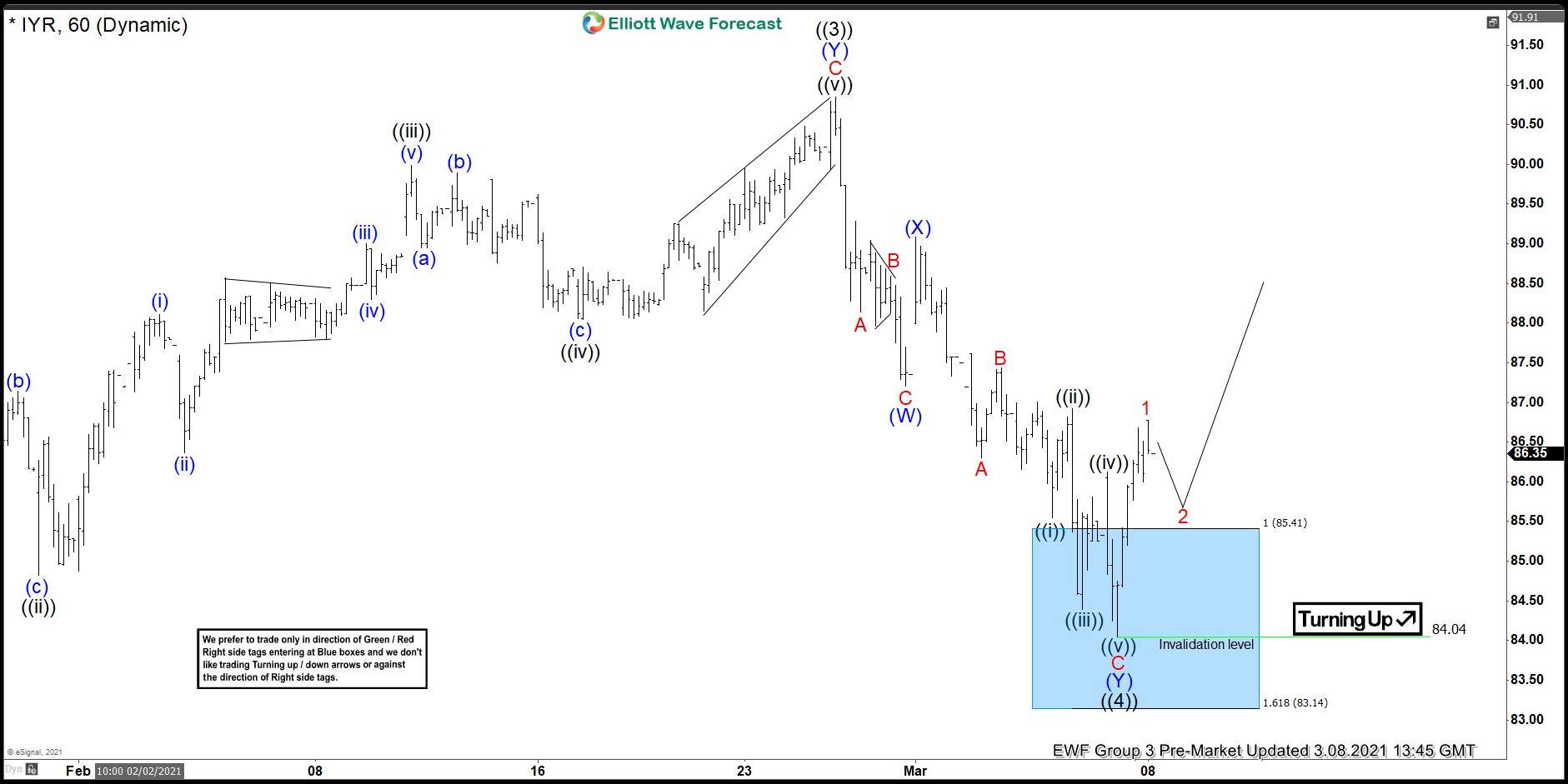

In this blog we take a look at US Real Estate ETF (IYR) reaction higher from the blue box.

The 1 hour chart below is an update from 3/8/2021.We see that IYR peaked at the 90.50 to 91.00 area and completed black wave ((3)) of an anticipated leading diagonal. Down from there, the ETF made 7 swings lower into the blue box. Subsequent to the 7 swingsdecline, IYR completed wave ((4)) at 84.04. In the 7 swings we see blue waves (W), (X), and (Y). Within both blue waves (W) and (Y), we see clear 3 swings subdivisions, which is A-B-C zig zags. Zig zag subdivisions consist of five wabes in A and C, with a correction in B. However, in the chart below, we show only internal subdivisions within red wave C of blue wave (Y) due to chart space constraints. We also see that the ETF had already started to react higher from the blue box. We therefore proposed the 84.04 level as a level of invalidation.

In the 1 hour chart below from 3/12/2021, we see further separation higher from the blue box. We anticipated this upside move from the blue box. We are able to anticipate such moves with our blue box system. All long positions from the blue box area were already running risk free. The right side remained upside. There is no reason therefore to sell IYR against it’s dominant upside trend.

Up from the blue box area, the ETF rallied in 5 swings in red wave 1. One may need to downgrade timeframe in order to see the swings in red wave 1 clearly. Naturally, we saw a correction follow in red wave 2 as per Elliot Wave nature of a motive sequence. We confirmed the next leg higher in red wave 3 once red wave 1 peak was broken. Although incomplete, we expected continuation higher in red wave 3, then 4 and 5 of bigger degree blue wave (1).

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Recommended Content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.