USDCAD, H4

The U.S. housing starts report beat estimates with big January gains for starts and permits after a small December starts boost, and a smaller than expected January completions decline. U.S. housing starts climbed 9.7% to 1.326 mln in January after falling 6.9% to 1.209 mln in December (revised from 1.192 mln). The surprisingly big gains were led by multi-family units and activity in the northeast, where we possibly had some “catch up” before month-end after a cold start to January and a weak Q4 for the region, as Q4 activity was skewed toward the south and west. Meanwhile, in Canada, Manufacturing shipments released as well, presenting a fall to 0.3% in December after a revised 3.8% gain in November. The decline in shipments was contrary to expectations for a modest gain (median +0.5%). A 4.1% pull-back in petroleum and coal product shipments, alongside a 2.6% drop in food industry shipments drove the slippage in total shipment values during December. Today’s report joins the somewhat disappointing December trade figures (export volumes dipped 0.2%) and the very disappointing 88.0k plunge in January employment.

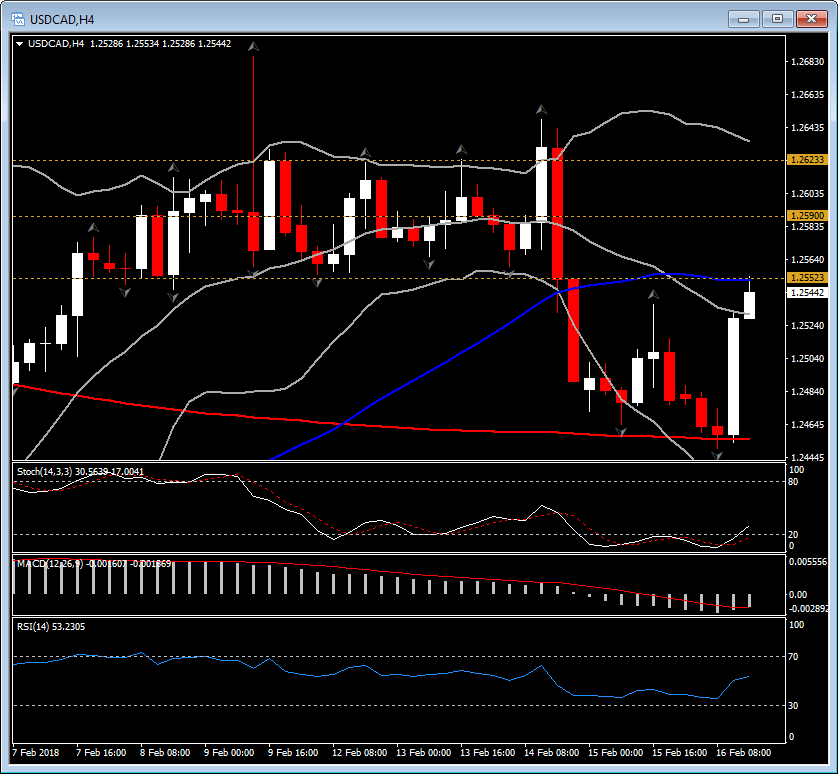

The dollar was a few ticks higher after the stronger housing starts and firmer import price data. EURUSD edged into 1.2430 N.Y. session lows, as USDJPY topped at 106.30. However, the biggest mover is the USDCAD, which perked up by nearly 50 pips, reaching the strong resistance at 50-DAY SMA, at 1.2550. Today, the pair rebounded from 1.2445 lows, broke the 20-period SMA in the 4-hour chart and it is currently moving to the upper Bollinger Bands pattern. Technical Indicators provide a mix overview of the Loonie, with MACD still negative, RSI is neutral while Stochastic sloping positively but it is still close to the oversold territory.

Nevertheless, if the pair closes today above the 1.2550 level , which was found as a strong support area for 5 consecutive day, between February 8 to February 13 , then this could suggest that bulls are gaining back the control of the pair. Therefore, the pair could retest Feburary’s highs. Next Resistance levels are at 1.2590 and 1.2625. Support comes at 1.2440.

Conversely, the pair might be seen in a consolidation mode,, since both 50 and 200 period SMA have been flattered.

Disclaimer: Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.