Testimony from the Fed’s Jerome Powell reassured global financial markets that easy monetary policy will be continued in the future. And we highlighted it in our last week’s Market News Report. Thursday’s Consumer Price Index came in as expected, so inflation remains very low. However, Friday’s Retail Sales number wasn’t that good. And the price of gold remained within a short-term uptrend last week.

The week ahead

What about the coming week? Probably the most important piece of economic data will be Wednesday’s FOMC Meeting Minutes release. Investors will get detailed insights regarding FOMC’s stance on monetary policy. We will also have series of quite important economic data releases from U.S. and the Eurozone. Be sure to check them out in the coming days. Let’s take a look at key highlights:

-

Wednesday’s FOMC Meeting Minutes will be the most important economic data release this week.

-

We will also get series of other quite important U.S. economic data announcements - Empire State Manufacturing Index on Tuesday, Producer Price Index, Housing Starts, Building Permits on Wednesday, Philly Fed Manufacturing Index on Thursday, and the Flash Manufacturing PMI, Flash Services PMI releases on Friday.

-

There will also be important economic data releases in the Eurozone – on Tuesday we will get the German ZEW Economic Sentiment, on Thursday the ECB Monetary Policy Meeting Accounts will be released and on Friday we will get PMI numbers from Germany and France, among others.

-

The currency traders will surely have to focus on this week’s economic data releases from Australia, Canada and the U.K.

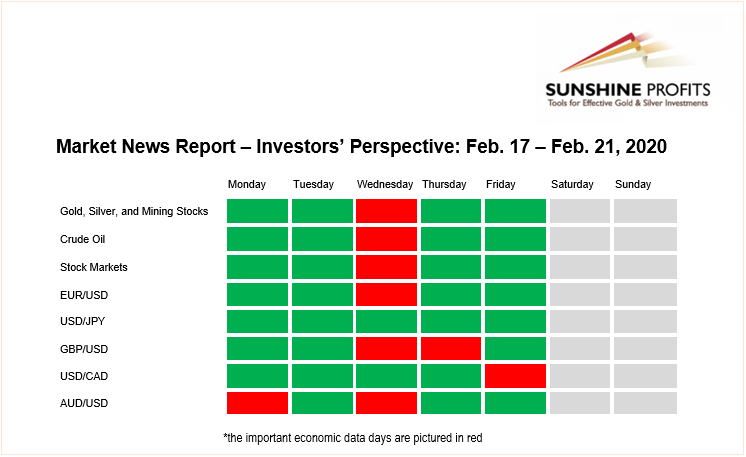

You will find this week’s the key news releases below (EST time zone). For your convenience, we broken them down per market to which they are particularly important, so that you know what to pay extra attention to, if you have or plan to have positions in one of them. Moreover, we put the particularly important news in bold. This kind of news is what is more likely to trigger volatile movements. The news that are not in bold usually don’t result in bigger intraday moves, so unless one is engaging in a particularly active form of day trading, it might be best to focus on the news that we put in bold. Of course, you are free to use the below indications as you see fit. As far as we are concerned, we are usually not engaging in any day trading during days with “bold” events on a given market. However, in case of more medium-term trades, we usually choose to be aware of the increased intraday volatility, but not change the currently opened position.

Our Market News Report consists of two different time-related perspectives. The investors’ perspective is only suitable for the long-term investments. The single economic data releases rarely cause major outlook changes. Hence, we will only see a handful of bold markings every week. On the other hand, the traders’ perspective is for traders and day-traders, because the assets’ prices are likely to react on a single piece of economic data. So, there will be a lot more bold markings on potentially market-moving news every week.

