The EUR/USD restored some positions that were lost yesterday on the background of hawkish rhetoric by the Fed’s chief Janet Yellen yesterday. Following the Fed’s statement on monetary policy it has become clear that 12 of the 16 FOMC members still support three rate hikes for 2017 which increases the chance of another round of monetary tightening in the US by this December. At the same time it was announced that the balance sheet reduction will start in October. Some pressure on the pair also came in from the better than expected unemployment claims in the US which were 259,000 versus the 302,000 expected and the Philly manufacturing index increased to 23.8 in September compared to 18.9 in August.

The USD/JPY quotes are consolidating after confident growth during yesterday’s trading session. The statement of the Bank of Japan on monetary policy had little influence on the mood of traders. The All Industries Activity index declined by 0.1% in August which was in line with the forecast.

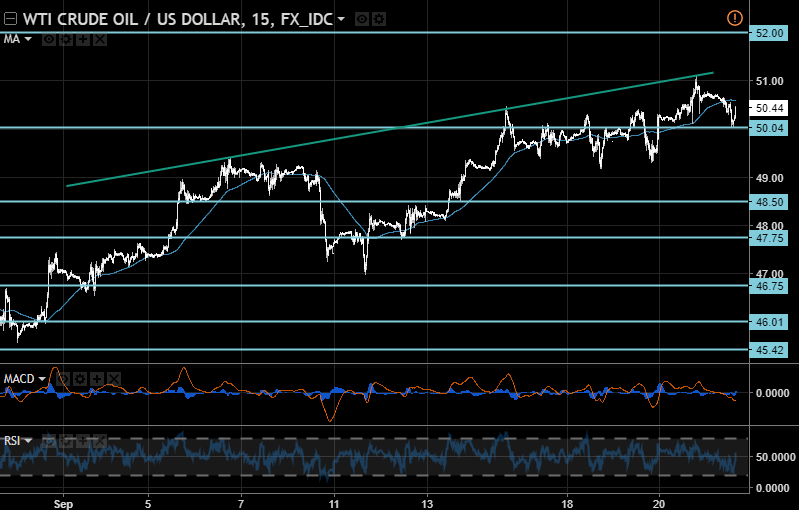

The Light sweet crude oil quotes rolled back under pressure of US dollar appreciation and due to the recent crude oil inventories report which showed an increase of 4.6 million barrels in the US against the forecasted growth of 2.8 million barrels. Production levels also returned to levels seen before the hurricanes hit the American oil rigs. The OPEC meeting will be held tomorrow where oil production cuts will be discussed between most OPEC members and some other major oil producing countries, including Russia. News from this meeting may significantly influence the mood of traders.

EUR/USD

The EUR/USD quotes were not able to break through the inclined support line and returned to the resistance at 1.1925 due to profit taking after the strong descending movement. In case of further growth, the nearest targets will be 1.2000 and 1.2070. On the other hand, fixing under the inclined support line may lead to continued drops with potential targets at 1.1700 and 1.1620.

USD/JPY

The USD/JPY has stopped growing after touching the inclined resistance line. In case of growth resuming along this line, the next targets will be 113.00 and 114.70. In case of a downward correction, the price may fall to 111.00 and breaking through that may become a signal to sell with potential goals at 110.30 and 109.60.

USD/WTI

The American crude oil benchmark, WTI, is falling after testing the 51.00 mark. In case of a decline below the 50.00 mark we are likely to see further drops with the potential to hit 48.50 and even 47.75. The RSI on the 15-minute chart rebounded from the oversold zone which in turn indicates that the descending movement is not yet exhausted. The immediate target in case of growth resuming will be 52.00.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter gross domestic product (GDP) data on Thursday.