Market Overview

After more data to reinforce concerns of a proliferating global economic slowdown, there is a stunted feel to major markets this morning. The stagnation of the Eurozone economy continues to be laid out as the forward looking PMIs suggest the malaise of the manufacturing sector is now filtering into services. Subsequently, with anticipation that the meeting between the US and China on trade (penciled in for the second week of October) will end in stalemate once more, there is a gradual flow back towards some of the more risk averse asset choices. Further evidence of this slowdown could come through the German Ifo data today. Reaction to US consumer confidence will also be key. Major markets are in cautious consolidation this morning, but there is a trend that has begun to develop in recent sessions. Gold is beginning to strengthen again, also the yen. If both of these start to run higher, it would be a sign that risk aversion is taking hold once more. This would also then come with renewed dollar outperformance (USD also seen as a safe haven asset). Already we see EUR/USD edging back lower again as part of this, whilst this would see the Aussie also beginning to slip again. A speech from RBA Governor Lowe will also be watched for any dovish bias given the disappointing employment data last week.

Wall Street closed almost flat on the day with S&P 500 less than -1 tick lower at 2992, whilst US futures are around +0.3% in early moves today. The Asian markets are tentatively higher with Nikkei +0.2% and Shanghai Composite +0.4%. In European indices, there is a mild gain also playing out, with FTSE futures +0.3% and DAX futures +0.2% higher. In forex there is almost no direction to speak of, however, keep an eye on GBP this morning as the UK Supreme Court decides on whether it was illegal for Prime Minister Johnson to prorogue (suspend) Parliament supposedly to restrict scrutiny over Brexit. AUD will also be a mover on RBA Governor Lowe’s speech at 1055BST. In commodities, there is a consolidation in the upside traction on gold, whilst oil is around half a percent weaker as recent consolidation continues.

There are a couple of key surveys on the economic calendar to keep an eye out for today, with the German Ifo and US Consumer Confidence both key. The German Ifo Business Climate for September is at 0900BST, with the consensus expected to see a slight improvement to 94.4 (from 94.3 in August). This would be driven by a slight deterioration in the Ifo Current Conditions to 97.0 (down from 97.3 in August) whilst the Ifo Expectations component is expected to improve slightly to 91.8 (from 91.3 in August). The UK Public Borrowing requirement is at 0930BST and is expected to see borrowing of +£6.0bn in August ( after +£5.9bn of borrowing in the equivalent month last year. The S&P Case Shiller House Price Index is expected to show a slight improvement to +2.2% in July (up from +2.1% in June). The Conference Board’s Consumer Confidence reading is the other key data point of the day at 1500BST and is expected to show confidence slipping back to 133.5 in September (from 135.1 in August) although this would still be above where it has been for much of 2019. The Richmond Fed Composite Index is at 1500BST and is expected to improve marginally to +2 in September (from +1 in August).

