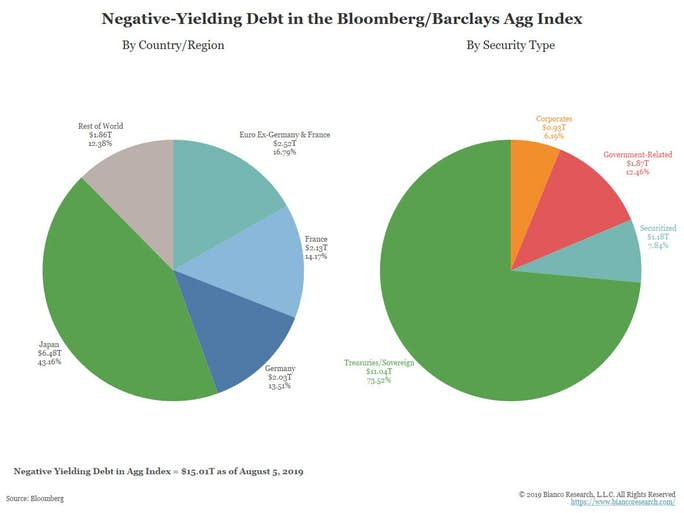

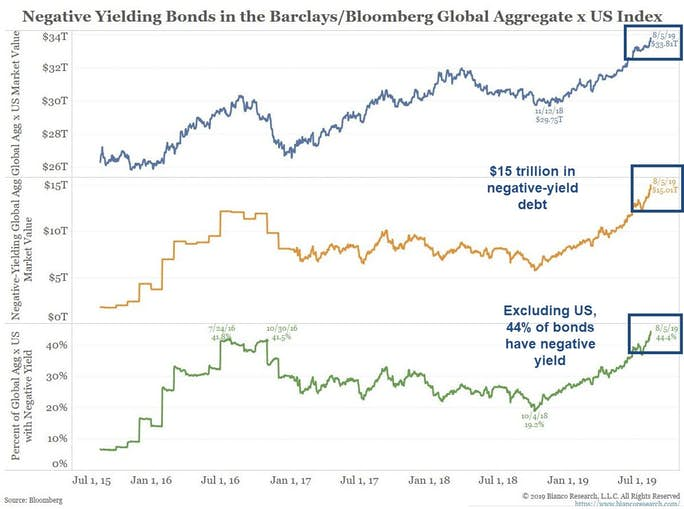

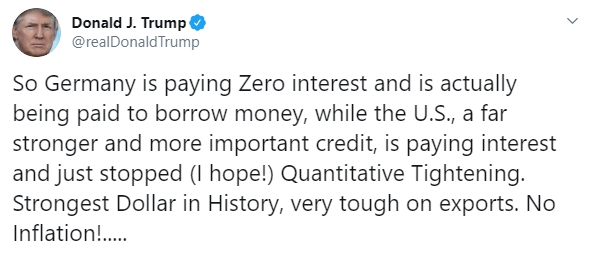

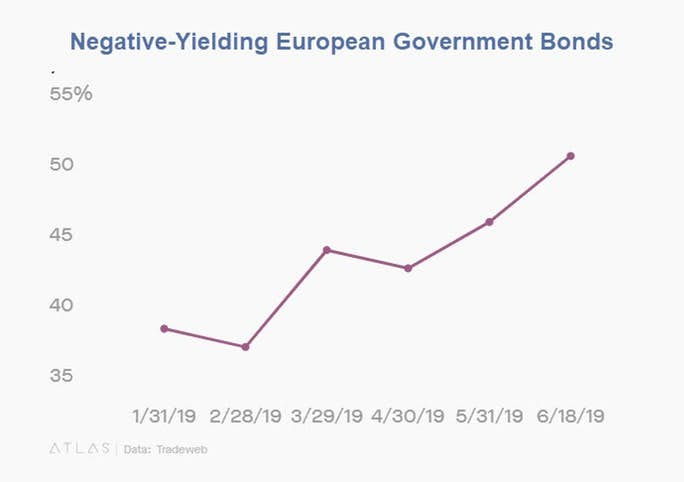

Over 50% of European gov't bonds have a negative yield. Globally there's $15 trillion in negative-yield debt.

