In a surprise beat on the estimates, New Zealand's first quarter inflation rate nudged higher, rising 1.0% in the quarter, sending the inflation rate to 2.2%. It was the highest in more than 5-years as inflation edged back into the RBNZ's target range. The NZDUSD posted strong gains, rising 0.43% at the time of writing, trading near intraday highs of 0.7033.

Elsewhere, the British pound managed to hold on its gains from earlier in the week. The UK parliament approved Mrs. May's calls for early elections by an overwhelming majority setting the stage for a June election. The Eurostat confirmed that inflation eased in the Eurozone yesterday, rising 1.5% on the headline and 0.7% on the core as per the preliminary report.

Lack of any clear catalysts during the day saw most of the currencies trading on local cues. Looking ahead, the economic calendar today is void of any major news events. U.S. Treasury Secretary Steven Mnuchin is expected to speak later today while on the data front, the weekly jobless claims and the Philly Fed manufacturing index will be released.

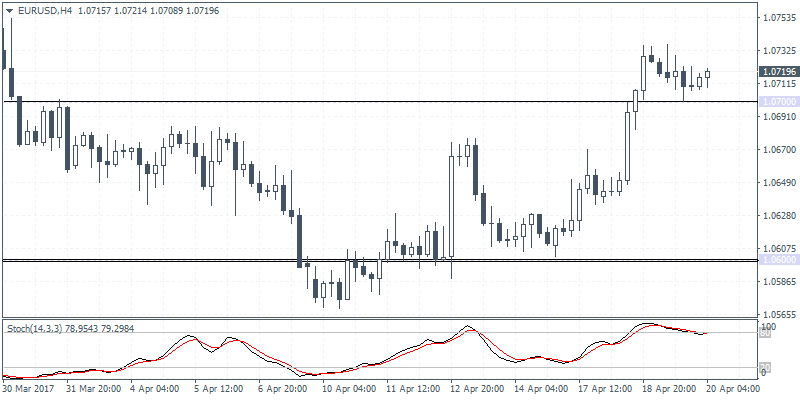

EURUSD intra-day analysis

EURUSD (1.0719): After EURUSD rose to a one-month higher yesterday; prices retreated pulling back from the highs of 1.0736 to close on a bearish note. With prices above 1.0700, there is strong indication that EURUSD could remain consolidated above 1.0700 in the near term. The bias remains to the upside above 1.0700, targeting 1.0800 resistance level. However, this could change in the event of a breakdown below the support at 1.0700. We could expect to see a decline towards the lower support at 1.0600.

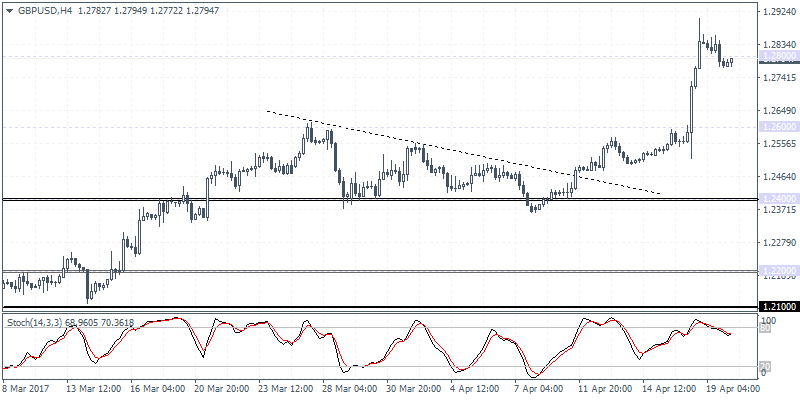

GBPUSD intra-day analysis

GBPUSD (1.2794): GBPUSD maintained some of the gains from the day before, but prices were seen consolidating after rallying to 1.2800 level. As mentioned in yesterday's daily report, we can expect to see GBPUSD slide back towards 1.2600 in the short term where support is most likely to be established. This level also marks the top of the descending triangle pattern from which we saw an upside breakout in prices. Establishing support at 1.2600 will signal a continuation to the upside in GBPUSD as a result.

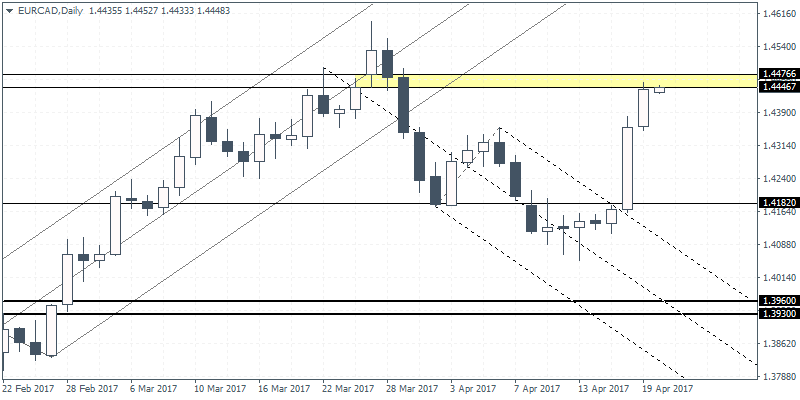

EURCAD daily analysis

EURCAD (1.4448): EURCAD posted strong gains in the past two days which saw prices rallying back to test the resistance level at 1.4450. If a lower high is formed here, relative to the previous highs formed near 1.4547, we can expect to see some downside in prices. The support at 1.3960 remains the downside target in EURCAD which is most likely to be tested if we get to see a reversal candlestick pattern in EURCAD and a breakdown below the minor support at 1.4182. Tomorrow's inflation data from Canada is likely to be the catalyst for the downside bias in EURCAD.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.