The Japanese Yen was down against its global peers after an interview by Bank of Japan Governor, Hurohiko Kuroda. In the interview, he said that officials were concerned with the low inflation rate, which could delay the normalization process. Early this year, he had predicted that the bank would start winding up the stimulus package in April next year. The yen was also pulled down by the manufacturing PMI number that missed analysts’ forecast. The number showed that the PMI was at 53.3 which was higher than last month’s 53.1 but lower than analysts’ forecast of 53.4.

The yen was also weighed down by reports that North Korea was ready to end all nuclear test programs. The yen is viewed by investors as a safe haven. This is partly because of the huge US treasuries Japan has accumulated over the years. Today, Japan holds more than $4 trillion of US debt. On Friday, BOJ will release the interest rate decision and a formal statement on the decision.

The dollar was higher after the Wall Street Journal reported that Treasury Secretary, Steve Mnuchin was planning a trip to China. During the trip, he will meet with the country’s leaders including President, Xi Jinping. The trip is intended to help ease trade tensions between the two countries. The US will ask China to open up its market by removing the barriers that exist for American companies and products.

The euro was little moved against the UK pound, but lower against the US dollar after Germany released the manufacturing PMI numbers. The data showed the PMI at 58.1. This was lower than last month’s 58.2 but higher than what analysts were expecting. Traders are expecting a PMI of 57.6. Traders are also looking forward to a series of talks between European leaders with US leaders. Emmanuel Macron will arrive in Washington today while Angela Merkel of Germany will arrive on Friday.

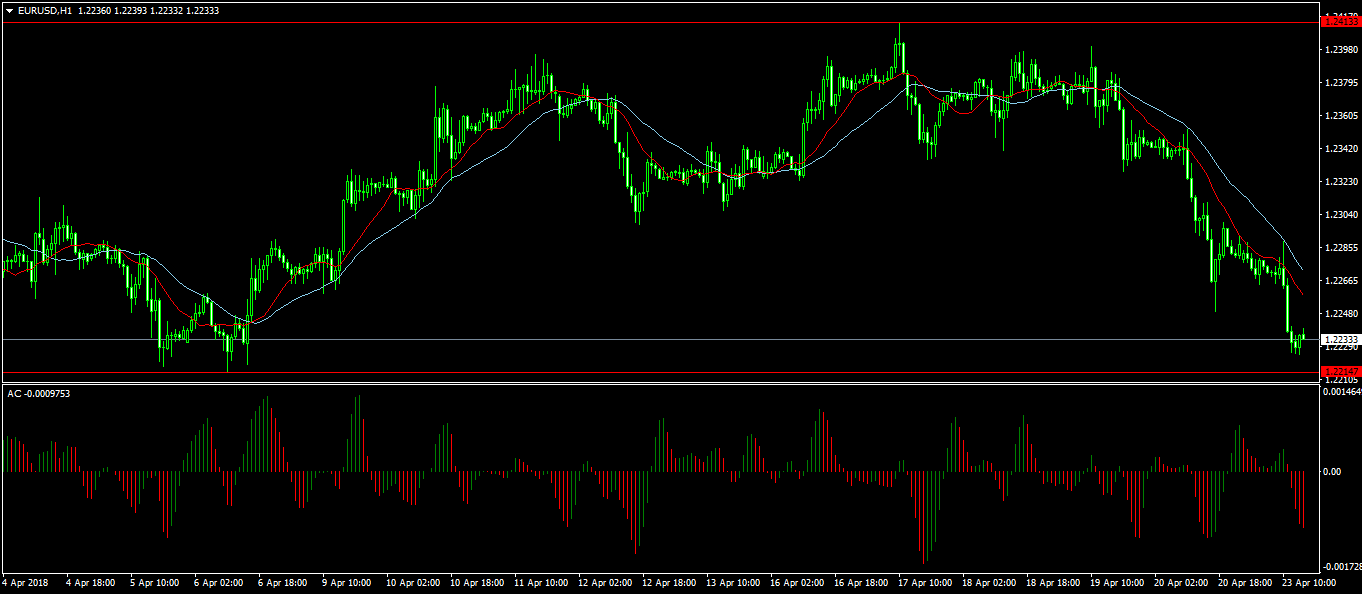

The EUR/USD pair started the month by rising from a low of 1.2210. It then rose to a monthly high of 1.2413. In the past few days, the pair has given up on the earlier gains and is closing in on the monthly low. The gains on the dollar can be attributed to the easing of tensions on trade and the hope of a deal with North Korea. The pair could continue moving lower until it reaches the monthly low.