$15 Trillion in Negative-Yield Debt

Excluding the US 44% of Bonds Have a Negative Yield

European Negative Yield Government Bonds

As of mid-June, over 50% of European government bonds have a negative yield. The total is higher now.

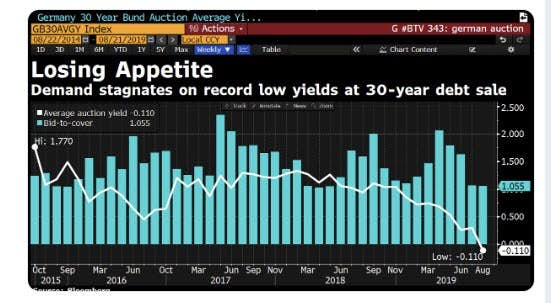

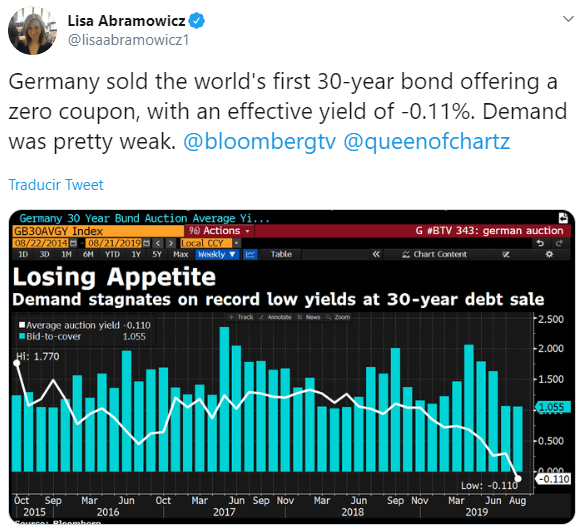

Negative-Yield 30-Year Bond

Yesterday, Germany issued a 30-year bond yielding less than 0%. Held to maturity you will not even get your money back.

Logically this is impossible. But it's happening. And Trump likes it.

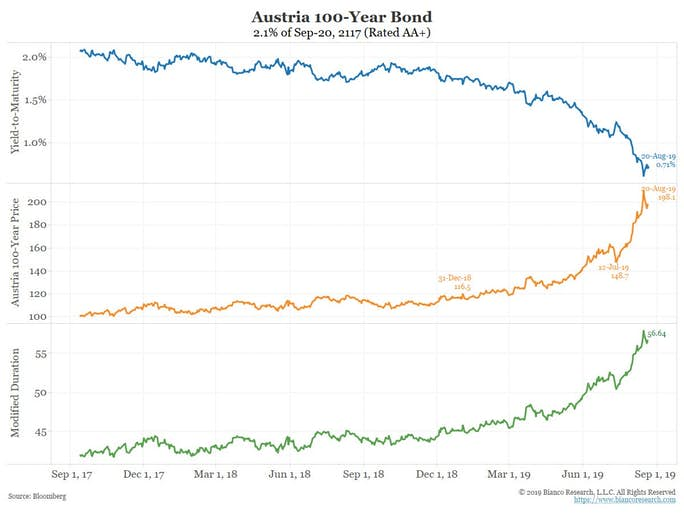

What Happens on Hundred-Year Bonds?

Austria has a 100-year bond that was trading at 116% of par on December 31 and 198% of par yesterday.

Note that if held to maturity, the bond would get about half your money back.

I asked Jim Bianco at Bianco Research a pair of questions.

- What happens if the yield very quickly rises to 0.25%, 0.5%, 1.0%, 2.0%?

- Same thing in reverse. What happens if the yield very quickly falls to -0.25%, -0.5%, -1.0%, -2.0%?

Jim responded that movement is not linear because of duration and convexity.

Convexity measures the degree of the non-linear relationship between the price and the yield of the bond.

Austria 100-Year Bond Example

Bianco Comments

- If the Modified Duration (green line) goes up and the Yield-to-Maturity (blue line) drops, the bond has "positive convexity". Callable bonds like mortgages, because we can “pre-pay them when we re-finance, have “negative convexity”.