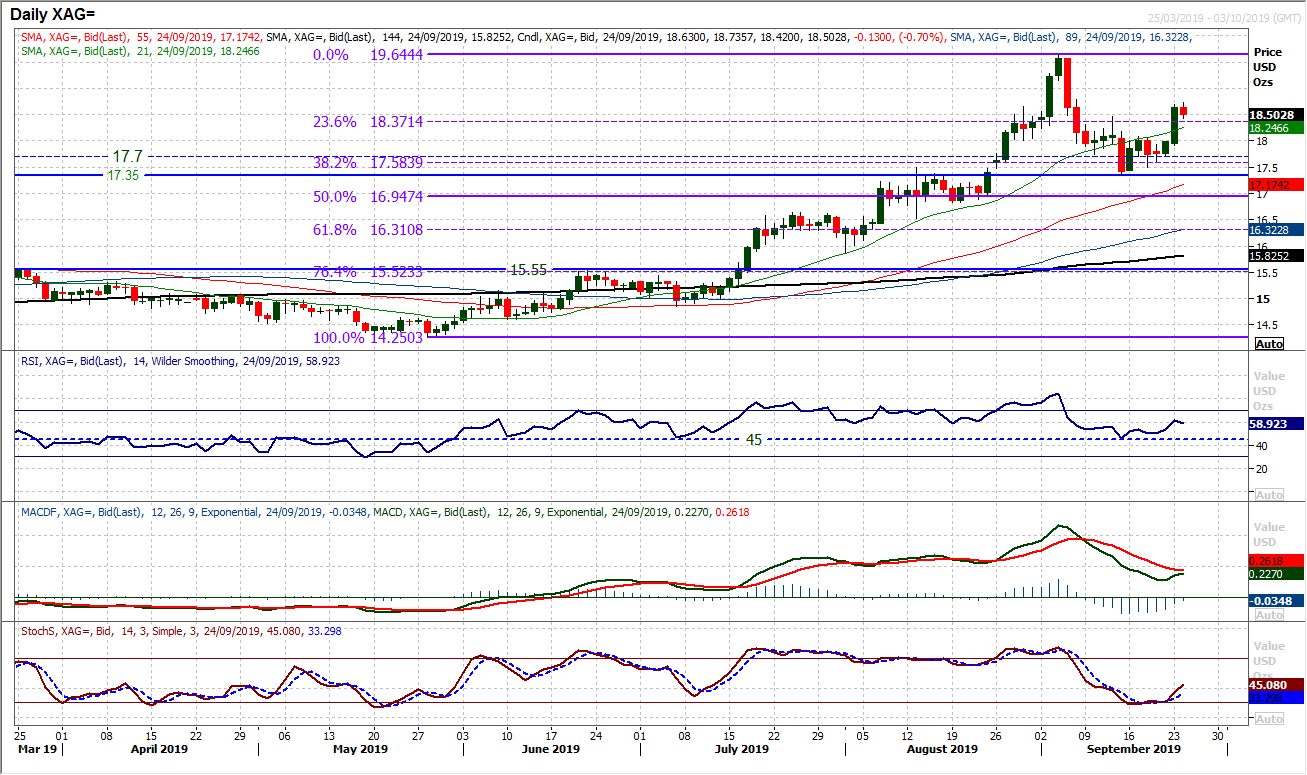

Chart of the Day – Silver

After a couple of weeks of consolidation it is interesting to see the precious metals making a move higher again. This is being led by the upside break on Silver. A decisive bull candle has added +3.6% and pulled silver to a two week high. Having broken a 10 week uptrend during the consolidation back to breakout support at $17.35, this strong bull candle has broken a corrective run. It also now means the bulls are the dominant force. Momentum is confirming the move, with a similar upside break on RSI (now strong around 60) having held the 45 level again. MACD lines are looking to turn up above neutral, whilst the bull cross on Stochastics is also an important improvement. The move through yesterday’s session looks to have been a real sign of renewed buying pressure resuming and that corrections should be used as a chance to buy. There is a band of initial support $18.20/$18.30 whilst the hourly chart shows a breakout band $18.00/$18.10. The move on the RSI has further upside potential. And if the bulls can defend against any sizeable intraday retracements today, they can continue to look higher again. Beyond this morning’s high of $18.74, there is little resistance until $19.65.

EUR/USD

With the downtrend channel once more re-asserting itself, the market is beginning to edge lower again. After a period of consolidation in recent weeks, the past few sessions have seen the sellers starting to gain the upper hand again. Old levels of key support at first $1.1100 and now $1.1025 are acting as a basis of resistance. Yesterday’s negative candlestick with a close under $1.1000 (a two and a half week low) has re-opened the key support at $1.0925 once more. Momentum indicators have retained their medium term negative configuration and have once more begun to swing lower with renewed downside potential. Another bear candle today would bring the RSI into the 30s, whilst Stochastics are already in decline and if this were to be joined by a sell signal on MACD it would be a real indication of selling into strength once more. The channel resistance is at $1.1075 with resistance heavy at $1.1075/$1.1110. Initial support of yesterday’s low at $1.0965.

