![]()

The start of 2015 looks very familiar to the end of 2014 for many markets around the world as the USD continues to dominate the spectrum and commodity prices fall even further. Or as my colleague Matt Weller so poetically stated already this morning, “New Year, Same Result.†While the EUR/USD is grabbing a lot of the headlines this morning for reaching a 4.5 year low on the back of comments from European Central Bank President Mario Draghi, the GBP/USD is suffering even more greatly, falling over 200 pips since the high set on the last day of 2014.

While I mentioned earlier this week that the 1.56 level might be a particularly difficult to overtake due to technical resistance in that area, I must admit, I didn’t foresee such a strong selloff at that point. Particularly since the reason for the selloff appears to be more based on what the ECB is doing rather than any specific dynamics in the UK, this move may be a little overzealous. Now don’t get me wrong, the GBP isn’t doing itself any favors with Manufacturing PMI coming in lower than anticipated this morning, but not to this extreme.

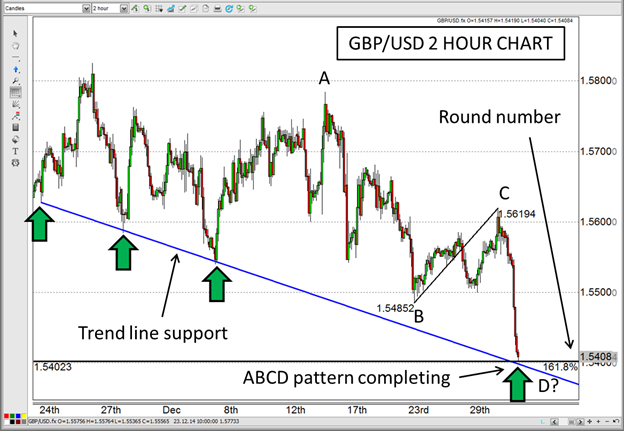

Therefore, it may be prudent to try to see if there are any levels at which it would seem logical to see a bounce in this currency pair that visually appears to be overreacting. Fortunately, there is one level in particular that fits this bill for three reasons. It is widely known that round numbers often attract attention as our logistical brains seek order in chaos, so 1.54 looks tempting simply based on that principle. In addition to that though, there is a previously established trend line that corresponds with that level along with the completion of an ABCD pattern there as well.

The culmination of those technical patterns as well as the logistic reason for support near 1.54 could give this currency pair reason enough to bounce at that level. Be warned that if you see enough evidence for support, round handles tend to get broken before they bounce. So it may be prudent to wait for the break before hopping on the bandwagon. Also, since I’ve been using movies all week as a backdrop for my articles, let’s collectively tell the GBP/USD that “You Can Do It!â€

The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase of sale of any currency. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.