Evidence of Soros' Theory of Reflexivity remaining prevalent in financial markets re-emerged this week as the euro made its biggest single day advance since the Fed's announcement of QE in 2009. Simply put, the euro soared 4% due to misplaced and unfulfilled market expectations that the ECB would increase the size of its monthly asset purchases. The crowding out of euro-short algos was pivotal in the magnitude of the resulting short squeeze. But questioning the intensity of euro shorts deserves more time and attention than criticizing or doubting a central banker's decision.

Click To Enlarge

Question your Expectations, not the Central Bank Decision

Many who were “angry” at the Fed's decision to not raise rates in September –on the grounds that they got it wrong (on the grounds that they were mislead by prior Fed comments) –are the same who were critical of yesterday's ECB decision to under-deliver. I will not go into detail about how the ECB gave no reason to expect QE expansion or a bigger rate cut than 20 bps. That was the work of one or two major bank economist's forecasts, who were later followed by the rest of the pack—with a few adjustments.

My colleague Adam Button and I made it clear in several Intraday Market Thoughts and tweets that QE expansion would be difficult (or impossible) to attain at the December meeting, making way for only a rate cut and/or QE extension. Markets went too far with embracing the notion of “policy divergence”, assuming QE expansion was inevitable. Once corrected by the ECB, the result was massive. At the end of day, anyone who landed on planet euro and saw the spike in the single currency and 4% tumble in the DAX, would have expected the ECB had tapered the size of QE, or ended it completely. Not at all. It was all expectations' fault. As George Soros postulated in his version of Reflexivity Theory into economics, markets are principally driven by expectations. Once the basis of those expectations is altered (ECB's policy actions), the market corrects.

Today's Draghi Speech is no different from Yesterday's

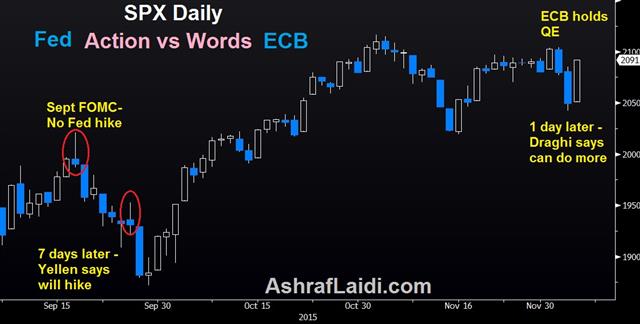

Some say expectations were fed by the central bankers themselves. Not at all (again). Today's Draghi speech in NY appears to be the main catalyst behind the 2% rally in US indices. The main reason to the rally is attributed to Draghi's statement indicating the ECB stood ready to deploy “further tools if necessary”. It may not matter that Draghi made a similar statement at yesterday's conference i.e. more measures would/could be implemented if the need arose. One day seems to be too late for traders who lost money, but not too late to make it some of it back today.

A similar situation occurred on September 24, when Fed chair Yellen made a hawkish speech seven days after giving highly dovish press conference on the day of the Fed decision to not raise rates. Markets bottomed three sessions later.

Undoubtedly, Draghi's power of words continues to hold sway. But since pulling the QE trigger in March, the timing of the words becomes as important as the words themselves. This is no longer September 2012, when “we'll do what it takes” sufficed.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.