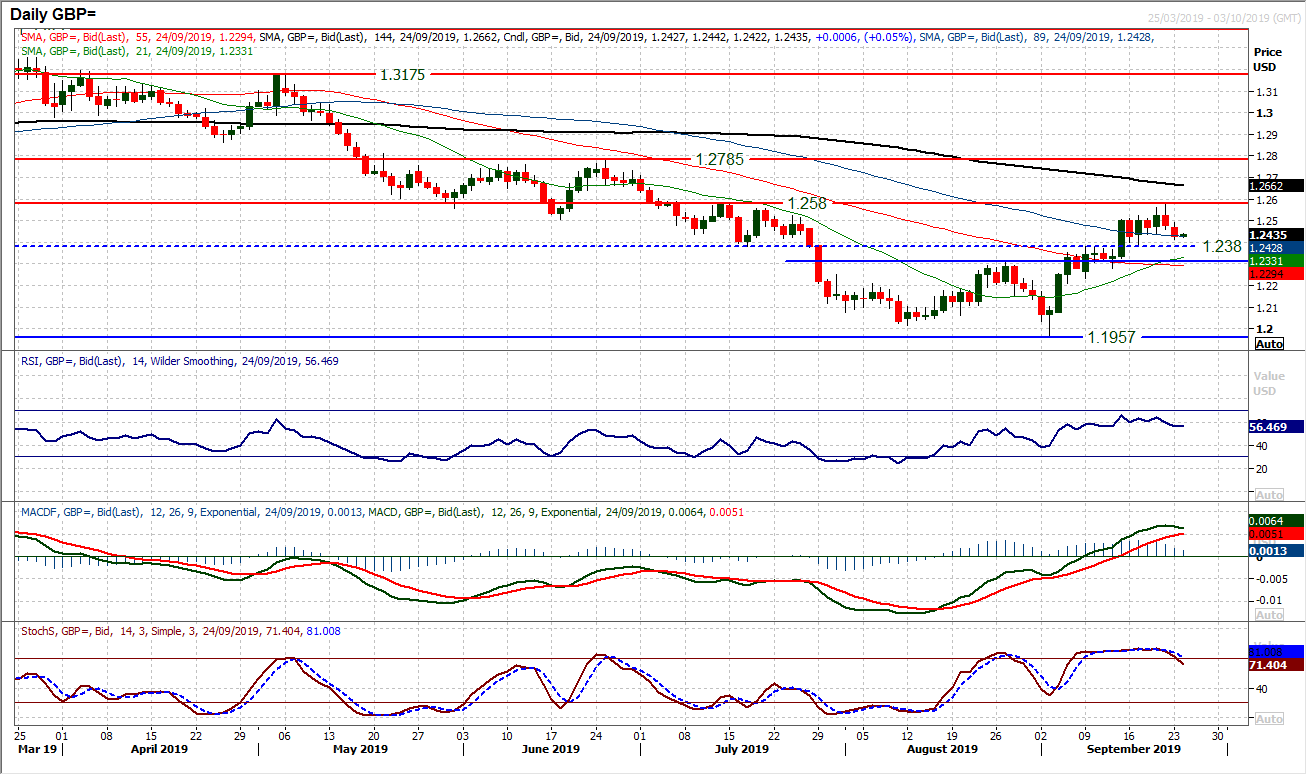

GBP/USD

The sterling bulls have just lost their way slightly in the past couple of sessions. Two bear candles with negative closes have broken the sharp uptrend and the run higher has lost impetus. However, the breakout above $1.2380 is still intact and as yet there is nothing too negatively configured on Cable. However, the cross lower on Stochastics is the first warning. If this were to also be accompanied by a bear cross on MACD and RSI decisively below 50, then this would be something to be far more concerned with. The hourly chart suggests that this is more of a consolidation of the past week (for now). Losing support at $1.2380 would be a blow, but the bulls are in control above $1.2305. Expect volatility on Cable this morning with today’s UK Supreme Court ruling.

