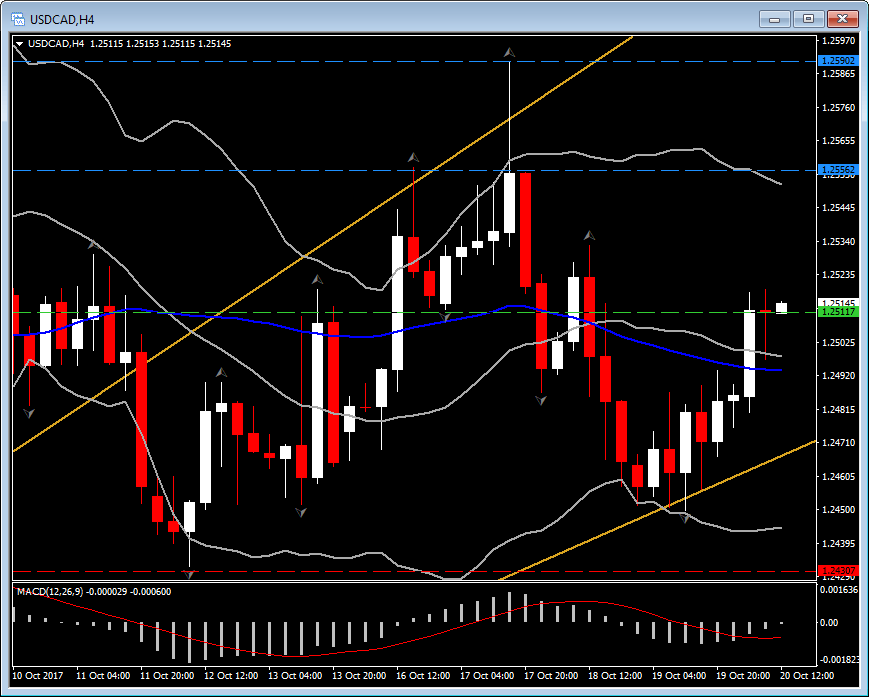

USDCAD, H4

The dollar has rallied across the board, up 0.3% versus the euro and by 0.6% against the yen, and other major crosses, following news that the U.S. Senate had passed a budget blueprint that will help push forward the Republican party’s planned $1.5 tln tax cut. USDCAD has rallied back above 1.2500 with the U.S. dollar encountering demand after the Senate passed the budget . With the Fed still seen on track to hike the Fed funds rate by 25 bp in December, and with BoC policymakers having actively dispelled any notion that it is on a committed tightening path, the overall bias expected to remain to the upside. The BoC’s quarterly business survey, released earlier in the week, showed economic activity to be remaining robust in a state of moderation following a strong performance over the summer period.

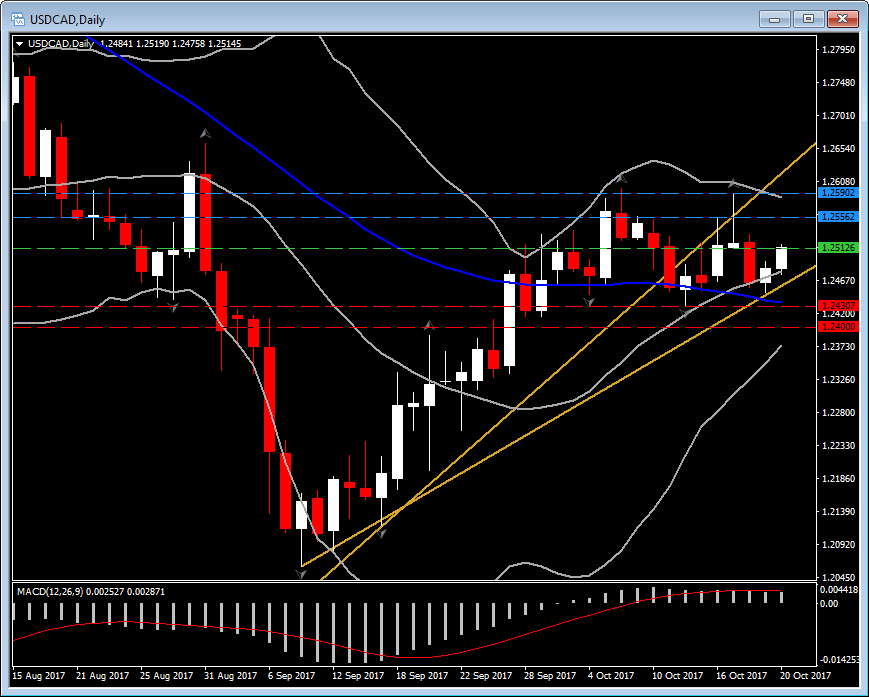

Today, USDCAD rebounded by its yesterday’s lows at 1.2450, and it is currently traded above round level at 1.2500. The break of the 1.2500 level which is also the 20-period MA in the 4-hour chart, gave an indication that upside movement is likely to continue for the day. However, the latest logged leg candle that closed above 1.2500 and closer to today’s highs, is what actually triggered our Long position in USDCAD. Hence an entry was taken at 1.2511, with support at 50-Day MA, at 1.2430. Targets were set at 1.2560 (H4) and 1.2590( Daily). Meanwhile MACD is negative in 4-hour chart, but remains positive for the whole October in a Daily time-frame.

As per my post on October 18 : “The pair is in an uptrend since early September, with a consolidation seen between 23.6 and 38.2 Fibonacci level on October and hence a Strong support level at 23.6 Fib. at 1.2425 and a more immediate support at 20-Day MA which supports the pair very well.” – this still holds, with a trend-line drawn since September satisfying even better, pair’s price movement . any break below that , will indicate a weakness down to 1.2320 long time-frame support level.

However focus is today on Canadian CPI and Retail Sales at 12:30 GMT. Canada CPI expected, to grow 0.2% in September relative to August, leaving a pick-up in the annual growth rate to 1.6% in September from 1.4% in August. Canada retail sales expected, to rise 0.5% m/m in August after the 0.4% gain in July. CPI implies a boost on retail sales values from modestly rising prices. Retail sales volumes expanded in every month from January to June of this year before dipping 0.2% in July.

Disclaimer: Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.