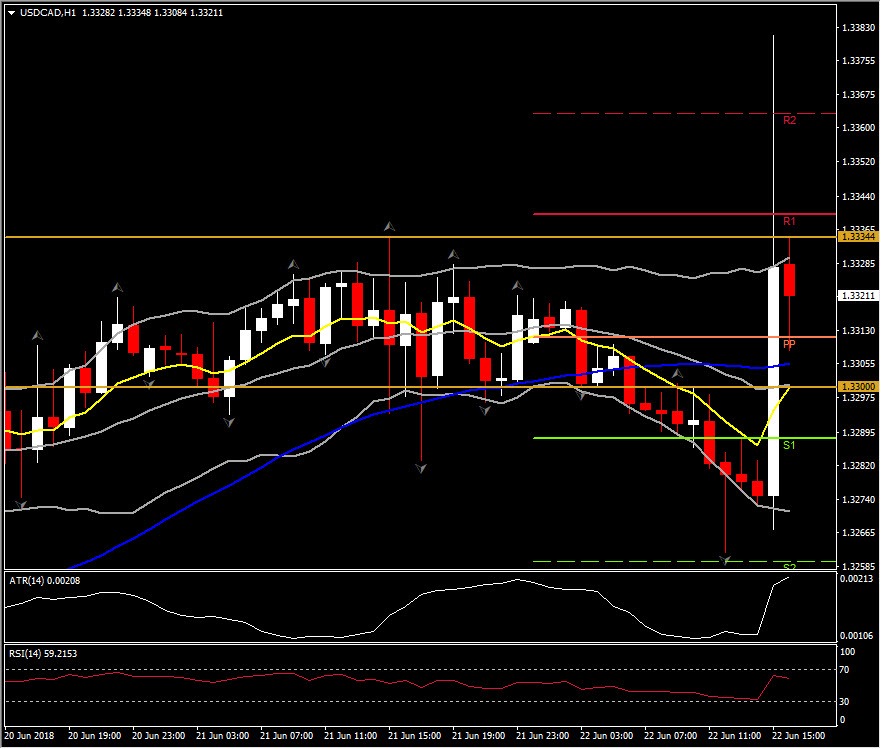

USDCAD & USOIL, H1

USDCAD spiked up to fresh 1-year highs of 1.3381 from 1.3267 on the weaker than expected data duo of CPI and Retail Sales. Canada Retail Sales plunged 1.2% in April (m/m, sa) following a revised 0.8% gain in March (was +0.6%). Meanwhile, Canada CPI grew at a 2.2% y/y pace in May, matching the 2.2% rate of increase in April to undershoot expectations for an acceleration in the annual CPI growth rate (we saw +2.5%).

While the BoC can take the CPI report in stride, with the 1.9% seen across all three core measures close to the BoC’s 2% target and the total CPI index holding above 2%, the Retail Sales report may warrant closer scrutiny given the moderation in consumption evident in the Q1 GDP. But poor April weather (Ontario saw an ice storm in mid-April) may explain much of the April Retail Sales drop, allowing the BoC to look past April Retail Sales. That being said, April GDP is going to struggle to show any growth given the 1.4% drop in retail sales volumes that joins declines in manufacturing and wholesales. The 2-year GoC swung to 1.79% from 1.85% ahead of the data, leaving a 3 bps drop where there was a 3 bps gain (relative to Thursday’s close). The S&P/TSX 60 remains firmer in pre-market action, following alongside gains on Wall Street futures.

The USDCAD retested the round 1.3400 level, after breaking yesterday’s peak at 1.3334. The pairing had been on the decline overnight on the back of firmer oil prices, bottoming at 1.3264 in London. In contrast to Canadian Dollar’s weakness, USOIL popped to 3-week highs of $67.91 from near $66.50. The rally comes as many in the market were expecting at least a 1.5 mln bpd increase in output, while OPEC agreed to increase production by 1.0 mln bpd at their meeting in Vienna.

Disclaimer: Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.