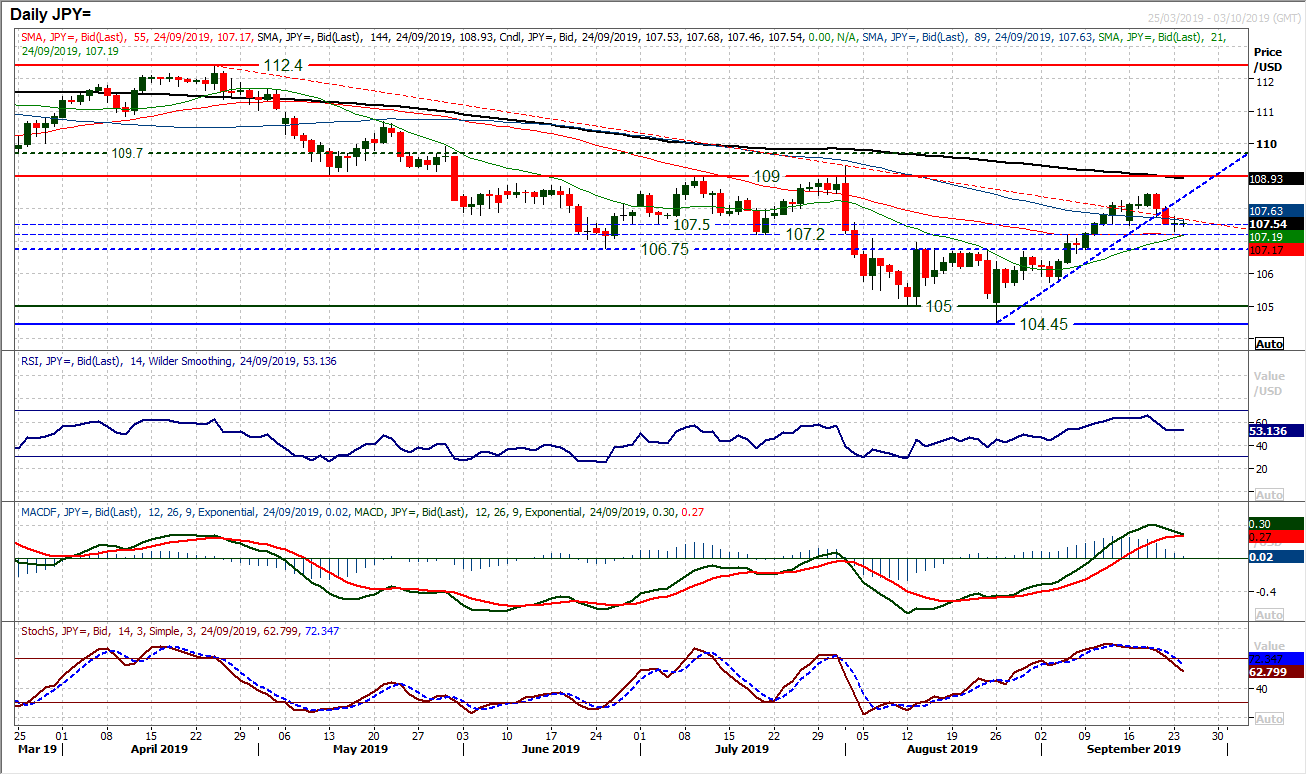

USD/JPY

We continue to focus on the importance of initially the pivot band 106.75/107.50 but more specifically at the moment, support at 107.50. An intraday breach is a warning, but holding the level into the close for a second successive session is an encouraging sign. However, this is a very important moment for the pair, as the recovery is certainly being tested. Breaching the breakout support at 107.50 is a growing concern and means that the previous breakout supports at 107.20 and 106.75 become increasingly important. Given that the market has had a couple of looks at 107.50, suggests this is a level which is growing in importance, especially on a closing basis. Momentum indicators are also on the brink. The Stochastics (the most sensitive of the three we look at) are posting a confirmed sell signal. If this sees multiple confirmation of a MACD bear cross (which is close) and RSI decisively below 50 (also close) then pressure on the key support at 106.75 would be likely. For now, given the importance of this pivot band 106.75/107.50, it would be a wait and see position. The importance of the resistance at 108.45 (last week’s high) is also growing now, with initial resistance at 107.75.