- The 100-year Austria bond is the longest ever recorded in history. The Modified Duration is now effectively 56.64.

- The orange line represents the price. On December 31, the price was 116.5. It's now 198.1. That's a year-to-date gain of 70%. Add is 8/12s of a 2.1% coupon and its total return is over 71%. This might be the best total return for an investment-grade bond in human history.

- You would lose over half your money if the Austrian 100-year yield “skyrockets” to the nose-bleed interest rate of 1.7%. What would cause that to happen? An economic recovery.

- So, yes the bond market is at risk of blowing up should Europe’s economy recover. That said, Germany all but admitted they are in recession which is why they are considering pump priming fiscal stimulus.

Bond Market Blow-Up

Clearly, no one intends to hold a 30-year negative-yield bond to maturity. Losses will be both steep and sudden should yields rise.

At some point the bond market is guaranteed to blow up. Timing the point is difficult.

Traders have been betting against Japan for two decades, incorrectly.

Negative Yield Madness

The 10-year Swiss bond yield of negative 1% implies it is better to have 90 cents ten years from now than a dollar today.

That is logically impossible. It would never happen in the real world without central bank intervention.

Yield vs Storage Costs

It's important to distinguish between yield and storage costs.

One would expect to pay a small nominal storage costs for gold.

But if one lent gold, as opposed to placing it in a bank for safekeeping, the yield would never be negative or zero.

Lending Gold

Historically, banks collapsed when they lent more gold than they had rights to do so.

Lending gold that is supposedly available on demand is fraud. Gold cannot be available on demand if it is lent. The same applies to checking accounts whose money is also supposedly available on demand.

The bottom line is fractional reserve lending is a fraud. This is why I support a 100% gold-backed dollar.

Making Sense of the Madness

- Those buying 100-year bonds are betting there will not be an economic recovery.

- Those buying negative-yield bonds are speculating that yields will go even further negative.

Even though we can rationalize purchasing negative-yield bonds, the fact remains that negative yields are logically impossible and can only occur with central bank intervention and outright monetary fraud.

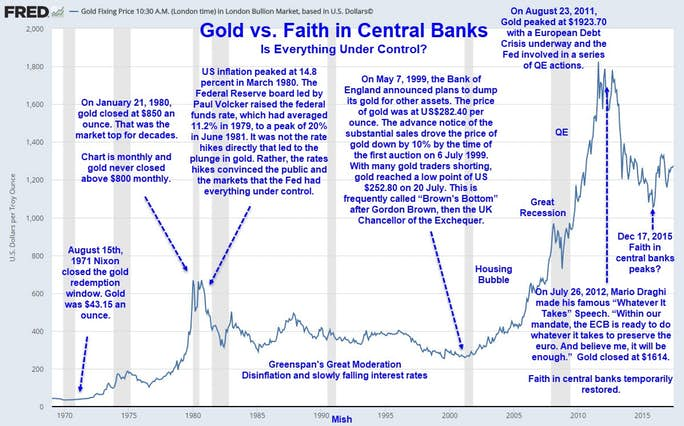

Gold vs Faith in Central Banks

What Gold is and Isn't

In addition to being money, gold is primarily a hedge against central bank sponsored monetary madness.

If you believe central banks have everything under control, don't buy gold.

However, negative yield bonds are proof of monetary madness.

Everything Under Control?

- "Zero Has No Meaning" Says Greenspan: I Disagree, So Does Gold

- 30-Year Long Bond Yield Crashes Through 2% Mark to Record Low 1.98%

- More Currency Wars: Swiss Central Bank Poised to Cut Interest Rate to -1.0%

- Inverted Negative Yields in Germany and Negative Rate Mortgages.

- Fed Trapped in a Rate-Cutting Box: It's the Debt Stupid

If you believe monetary madness, negative interest rates, and negative rate mortgages prove central banks do not have things under control, then you know what to do.

Buy gold, but please understand what gold is and isn't.

Gold is Not an Inflation Hedge

In contrast to popular belief, Gold is Not a Function of the US Dollar Nor is Gold an Inflation Hedge in any meaningful sense with one exception (sustained high inflation including hyperinflation).

Gold has historically been money for thousands of years. Governments and central banks have not changed that fact.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.