Investors’ Perspective

Gold, Silver, and Mining Stocks

Monday, February 17

-

All Day, U.S. - Bank Holiday - Washington's Birthday

Tuesday, February 18

-

8:30 a.m. U.S. - Empire State Manufacturing Index

Wednesday, February 19

-

8:30 a.m. U.S. - PPI m/m, Core PPI m/m, Housing Starts, Building Permits

-

2:00 p.m. U.S. - FOMC Meeting Minutes

Thursday, February 20

-

8:30 a.m. U.S. - Philly Fed Manufacturing Index

Friday, February 21

-

9:45 a.m. U.S. - Flash Manufacturing PMI

Crude Oil

Monday, February 17

-

All Day, U.S. - Bank Holiday - Washington's Birthday

Tuesday, February 18

-

8:30 a.m. U.S. - Empire State Manufacturing Index

Wednesday, February 19

-

8:30 a.m. U.S. - PPI m/m, Core PPI m/m, Housing Starts, Building Permits

-

2:00 p.m. U.S. - FOMC Meeting Minutes

-

4:30 p.m. U.S. - API Weekly Crude Oil Stock

Thursday, February 20

-

8:30 a.m. U.S. - Philly Fed Manufacturing Index

-

11:00 a.m. U.S. - Crude Oil Inventories

Friday, February 21

-

9:45 a.m. U.S. - Flash Manufacturing PMI

Stock Markets

Monday, February 17

-

All Day, U.S. - Bank Holiday - Washington's Birthday

Tuesday, February 18

-

5:00 a.m. Eurozone - German ZEW Economic Sentiment

-

8:30 a.m. U.S. - Empire State Manufacturing Index

Wednesday, February 19

-

8:30 a.m. U.S. - PPI m/m, Core PPI m/m, Housing Starts, Building Permits

-

2:00 p.m. U.S. - FOMC Meeting Minutes

Thursday, February 20

-

8:30 a.m. U.S. - Philly Fed Manufacturing Index

Friday, February 21

-

3:15 a.m. Eurozone - French Flash Services PMI

-

3:30 a.m. Eurozone - German Flash Manufacturing PMI, German Flash Services PMI

-

9:45 a.m. U.S. - Flash Manufacturing PMI, Flash Services PMI

-

10:00 a.m. U.S. - Existing Home Sales

EUR/USD

Monday, February 17

-

Tentative, Eurozone - German Buba Monthly Report

-

All Day, Eurozone - Eurogroup Meetings

-

All Day, U.S. - Bank Holiday - Washington's Birthday

Tuesday, February 18

-

5:00 a.m. Eurozone - German ZEW Economic Sentiment, ZEW Economic Sentiment

-

8:30 a.m. U.S. - Empire State Manufacturing Index

-

All Day, Eurozone - ECOFIN Meetings

Wednesday, February 19

-

8:30 a.m. U.S. - PPI m/m, Core PPI m/m, Housing Starts, Building Permits

-

2:00 p.m. U.S. - FOMC Meeting Minutes

Thursday, February 20

-

7:30 a.m. Eurozone - ECB Monetary Policy Meeting Accounts

-

8:30 a.m. U.S. - Philly Fed Manufacturing Index

Friday, February 21

-

3:15 a.m. Eurozone - French Flash Services PMI, French Flash Manufacturing PMI

-

3:30 a.m. Eurozone - German Flash Manufacturing PMI, German Flash Services PMI

-

9:45 a.m. U.S. - Flash Manufacturing PMI, Flash Services PMI

-

10:00 a.m. U.S. - Existing Home Sales

USD/JPY

Monday, February 17

-

All Day, U.S. - Bank Holiday - Washington's Birthday

Wednesday, February 19

-

8:30 a.m. U.S. - PPI m/m, Core PPI m/m, Housing Starts, Building Permits

-

2:00 p.m. U.S. - FOMC Meeting Minutes

Thursday, February 20

-

6:30 p.m. Japan - National Core CPI y/y

-

7:30 p.m. Japan - Flash Manufacturing PMI

-

11:30 p.m. Japan - All Industries Activity m/m

GBP/USD

Monday, February 17

-

All Day, U.S. - Bank Holiday - Washington's Birthday

Wednesday, February 19

-

4:30 a.m. U.K. - CPI y/y

-

8:30 a.m. U.S. - PPI m/m, Core PPI m/m, Housing Starts, Building Permits

-

2:00 p.m. U.S. - FOMC Meeting Minutes

Thursday, February 20

-

4:30 a.m. U.K. - Retail Sales m/m

-

8:30 a.m. U.S. - Philly Fed Manufacturing Index

Friday, February 21

-

4:30 a.m. U.K. - Flash Manufacturing PMI, Flash Services PMI

USD/CAD

Monday, February 17

-

All Day, U.S. - Bank Holiday - Washington's Birthday

-

All Day, Canada – Holiday – Family Day

Wednesday, February 19

-

8:30 a.m. U.S. - PPI m/m, Core PPI m/m, Housing Starts, Building Permits

-

8:30 a.m. Canada - CPI m/m

-

2:00 p.m. U.S. - FOMC Meeting Minutes

Thursday, February 20

-

8:30 a.m. Canada - ADP Non-Farm Employment Change

Friday, February 21

-

8:30 a.m. Canada - Retail Sales m/m, Core Retail Sales m/m

-

9:45 a.m. U.S. - Flash Manufacturing PMI, Flash Services PMI

AUD/USD

Monday, February 17

-

7:30 p.m. Australia - Monetary Policy Meeting Minutes

-

All Day, U.S. - Bank Holiday - Washington's Birthday

Tuesday, February 18

-

7:30 p.m. Australia - Wage Price Index q/q

Wednesday, February 19

-

8:30 a.m. U.S. - PPI m/m, Core PPI m/m, Housing Starts, Building Permits

-

2:00 p.m. U.S. - FOMC Meeting Minutes

-

7:30 p.m. Australia - Employment Change, Unemployment Rate

Thursday, February 20

-

8:30 a.m. U.S. - Philly Fed Manufacturing Index

-

5:00 p.m. Australia - Flash Manufacturing PMI, Flash Services PMI

Summing up, if you’re an investor and not a trader, you should pay extra attention to the mentioned Wednesday’s FOMC Meeting Minutes release. Plus, there will be important economic data releases from Australia, Canada and the U.K. in the coming week.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.