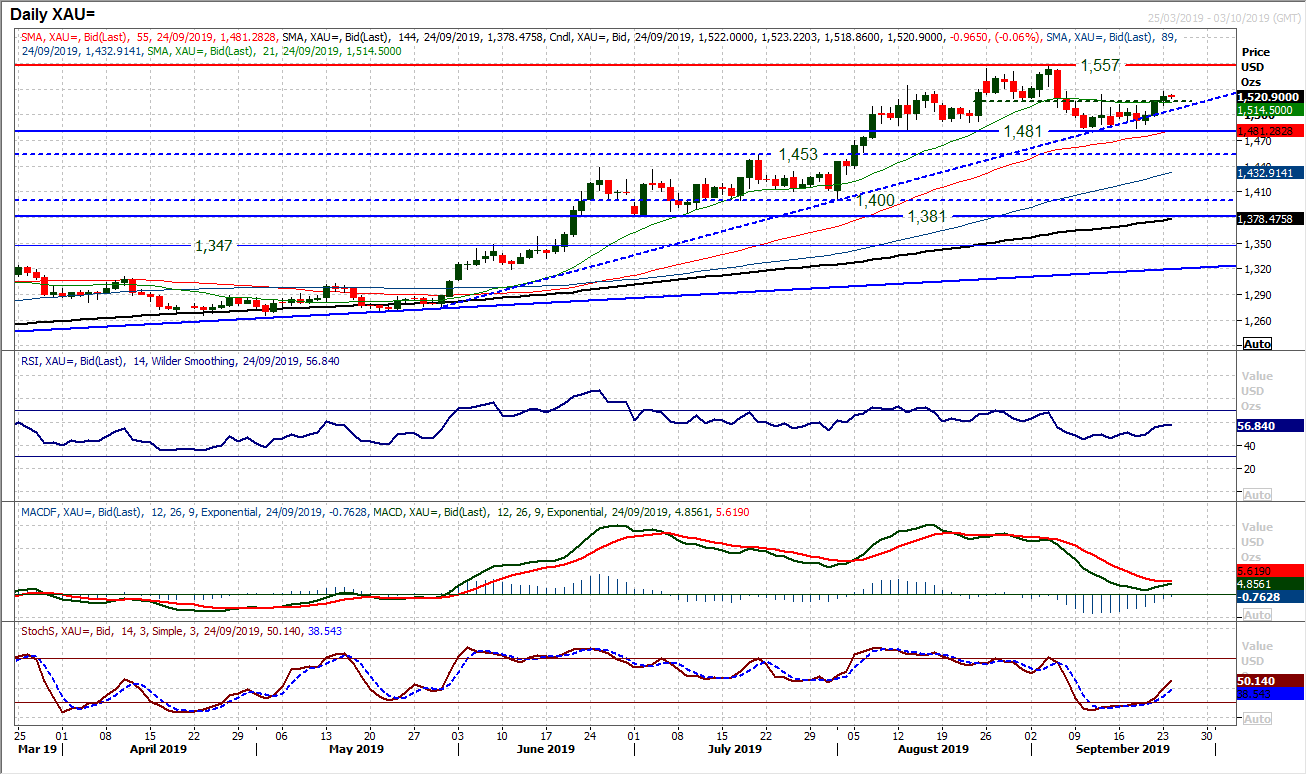

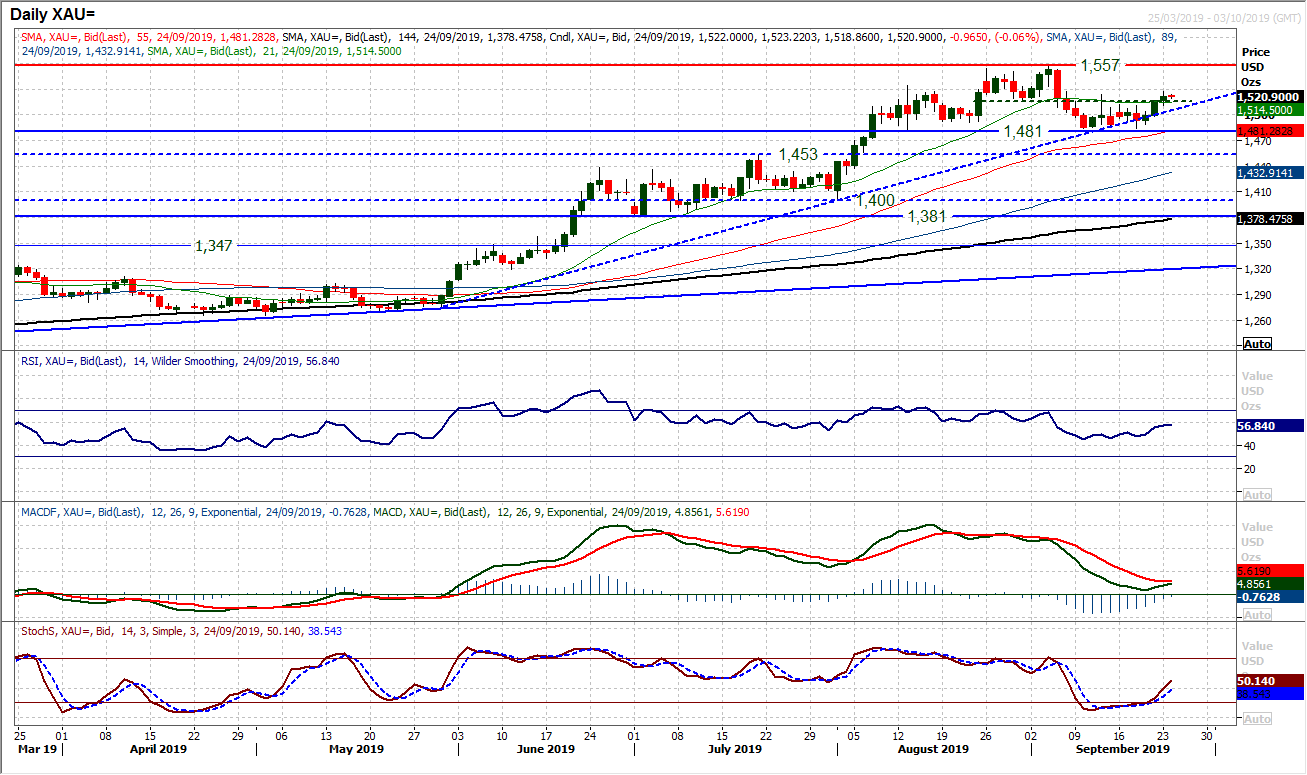

Gold

The bulls are gaining in strength once move. A decisive closing breakout above not only the old low at $1517, along with an intraday breakout to a two week high (above $1523) is looking to set the bulls free once more. This comes with an acceleration higher on momentum indicators. The Stochastics are confirming a buy signal, MACD lines threatening a bull cross and RSI decisively above 50. The hourly chart shows the market edging towards a more positive configuration but without quite breaking the shackles yet. It is interesting to see old near term breakouts and pivots becoming supportive too, with $1511 initially yesterday, and latterly $1517. Initial resistance is at $1527 from yesterday’s high, but realistically a market that pushes through this resistance, especially on a closing basis would suggest bull traction returning. A retest of the multi-year high of $1557 would then begin to open up. We are on the brink of turning bullish on gold, just needing that confirmation that the market is breaking out.

