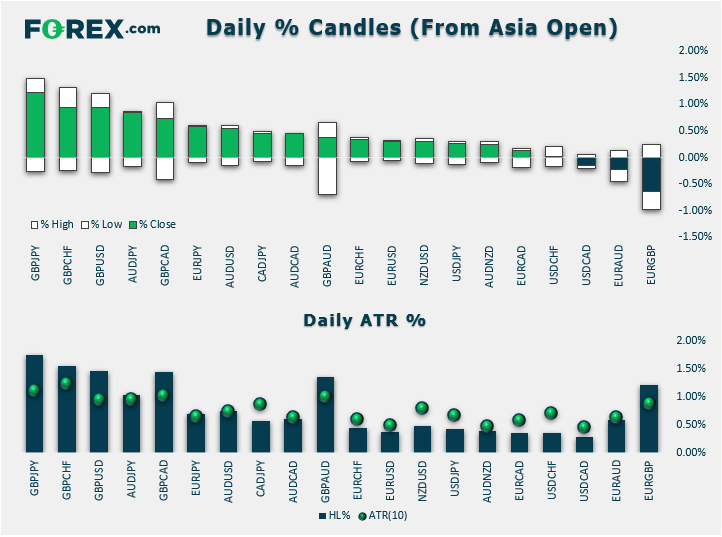

At midday in London, GBP was the strongest while the JPY was the weakest among major currencies. Stocks continued to push sharply higher following yesterday’s big rally. Oil and copper prices found further support, while safe-haven gold eased back after its earlier rebound. In other words, it was risk ON at the time of writing.

GBP/USD and GBP crosses continued to hit repeated session highs this morning. This comes on the back of "constructive" Brexit talks between EU and UK negotiators Michel Barnier and Stephen Barclay this morning, and after leaders of the UK & Ireland held detailed discussions yesterday, agreeing that they could see a "pathway to a possible deal." Lots of optimistic headlines, even if nothing has changed fundamentally. Traders are evidently happy to be buying the rumours and will be asking questions later.

Key data this afternoon from North America is Canada’s employment report, which is expected to show 11,200 new net jobs created last month. Meanwhile US consumer Sentiment is expected to ease to 92.0 from 93.2 previously.

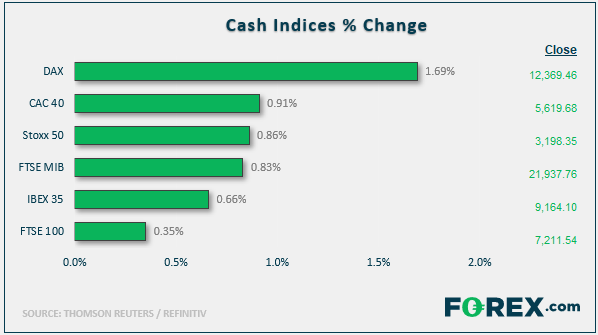

Global stocks continued to rally on the back of optimism the US and China will reach an agreement of some sort to prevent any further escalation in their bitter trade war. Following the conclusion of the first day of talks, investors expressed optimism that they might be able to ease the conflict and delay a planned US tariff hike scheduled for next week. Trade-sensitive DAX was the strongest European index, while the FTSE underperformed because of the pound’s big rally and despite sharp gains for some individual names on Brexit hopes-related (see below). US index futures were up around 1%, suggesting Wall Street will gap higher at the open – unless, something big happens, for example Trump cancelling his scheduled meeting with Chinese Vice Premier Lie He at 14:45 EDT today.

In company news

-

SAP, Europe's most valuable technology company, was up sharply on the back of strong third-quarter results

-

Publicis tumbled more than 10% after the ad firm lowered its full-year sales target for the second time this year. The news also weighed on London rival WPP.

-

Hugo Boss dropped sharply after the fashion house cut its 2019 earnings forecast and reported third quarter results below expectations.

-

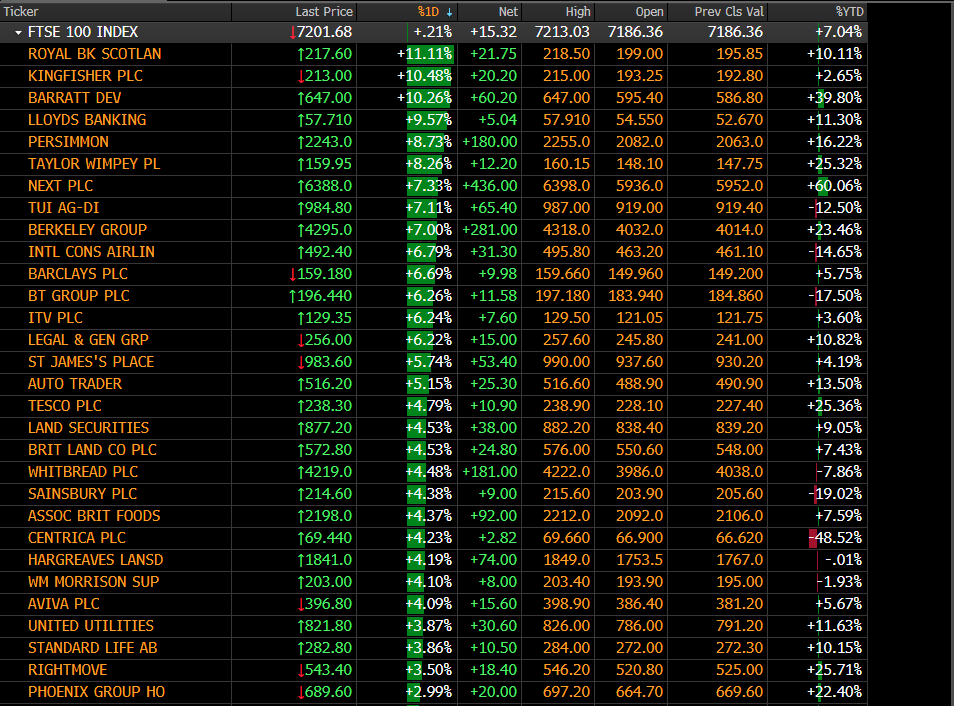

RBS and LLOYDS shares were up more 10% each this morning on Brexit optimism. Here are today’s big risers, mostly due to Brexit optimism, courtesy of Bloomberg and colleague Ken Odeluga:

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.