![]()

Currency traders woke up to a rather unsettling headline this morning – “Yougov poll finds rapid shift in favour of Scottish Independence”. For most of the campaign the FX market has shrugged off the risks of a win for the yes vote, as the no campaign had enjoyed a healthy lead; however, with just over three weeks to go until polling day the tide is starting to shift.

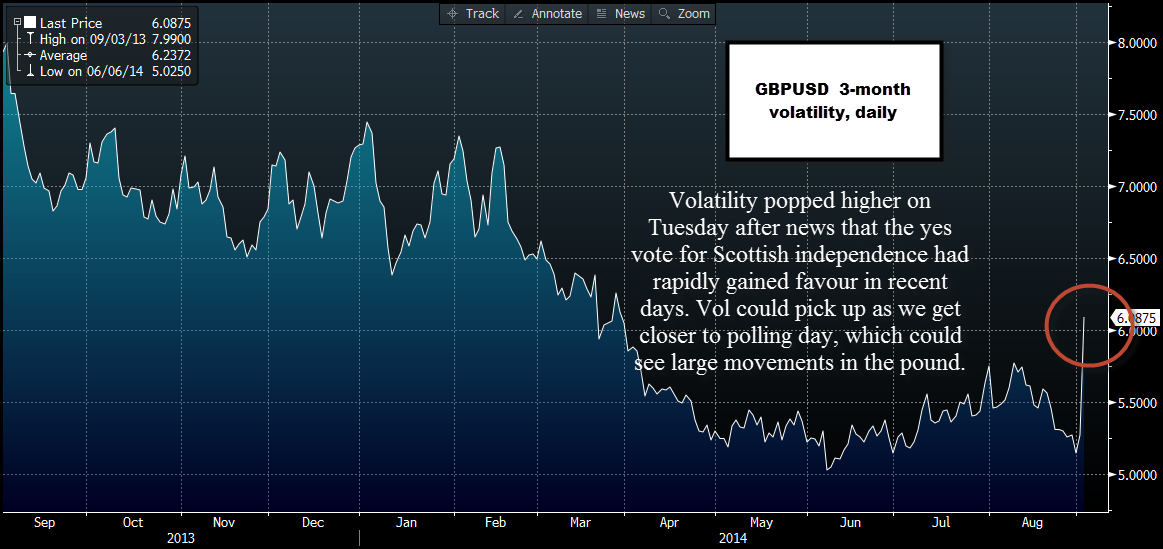

While it is hard to pinpoint exactly what the economic impact of Scottish independence would be, there still isn’t a definitive answer about whether Scotland could keep the pound; we think that the prospect of independence could boost volatility in GBP in the coming weeks. As you can see in figure one volatility has already popped in GBPUSD on the back of the Yougov poll.

Looking at history as an example:

While the UK has never experienced a referendum of this kind before, back in 1995 Canada held the Quebec referendum, which was the second referendum to ask voters in the Canadian province whether Quebec should proclaim national sovereignty and become an independent state, much like the Scottish referendum. (Quebec’s first referendum in 1980 asked voters if they should pursue the path to sovereignty).

During the Canadian referendum, the no vote had a comfortable lead until the last few weeks before polling day. There are a couple of lessons we could learn from Quebec’s experience:

A record 94% of registered people voted in Quebec, suggesting that referendums that impact national pride tend to see a large turnout, which could skew the Scottish vote at the last minute.

The result was much tighter than many had anticipated, with 49.42% voting yes to independence and 50.58% voting no.

The pre-election polls had not predicted such a tight outcome, suggesting that the result of these types of referendums can be highly uncertain.

If you ask a variety of different analysts what the Scottish referendum means for the pound and UK markets you are likely to get very different answers. Take today’s poll news, the pound is lower, while the FTSE 100 is at an 8- week high. The impact on UK–based markets could have different reactions in the both the long and the short term, here are a few potential outcomes:

- GBP falls in the short term after a yes vote, as markets ponder what this means for the UK; however in the long term GBP rallies as some think that the Britain without Scotland will lead to more Conservative governments getting elected in future, which tends to be currency positive as the Conservatives have better economic reputations.

- GBP falls in the short and long term if the UK has to cover Scotland’s portion of UK debt, this could also impact Gilts, and could make it more expensive for the UK to borrow, which would likely be pound negative.

UK stocks may fall on a yes vote, although we think any weakness will be short lived because Scotland is such a small part of the UK economy.

But, if the international community thinks that a yes vote for Scotland makes it more likely that the UK will leave the EU this could be universally bad for UK-based assets.

The lead up to the referendum:

If the yes vote manages to climb further in the polls then we could see volatility start to build in GBPUSD. Using the Canadian experience as an example, back in 1995:

In the two weeks leading up to the Quebec vote, USDCAD rallied (CAD fell) more than 3.5%.