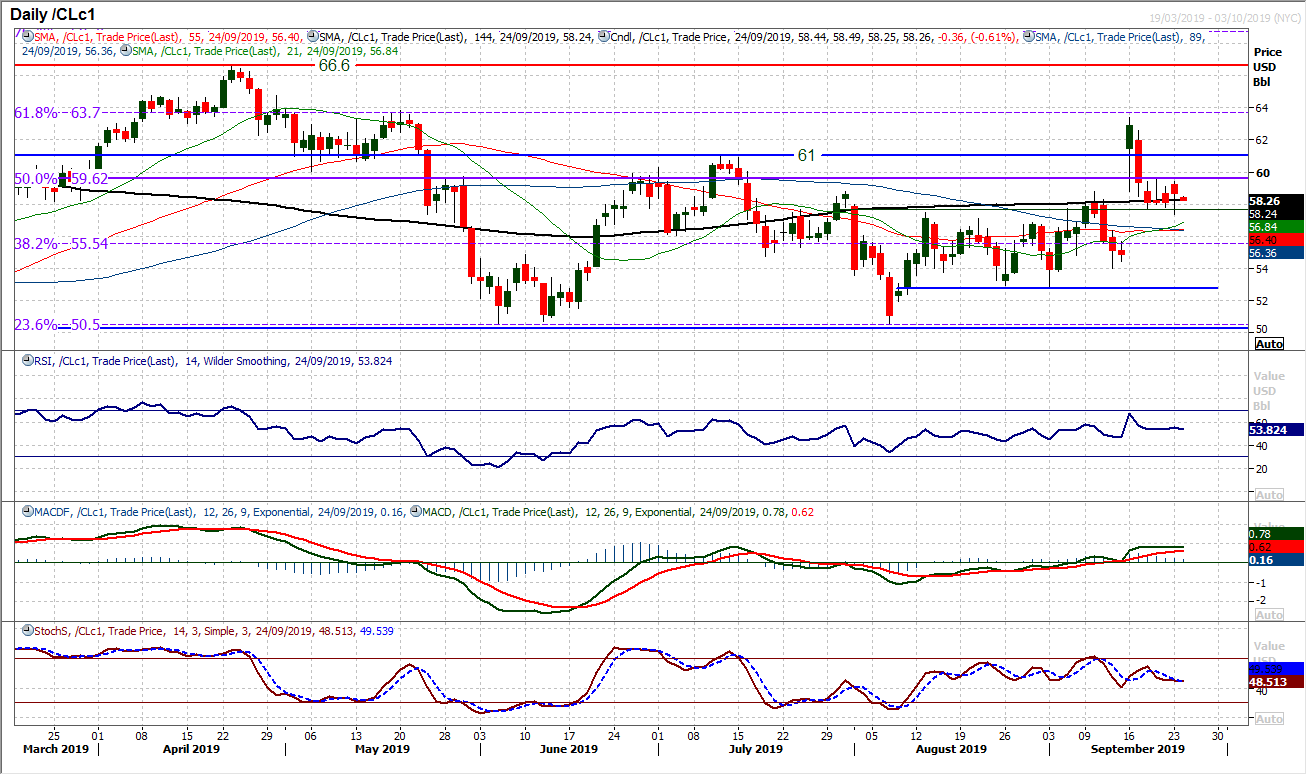

WTI Oil

WTI is an intriguing chart right now. The huge spike higher has seen a degree of retracement, but not entirely. There is clearly still a degree of risk premium priced in from the Saudi oil refinery attacks, but the bulls are not managing any sustainable positive traction. Each of the past five completed candlesticks has had either a bearish configuration or disappointing close. Yesterday’s candle fairly well sums up the current mood. A positive close on the day, but well off the day high and a session to leave the bulls disappointed. Momentum indicators are very much reflecting the consolidation too. There is a basis of support $57.35/$57.75 holding up the market, but equally, resistance under the 50% Fibonacci retracement at $59.60. A market looking for direction.

