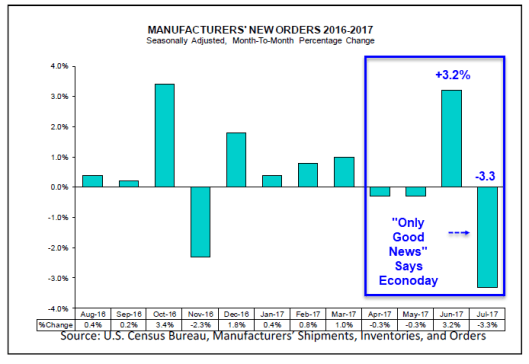

In a widely expected result, new orders for manufactured goods fell 3.3% in July according to the Census Bureau.

Don’t give economists too much credit because the advance report two weeks ago provided insight.

Econoday claims the report is entirely good news.

There’s really only good news in the July factory orders report where the headline, at minus 3.3 percent, reflects a slowing in what were strong prior gains for aircraft orders. The best news is a 6 tenths upward revision to core capital goods orders (nondefense ex-air) to a 1.0 percent gain and a 2 tenths upward revision to core shipments, now at 1.2 percent. These numbers point to accelerating strength for third-quarter business investment.

Total shipments rose a moderate 0.3 percent in the month with inventories up only 0.2 percent. This takes the inventory-to-shipments ratio to a more lean and positive 1.37 from 1.38. Unfilled orders are not a positive, falling 0.3 percent after however a giant 1.3 percent build in June.

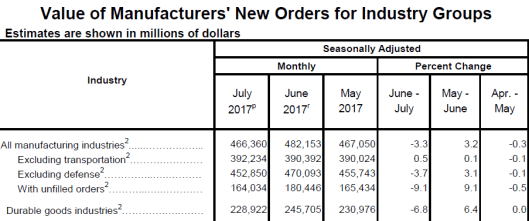

The split between the report’s two main components shows a 0.4 percent gain for nondurable goods — the new data in today’s report where strength is tied to petroleum and coal — and a 6.8 percent dip for durable orders which is unchanged from last week’s advance report for this component. The total ex-transportation gain is a strong 0.5 percent vs June’s 0.1 percent increase.

The core strength was posted despite weakness at the heart of capital goods and that’s machinery where orders fell 0.9 percent though shipments of machinery did rise 0.2 percent. Today’s factory orders report closes the book, one that includes a 0.1 percent decline in the manufacturing component of the industrial production report, on what was a mixed month for the factory sector.

Census Bureau Summary

New orders for manufactured goods in July, down three of the last four months, decreased $15.8 billion or 3.3 percent to $466.4 billion, the U.S. Census Bureau reported today. This followed a 3.2 percent June increase. Shipments, up seven of the last eight months, increased $1.6 billion or 0.3 percent to $474.3 billion. This followed a 0.1 percent June increase. Unfilled orders, down two of the last three months, decreased $3.6 billion or 0.3 percent to $1,131.9 billion. This followed a 1.3 percent June increase. The unfilled orders-to-shipments ratio was 6.75, down from 6.82 in June. Inventories, up eight of the last nine months, increased $1.4 billion or 0.2 percent to $651.6 billion. This followed a 0.3 percent June increase. The inventories-to-shipments ratio was 1.37, down from 1.38 in June.

“Only Good News?”

Econoday has a point about core capital goods, but the report is not “only good news”.

Key Points

-

July reversed June

-

Durable goods plunged because of autos

-

Core capital goods orders rose

-

New Orders down three of four months

-

Shipments up seven of eight months

-

Inventories up eight of nine months

Key Question

How long can points 5-6 last unless there is an improvement in point 4?

Auto Sales Notes

Finally, please recall that autos constitute about 20% of retail sales.

Auto sales suck. Of course, one can always rely on the broken window fallacy and claim Hurricane replacement of autos will boost GDP.

For a discussion of the auto percentage of retail sales please see Where Do Consumers Spend the Most Money? (Answer Will Likely Surprise You).

For a discussion of Hurricane Harvey’s potential impact on cars, please see Auto Sales Unexpectedly Plunge to February 2014 Low: Hurricane Boost Coming?

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.