In the few days before the vote USDCAD traded sideways.

The day after the vote saw a large reaction in the CAD, USDCAD erased previous gains and fell nearly 3%.

The Canadian stock market sold off sharply in the run-up to the referendum, however, it bounced back on voting day and the day after.

What can we infer from the Canadian experience?

The reaction tends to take place in the week or so before the referendum as nerves start to fray over what the outcome will be.

The impact of a no vote tends to be short-lived.

However, a yes vote could be a different story…

The outlook for GBPUSD:

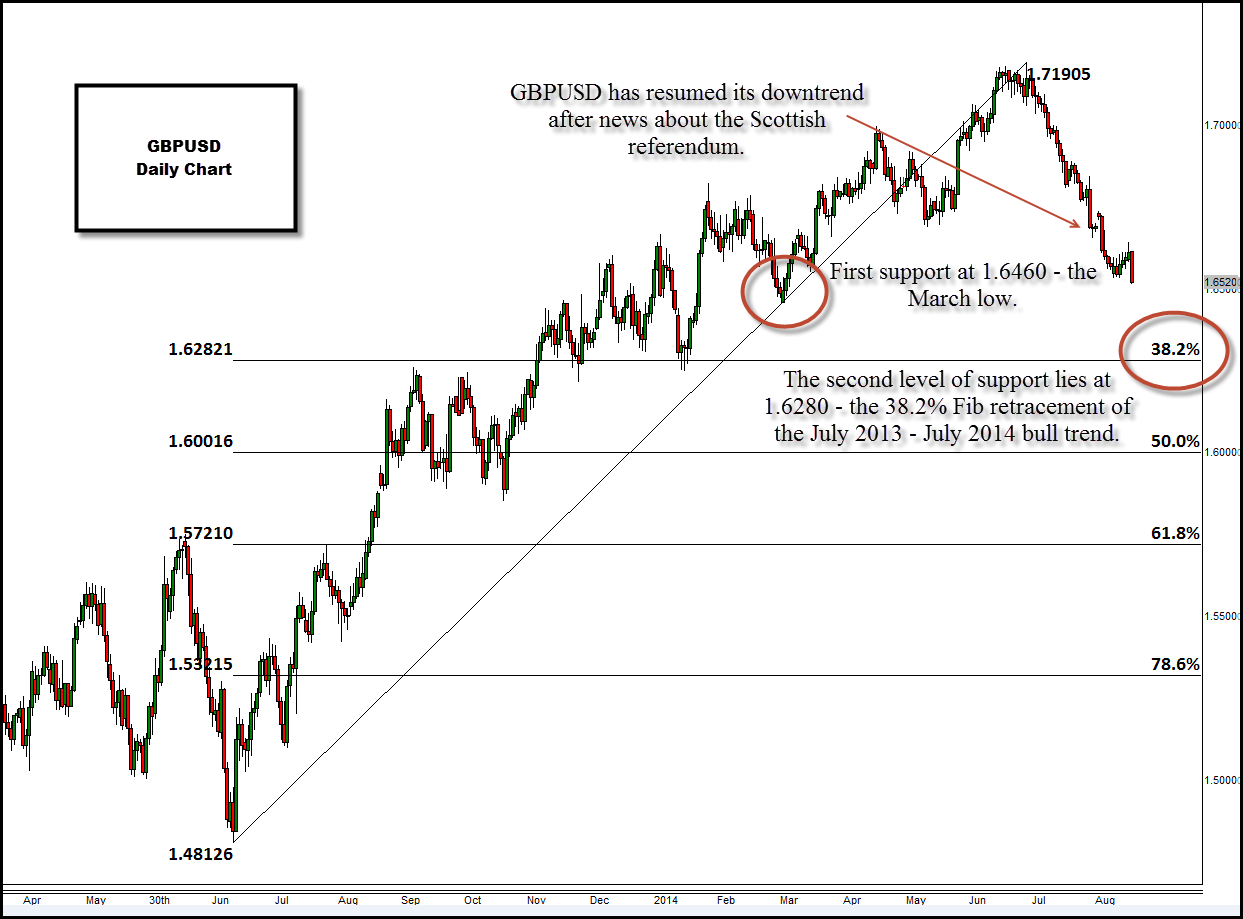

We mentioned yesterday that the rebound in the pound did not look sustainable, and it hit a wave of headline-inspired selling pressure around 1.6644 earlier today, well ahead of key resistance at 1.6765 – the 38.2% Fib retracement of the July – August decline. The resumption of the downside is now in full swing, and we look for a break of key support at 1.6460 – the low from March 24th. Below here opens the way to 1.6284 – the 38.2% Fib retracement of the July 2013 – July 2014 bull trade.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.