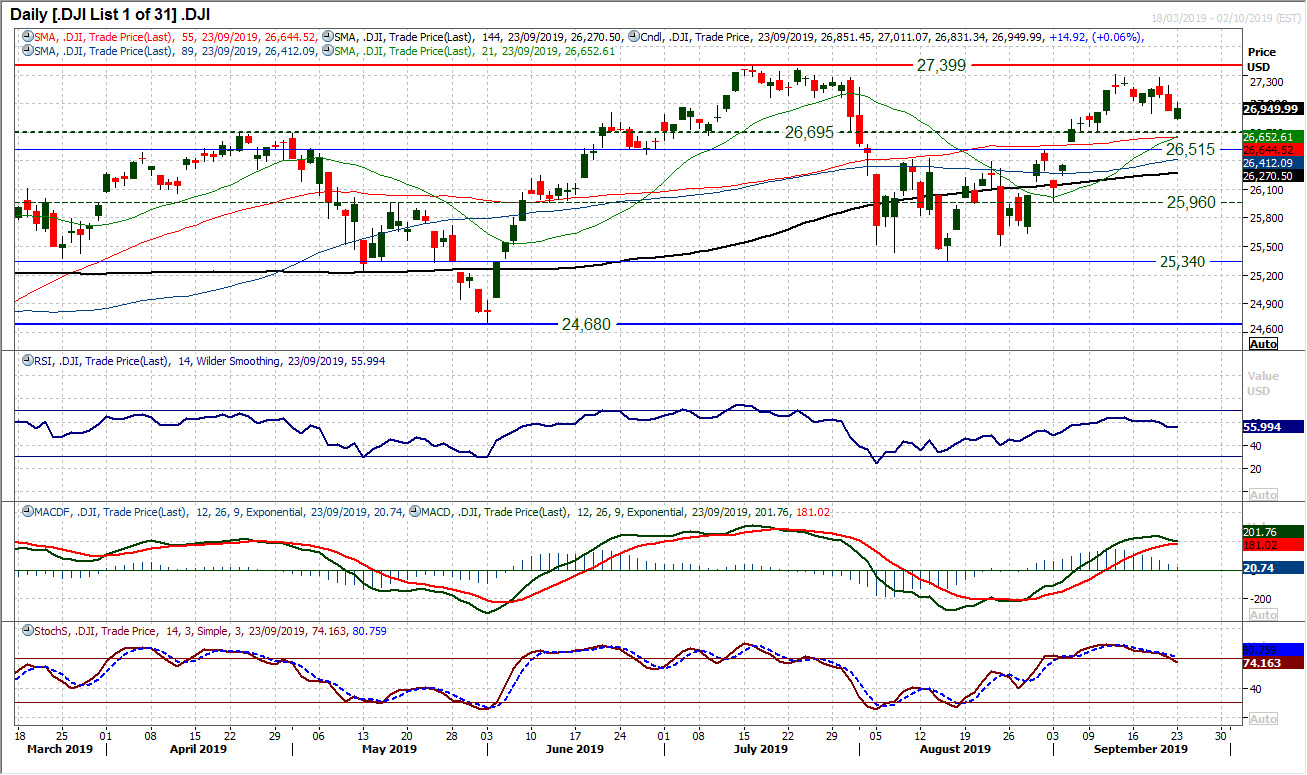

Dow Jones Industrial Average

The bulls reacted well to a shaky open to yesterday’s session, resulting in a decent looking recovery candlestick on the daily chart. However, the threat of a corrective move has not yet been eliminated, with the momentum indicators still looking precariously lose to a series of negative signals. The Stochastics (the most sensitive) will tend to be the first to trigger and is close to a confirmation of a near term profit-taking bear cross. MACD lines are also close to a bear cross, but are holding up for now, whilst the RSI is drifting a bit. The reaction of the bulls in the next session or so will be telling. With a positive candle yesterday, and futures looking for a decent open today, the will be another swing higher for the bulls. However, a failure under the 27,272 lower high from last week would begin to ask serious questions over the longevity of this multi-week recovery. Support is in place at 26,830 above the key pivot band 26,515/26,695. For now it seems that the market is settling into a consolidation band 26,830/27,307.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold clings to strong daily gains above $2,380

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.