![]()

The US Stock Market, as measured by the S&P 500 index, has now gone nearly two full years without seeing a 10% correction, despite concerns about deflation, inflation, government shutdowns, Fed tapering, China slowing down, and unrest in Crimea, among others. With the US entering the meat of another quarterly earnings season, it’s worth revisiting the fundamental and technical drivers of the market.

Fundamentals: A Weak Start to Earnings Season

As my colleague Kathleen Brooks noted earlier this week, equity P/E ratios are slightly elevated, but far from historically dangerous levels. There are some longer-term concerns with elevated profit margins and multi-year valuation measures, but the biggest concern for shorter-term traders is the current earnings season, which is shaping up to be one of the toughest in recent memory due to inclement weather in Q1.

According to data from Factset, 66% of the 82 companies that have reported earnings thus far have beat analyst estimates for earnings and 50% have exceeded consensus revenue estimates. While these numbers may initially sound solid, they compare unfavorably with the 4-year averages of 74% for earnings and 58% for revenues. In fact, the S&P 500 is on track for its first decline in average earnings since Q3 2012. With nearly one-third of S&P500 companies (161 firms) scheduled to report earnings this coming week, traders will be keeping a close eye on whether these trends will continue.

Technicals: Leading Indices a Possible “Canary in the Coal Mine�

At first glance, the technical picture for the S&P 500 remains strong. The index is still within a rising bullish channel that dates all the way back to February of last year , and all three major moving averages (50-, 100-, and 200-day) are in consistent uptrends. Meanwhile, the RSI indicator has just found support in the key “40†zone, indicative of an overall uptrend. There was a small bearish RSI divergence near the recent highs, but the index uptrend has easily weathered similar divergences in the past.

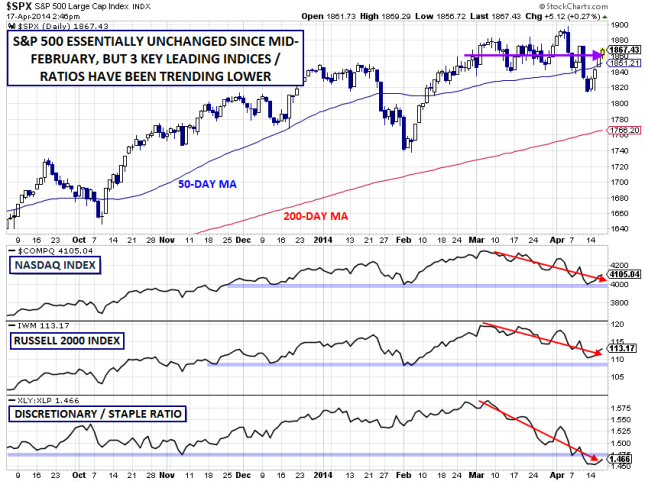

The S&P 500 is essentially unchanged since mid-February, but as I noted on twitter Wednesday, some of the other widely-followed stock market indices are waving caution flags:

For one, the NASDAQ index, which is more heavily weighted in economically-sensitive technology stocks, has actually been putting in a series of lower lows and lower highs since peaking over a month ago. Similarly, the Russell 2000 index of small-cap stocks (smaller companies) has also been trending lower for over a month. Historically, these two indices have turned before the more widely-followed S&P 500 and Dow Jones Industrial Average at major turning points in the market. If they break below their YTD lows (4000 on the NASDAQ and 108 on the IWM), the selling pressure may accelerate from here.

The final sub-chart below requires a bit more explanation. As many readers may know, the S&P 500 can be further subdivided into sectors that share common characteristics. Two of the most widely followed sectors are the consumer discretionary and consumer staples sectors, which can give insight into how consumers are behaving (or at least, how investors anticipate consumers will behave).

For example, if consumers are concerned about the economic future, they may choose to put off nonessential (“discretionaryâ€) purchases like a new TV, car, or set of golf clubs. On the other hand, no matter how worried consumers are about the future, they will still have to buy essentials (“staplesâ€) like toothpaste and toilet paper.

Therefore, looking at the ratio between the two sectors (XLY/XLP, below) can provide a potential leading indicator for the stock market and the economy as a whole. In this case, that ratio is not painting a bullish picture, having already dropped to a 9-month low after peaking in early March.

At this point, the weakness in these three leading indices is not necessarily an immediate signal to act for S&P500 traders. But if we see start to see the bearish evidence pile up (especially if earnings continue to come in below estimates), the drops in these leading indicators could well prove to be the proverbial “canary in the coal mine†for the S&P 500 and DJIA.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.