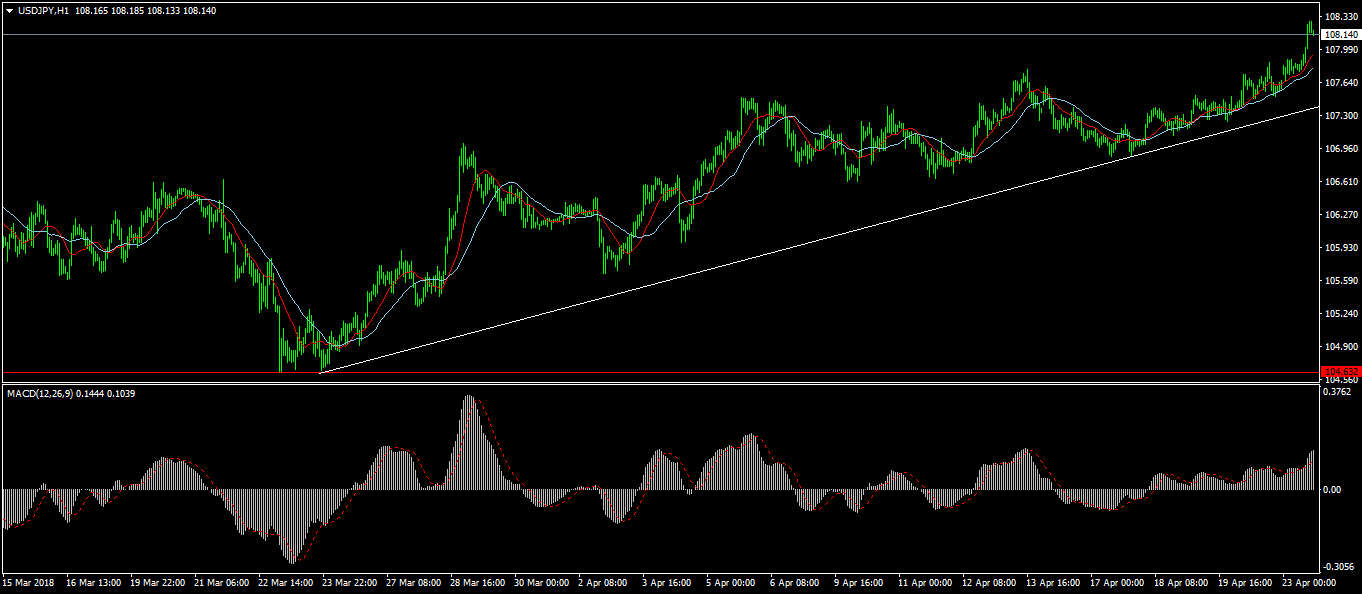

USD/JPY

The USD/JPY pair continued the rally started in late March to reach a monthly high of 108.33. Today’s rally was as a result of a dovish statement from the Bank of Japan Governor, Hurohiko Kuroda. The pair will likely be volatile this week as investors wait for the interest rate decision and the official statement from the BOJ on Friday.

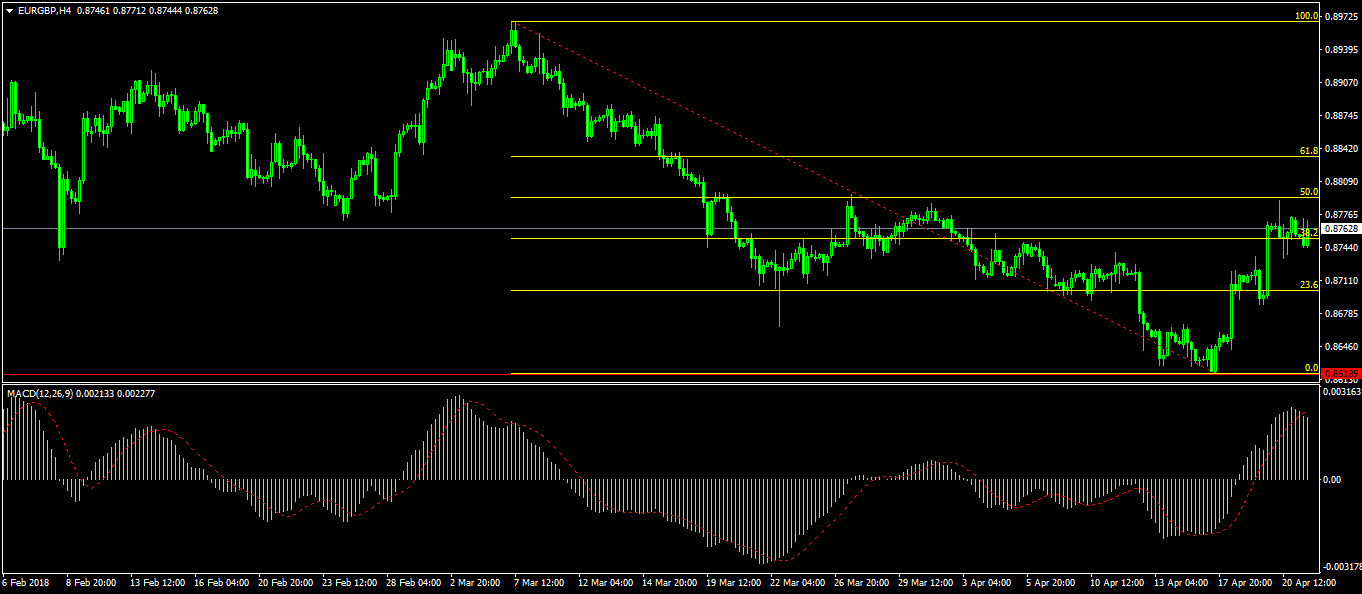

EUR/GBP

The EUR/GBP started the year by rising to a high of 0.8968. The pair then started dropping, reaching a YTD low of 0.8618 mid this month. Since then, the pair has moved significantly higher. In the past five days, it has gained by almost 2%, reaching the 50% Fibonacci Retracement level. The pair is now trading at 0.8763. There is a likelihood that the pair could test the 0.8852 level, which is the 61.8% retracement level.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.