![]()

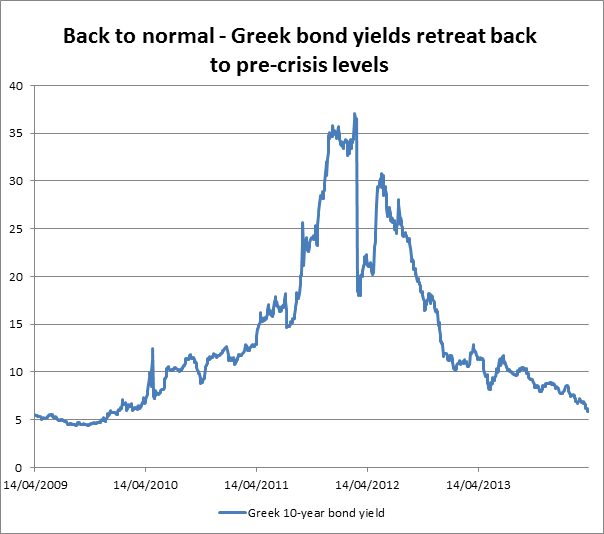

Greece is back. The troubled peripheral nation, who not that long ago was on the verge of being thrown out of the currency bloc and is still many billions in debt to the IMF and its European masters, sorry, I mean peers, is making a triumphant return to the bond markets after a 4-year tumultuous hiatus. Athens is selling EUR 3bn of 5-year debt with a yield of 4.95%. To put this in some context, Russia has to pay 9.8% to borrow for the same maturity. The rush for Greek debt is interesting since it seems to defy all fundamental logic:

The unemployment rate is currently 27.5%.

Greece is mired in deflation, annual CPI is -1.2% (which can be good for debt investors as it means the debt may hold its value).

Retail sales have not been in positive territory since 2010

The manufacturing PMI fell back into contraction territory at 49.7 in March.

S&P’s sovereign credit rating for Greece is B-, six steps below investment grade.

The political back drop is also weak, which makes the attraction of this bond sale equally puzzling:

Ahead of today’s bond sale a car bomb went off outside the Greek Central Bank in Athens.

The European elections next month could see big gains for the far left SYRZIA party, who have pledged to scrap the bailout if it came to power, potentially threatening the Greek position in the currency bloc.

The Troika never have anything good to say about Greece. On its last mission that was completed in March, Greece’s key lenders agreed its next steps for the bailout programme and came to a delayed agreement on re-financing the banking sector after burning the midnight oil once again.

So why can Greece sell debt so easily

The QE, low rates era is still with us and does not seem like it is going anywhere fast. Central banks around the world have turned investors into desperate yield junkies, so 4.95% seems worth it.

The bond is also issued under English law, which favours creditors over debtors, offering some guarantee for purchasers of this debt.

Greece may also be trading on its “Merkel Guarantee”. Two years ago Merkel essentially pledged that she would not allow a Grexit, queue the market’s confidence returning to the Eurozone periphery, which has culminated with this debt sale. The concept of the “bail-in” does not seem to be worrying investors.

A good case could be made that irrational exuberance is back – think property prices in London and debt sales in Greece. Essentially the sign of a “successful” exit for Greece from the sovereign debt crisis is being able to issue more debt, which was the root cause of the problem in the first place.

Who is buying this debt?

Mainstream investors are unlikely to be attracted to this sale because Greece’s debt rating remains below investment grade, which rules out pension funds etc.

Some large funds have come out and said they are buying Greek debt today, although many of these funds have held Greek debt for some time and ridden the wave of recovery in Greek bonds in recent years. Greek debt is not for the faint hearted.

Apparently investors in the East are also attracted to this debt sale, and they may also be behind the pick-up in Spanish and Italian bond markets. Reports suggest they are impressed by the Eurozone’s attempts to strengthen its institutions.

Conclusion:

Overall, this debt sale is a triumph in financial terms, however below the fancy sub -5% yield lies a simmering bed of risk. Greece is still the weakest link in the currency bloc and if the sovereign crisis flares up once more then Athens could struggle to stay in the euro-area. Next month’s European elections are also a risk that has not been spoken about in much detail. While gains for SYRZIA are not likely to disrupt the European parliament, they could have an impact on national politics. SYRZIA’s popularity is ahead of the ruling centre-right party and if the party becomes emboldened by victory at next month’s European elections then we could see them agitate for snap elections at home, which could rattle market confidence once again.

Also, some investors may be buying Greek debt in the hope that the ECB embarks on QE or other loosening policies, if the bank fails to do this then we could see volatility return to peripheral markets.

The EUR view:

EURUSD has been rallying into the Greek debt auction and since reaching a low of 1.3694 on Friday, it has made an impressive recovery. A daily close above 1.3857, the 61.8% retracement of the March – April decline, is a bullish development, however the 1.3900-1.4000 level has been sticky for EURUSD in the past and it may be too big a hurdle to the short term as the recovery looks a little over-extended.

EURUSD is also a beneficiary of dollar weakness, which tumbled on the back of the dovish Fed minutes last night. Overall, whether or not we get above 1.40 remains unclear as we haven’t been able to do so in recent weeks and it could ignite some rhetoric from the ECB who have been prone to talking down the EUR of late. Some key levels to watch include:

Resistance:

1.3876 – the March 24th high

1.3967 – March 13th high

1.4000 – major psychological level.

Support:

1.3789 – the 38.2% Fib retracement of the March – April decline.

1.3759 – the 50-day sma.

1.3702 – the 100-day sma.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.