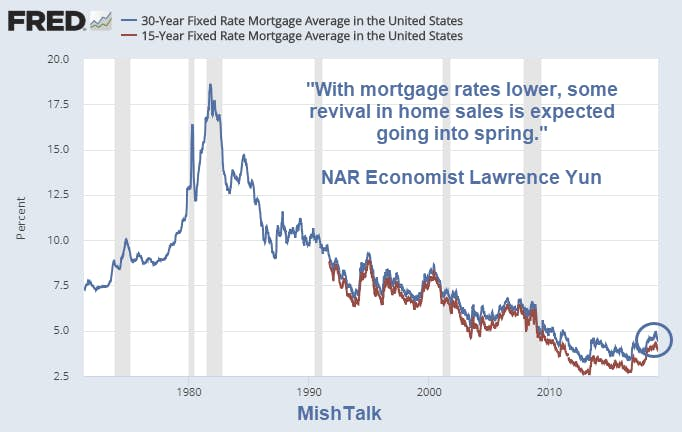

NAR Chief Economist Lawrence Yun predicts a housing revival this Spring.

Commenting on the Renewed Plunge in Existing Home Sales, NAR economist Lawrence Yun Blames Mortgage Rates.

"The housing market is obviously very sensitive to mortgage rates. Softer sales in December reflected consumer search processes and contract signing activity in previous months when mortgage rates were higher than today. Now, with mortgage rates lower, some revival in home sales is expected going into spring."

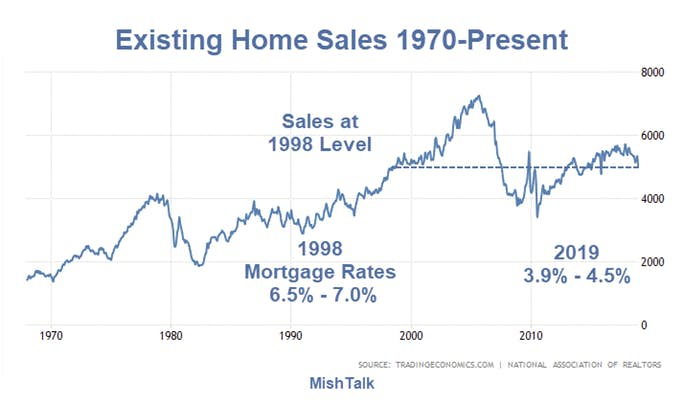

Existing Home Sales 1970-Present

Existing home sales are about where they were in 1998 when mortgage rates were generally in the 6.5% to 7.5%. Today, 30-year fixed rates are under 4%.

Population-adjusted, these sales numbers are a disaster. Clearly mortgage rates are not the overriding factor.

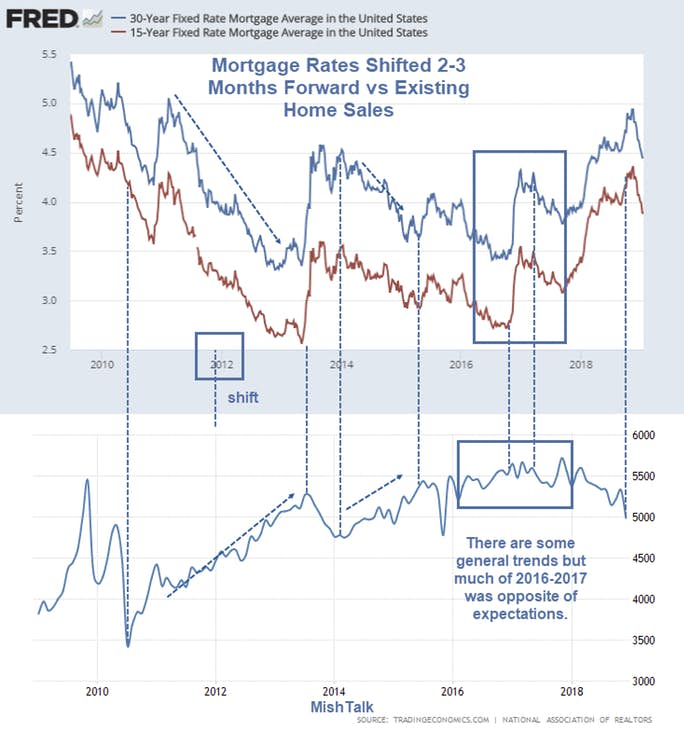

Mortgage Rates Shifted 2-3 Months Forward vs Existing Home Sales

Existing home sales are recorded at signing. The purchase offer is typically 1-3 months prior.

Yun blames December weakness on "contract signing activity in previous months when mortgage rates were higher than today."

In the above chart I shifted mortgage rates forward approximately 2-3 months forward so the sales more accurately reflect the interest rates at signing.

There are some long-term trends that hold, but there is no magnitude or scale that directly ties the two together.

2013 vs 2016

A decent spike in mortgage rates in 2013 correlates with a decent drop in sales. A similar spike in 2016 did nothing.

Mortgage Rates a Small Factor

Mortgage rates are a factor, but clearly not the most important one. Affordability, jobs, sentiment towards buying a home count more than mortgage rates.

If that were not the case, existing home sales would not be at the 1998 sales level with allegedly millions more people wanting a home.

Wage Growth

Wage growth has been anemic. Home prices have risen far more than wage growth. That's what matters the most.

Shrinking Pool of Eligible Buyers

Each person who buys a home who can afford one, takes one person out of the pool of eligible buyers.

As long as home prices rise more than wages, the pool of eligible buyers shrinks.

Desire

Eligibility is not the only constraint. Desire is another. Millenials do not have the same attitudes towards assets, homes, cars, etc., as their parents.

Many live with their parents, taking care of them. Many are trapped by student loans.

Many saw their parents or friends' parents lose their homes in the financial crisis and do not want to be in the same position.

Enormous Headwinds

Finally, it's pretty clear the global economy is slowing. The US will not be immune.

Perhaps there is a short-term bounce, but perhaps we just saw it. The housing headwinds are enormous.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

AUD/USD holds hot Australian CPI-led gains above 0.6500

AUD/USD consolidates hot Australian CPI data-led strong gains above 0.6500 in early Europe on Wednesday. The Australian CPI rose 1% in QoQ in Q1 against the 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY sticks to 34-year high near 154.90 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US macro data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.